Nova’s Christopher Gerteisen talks gigantic gold hits, lithium exposure, and the path to production at Estelle

Pic: John W Banagan / Stone via Getty Images

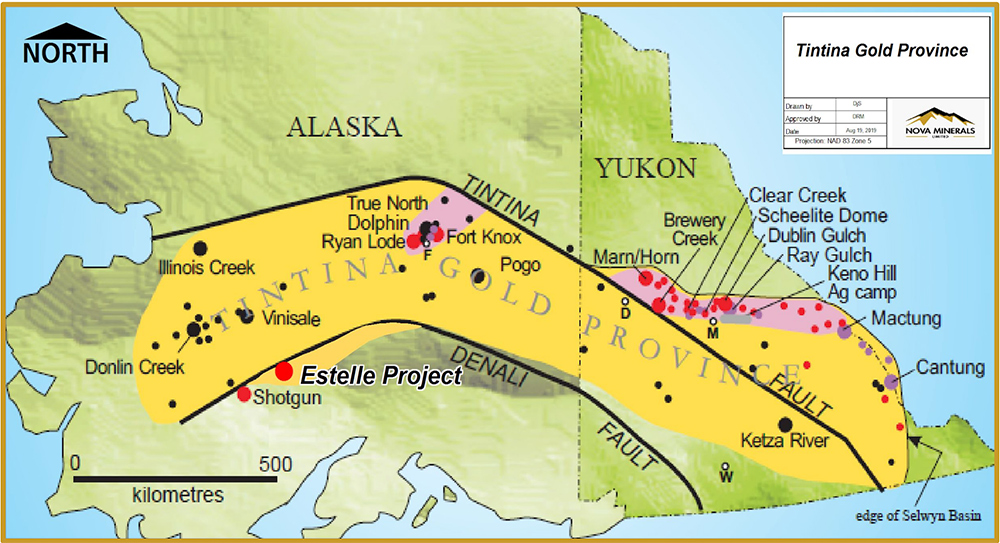

The Tintina gold province in North America is tremendously fertile, with over 200 million ounces of documented discoveries and production.

And while operations like Kinross Gold’s ‘Fort Knox’ run at grades well under a gram of gold per tonne (g/t), they are highly profitable, producing more than 200,000 ounces of gold a year at all-in sustaining costs (AISC) of US$1,000 ($1,300) an ounce.

This is the type of bulk mining operation Nova Minerals (ASX:NVA) envisages establishing at its flagship Estelle gold camp in Alaska.

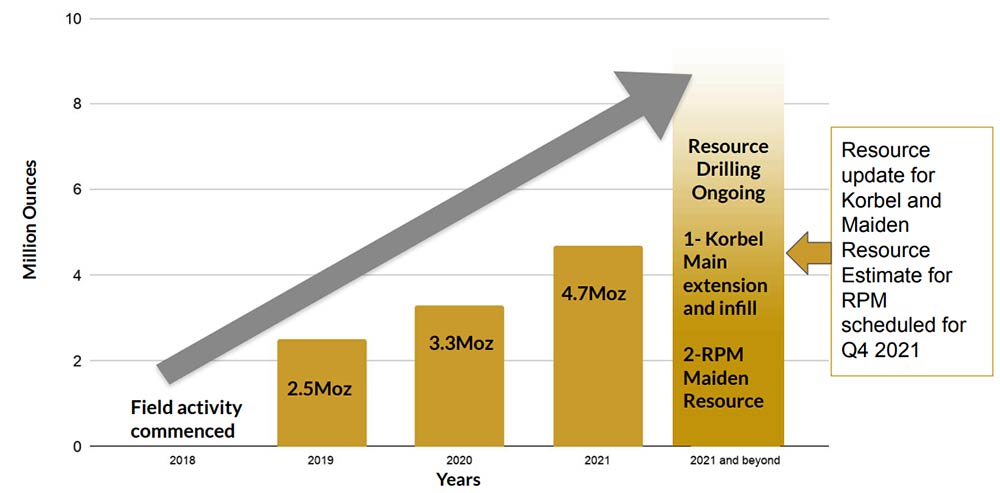

In 2019, Nova ran its first drilling program at Estelle and came out with a maiden 2.5Moz resource from the ‘Korbel’ deposit.

Since then, the explorer has been drilling nonstop, increasing that maiden resource to 4.7Moz in two short years.

That’s all from Korbel, one of ~15 known targets on Nova’s tenure.

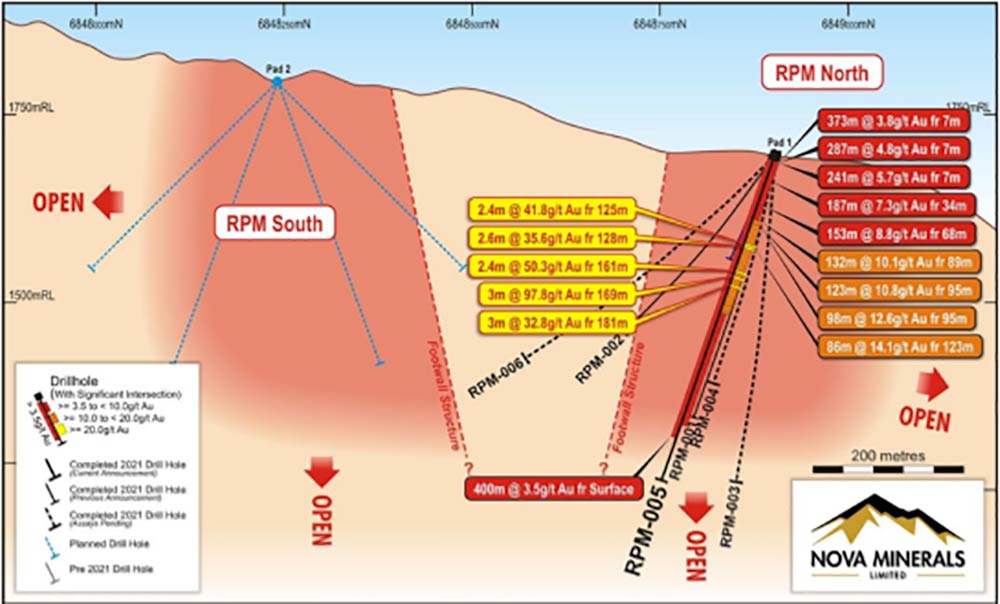

Last week, the explorer hit 132m at 10.1g/t gold at the newly drilled ‘RPM’ deposit.

Outrageous numbers. That must be up there as one of the gold hits of the year, if not the decade.

Stockhead chats with chief exec Christopher Gerteisen about gigantic gold hits and the path to production at Estelle, as well as some very interesting lithium exposure.

How does RPM now fit in with your development plans at Estelle?

“The Korbel deposit has always been our focus, but it is just one of 15 known prospects across our 324sqkm project area,” Gerteisen says.

“Next cab off the rank was always RPM, which sits 20 miles along mineralised strike due south of Korbel.

“We had a historic drill hole there of 120 metres at 1g/t. Not too shabby of a result, so we always wanted to go there, do some follow up drilling on that.

“This year we decided to go out there and start drilling, focussing on RPM North first.

“The first two holes came out a month or six weeks ago and looked pretty good. They confirmed the original historical drilling — we got similar results like 120 metres at 1g/t in those holes.

“This current hole — RPM five — hit the bullseye.

“People have thrown out all kinds of numbers — like it’s in the top 30 intercepts in the world ever; one person told me its top 10 in decades on the ASX.

“Either way, it is certainly world class.

“The thickness, the consistency and continuity of the grade, through those 130 metres is very impressive. And then it’s also right on the surface. Very happy with the result.

“I’m still waiting for results on hole three, four and six. At that stage, we’ll send all the data over to our resource estimation people and get a maiden resource out on RPM.

“I think it is going to be a ripper.

“By the size and shape of this thing we think this can be quite a large, large system.”

How does RPM compare with Korbel?

“They’re both intrusive related (IRGS) deposits,” Gerteisen says.

“These things can vary in tenor. When you are in the intrusive itself, like we are at Korbel, they tend to be lower grade.

“When you get into the contact and into the hornfels or sedimentary contact rocks they tend to be higher grade. And so that’s what we’re seeing in RPM.

“It seems to be a relationship at most deposits. At Korbel we just don’t see any of the contact areas; if we keep stepping out maybe we’ll eventually hit it.

“But Korbel is a beauty in its own right.”

And the metallurgy at Korbel is simple? An easy to mine, easy to process orebody?

“Yes. On surface, very low strip ratio,” Gerteisen says.

“It’s not one narrow vein or fault or structure you’re following — it’s basically sheeted veins throughout the entire intrusive.

“It’s just a sea of veins, a sea of mineralisation. The shape of the ore body, the geometry, is more like a big ‘blob’ like a large ellipsoidal shape.

“And so when we go to mine our strip ratio will be very low, approaching zero really, because everything you dig up is basically paydirt.”

How big is the resource going to get before you hit the button on a feasibility level study?

“This was our dilemma,” Gerteisen says.

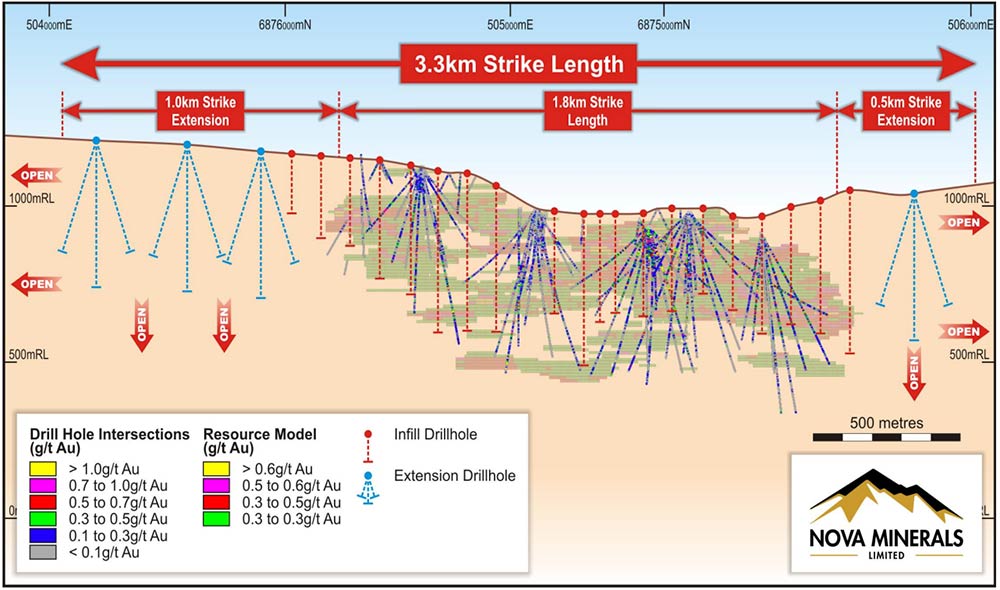

“Our 4.7Moz resource is at what we call the Korbel Main deposit, but throughout the Korbel valley where the deposit sits we currently have numerous other geophysical anomalies to test.

“Plus, the Korbel Main orebody currently has a strike length of 1.8km and it is still open in both directions. We think we are on one of these 10Moz whoppers just at Korbel alone.

“With RPM [and all the other targets] who knows how big this could be.

“We are unlocking the district. So — do we drill for the next two years, five years to just keep increasing the resource? We are on the path to production here.

“About a year ago we decided our strategy would be to have a starter operation, something that Nova can do on their own.

“The sweet spot would be a 100,000oz to 150,00ozpa, something that has a 10-year mine life, something like a year to a year-and-a-half pay back, ~$200m to $250m capex to build.

“That would be the starter operation – we would get some cashflow to just start ramping up.

“The plan is to establish the Korbel mining and processing hub – that’s where our tonnes are – and then through the years have this pipeline of other projects coming through.”

Onto the lithium stuff. You don’t mention the Thompson Brothers project too much but that was your original flagship back in 2016, wasn’t it?

“That’s correct. It’s a great project in Manitoba Canada. Currently has a resource of ~11Mt at ~1% lithium,” Gerteisen says.

“It will be the first zero carbon hard rock spodumene mine in the world. Manitoba runs 100% hydropower.

“One of the reasons we don’t talk about it a lot right now – we want to, because lithium is so hot – is because we are spinning that off [via Snow Lake Resources] and listing it on the NASDAQ.

“That listing is not far off.

Snow Lake Resources to Conduct Initial Public Offering in the United Stateshttps://t.co/ctGpjDnxBn@novaminerals #miningstocks #lithiumbatteries #nasdaqlisted pic.twitter.com/sDBzaWhAVV

— Snow Lake Resources (@snowlakeres) January 22, 2021

“Once we get this listing done the valuation will be about $120m.

“After listing, Nova will probably have 65 to 68% ownership [of Snow Lake].

“Once we get that money we will release the PEA, and drill to get that resource up to 20 to 30Mt.

“If you look at our [lithium] peers that have a PEA and have a similar resource, they are running up to $500m, $1bn valuations.

“We have a lot of people approaching us right now to do a block trade, take some of the shares off us – even buy us outright but we don’t want to do that pre-IPO.

“We want to let it run. We think there is a lot more value to be gained for Nova.”

At what point do you guys think you would be in production at Estelle?

“Our schedule is this: resource update coming out before the end of the year, and then very soon thereafter — based on the new resource numbers — we will release our Scoping Study,” Gerteisen says.

“We are hoping to get that out before the end of the year, early next year.

“We have already started our next level of PFS test work. The PFS will continue through the next year, and we would like to release that in mid-2023.

“Then we will go straight into the BFS and we would like a decision to mine around 2024, 2025 timeframe.

“I would like to be digging first dirt by 2025, 2026. That is very ambitious but there are number of things going for us and I think we have a good chance of hitting those targets.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.