NSW hangs the open sign but just 3 juniors are busy exploring the porphyry riches in the Macquarie Arc

Pic: Via Getty Images

After 10 long years of no new mine developments in NSW, two new projects in the space of a week and two other mine expansions in the last quarter have received the green light to proceed into development – a strong indicator that NSW is open for business.

Association of Mining and Exploration Companies CEO Warren Pearce last week hailed the approvals of Regis Resources’ (ASX:RRL) McPhillamys gold project and Silver Mines’ (ASX:SVL) Bowdens silver project as a “watershed moment for the NSW minerals industry”.

This is in addition to the March approval for Aurelia Metals’ (ASX:AMI) Federation zinc-lead-gold project – a new mine but using existing processing facilities, which came three months earlier than expected, and the February approval of Alkane Resources’ (ASX:ALK) Tomingley gold mine expansion, which includes moving a key portion of a regional highway.

“The approval of Bowdens silver project just days after Regis Resources’ McPhillamys gold project is a strong signal that NSW is open for business for the minerals industry,” Pearce said.

“Both new mines have only been approved after many years of geological research and investigation, as well as extensive environmental and social impact assessment and independent assessment.

“These projects demonstrate the deep rich natural mineral wealth within NSW and the determination that explorers and miners have to maximise the resource potential of NSW for significant public benefit.”

NSW ranked second for the total number of new mines approved in the state in the past five years following (obviously) Australia’s top mining state, Western Australia, according to data provided by peak industry body the Association of Mining and Exploration Companies.

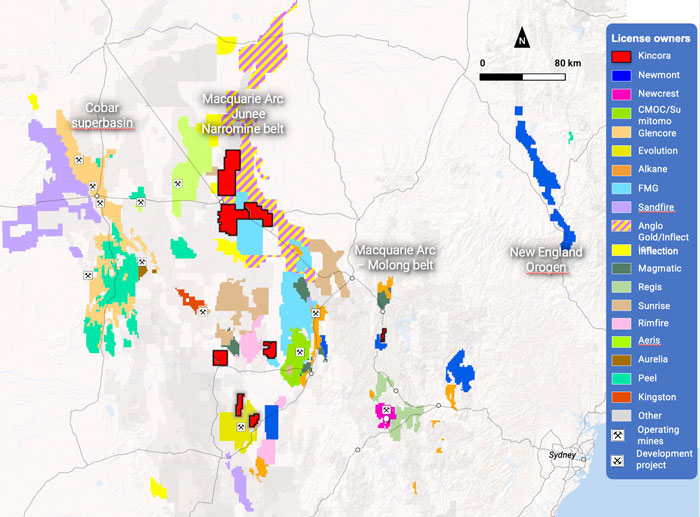

But while the NSW government is keen to monetise the state’s resources, just a handful of junior explorers are hard at work in one of NSW’s most mineral-rich areas – the Macquarie Arc.

The Macquarie Arc, in the fertile and well-known Lachlan Fold Belt, is considered a world-class porphyry district and likened to the Golden Triangle in Canada.

Porphyry deposits provide 60-70% of global copper supply and range from 100 million to several billion tonnes, ranking them among the largest ore deposits on earth. They also frequently occur in clusters of deposits along mineralised trends.

The juniors hunting for the next major porphyry discovery

The Macquarie Arc however only has three juniors doing proper exploration and drilling – one of which has in the last couple of months attracted an up to $135m earn-in from a new major entrant to the belt.

“In the Golden Triangle you have a double-digit number of juniors and majors undertaking proper exploration and drilling, supporting a comparable junior peer group with valuations from $20m to over $100m with various tie ups with mid-tiers and majors,” said Sam Spring, ex-Goldman Sachs analyst and now CEO of Kincora Copper (ASX:KCC) – which is one of the juniors with boots on the ground in the Macquarie Arc.

“This is despite drilling costs being 2-3x and the exploration season generally seasonal, compared to NSW, where drilling is possible year-round and with existing infrastructure.”

Besides Kincora, the only other juniors aggressively exploring their Macquarie Arc ground are Magmatic Resources (ASX:MAG) and Canada’s Inflection Resources.

Kincora is advancing its flagship Trundle project – the only brownfield project held by a listed junior in Australia’s foremost porphyry belt, while Magmatic’s recent work has focused on the Corvette prospect, along strike from Northparkes, where it has reported wide intersections of porphyry-style mineralisation in multiple holes.

Meanwhile, Inflection’s flagship Duck Creek target is just 2.5km from Kincora’s Nyngan licence boundary and was pegged as a nearology play to the ground Kincora had already secured with an attractive structurally controlled magnetic feature.

Duck Creek, like Kincora’s drill targets at both the Nyngan and Nevertire projects, sit on the shoulders of local magnetic high anomalies truncated by cross arc structures – a common setting for deposits such as at Cadia, Cowal and Boda in the Macquarie Arc, and a common setting in other globally significant porphyry belts.

“While you don’t have as much direct junior explorer news flow coming out of NSW as other world-class porphyry districts, due to the industry majors having already directly secured ground themselves, with only really Magmatic and Inflection Resources, plus Kincora, undertaking active systematic porphyry drilling programs, there is no shortage of good news flow,” Spring explained.

“In the last quarter in NSW, we have seen two greenfield discoveries ermitted to become mines (Bowdens and McPhillamys), the brownfield Federation discovery approved, discovered less than four years ago, and the Tomingley’s expansion pushed forward.

“Direct support from the NSW government via these mine approvals, the $130m Critical Minerals and High-Tech Metals Activation Fund for development projects and multiple phases of the New Frontiers Exploration Programs send a strong pro-investment and pro-exploration to mining message.”

Serious ramp up in M&A

Spring said given this positive landscape, it was not surprising that corporate activity in the region was starting to ramp up.

“Newmont’s multi-billion-dollar play for Newcrest, driven by its cash cow Cadia mine, Anglo-Gold Ashanti’s up to $135m earn-in deal with Inflection, driven by their discovery on our Nyngan project licence boundary, and reports of CMOC running a process for its stake in Northparkes having recovered its $US820m ($1.2b) original acquisition cost in only a decade,” he elaborated.

“Even just last week, Legacy Minerals announced a farm-in and JV agreement with Newmont.

“That puts the spotlight on Magmatic’s ongoing drilling at Corvette and our program at Trundle, the latter we believe hosts a quarter of the Northparkes system. Magmatic’s $36m and Inflection’s $C22m ($24.2m) market caps certainly make Kincora ($12m) look like the cheap entry into the district.”

This article was developed in collaboration with Kincora Copper, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.