Nova heads towards 10Moz milestone and critical US antimony supply role

Pic: Getty Images

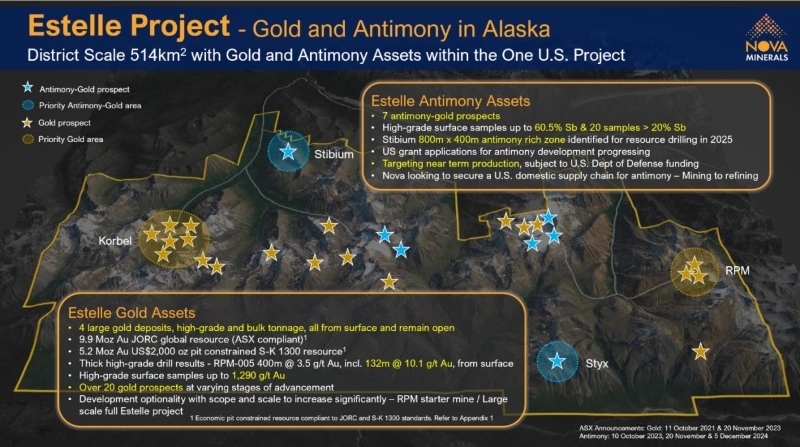

- Fresh assays from Nova’s Alaskan summer drill program could lift its flagship Estelle resource beyond 9.9Moz and advance the RPM and Korbel deposits toward feasibility and permitting

- Maiden drilling at Stibium prospect, along with advanced discussions with the US Department of War (DoW) and other US government agencies, potentially positions Nova as an early-mover fully integrated US antimony supplier, from mining to refining

- With infrastructure momentum and a strong cash position, Nova is primed to accelerate its push from explorer to near-term producer, as well as pursue more resource growth

Special report: Nova Minerals has wrapped up an almost 24/7 Alaskan summer drilling campaign at its Estelle gold and critical minerals project as it looks to several key milestones in the aims to become a world-class tier-one global gold producer and help secure a US supply chain for antimony.

With drilling complete and core samples submitted for laboratory analysis, results from Nova’s (ASX:NVA) northern summer drilling campaign are expected to headline a busy period of newsflow in the coming months.

This year’s campaign focused on three key targets, with the pivotal high-grade 1.24Moz RPM deposit getting most attention.

Drilling at RPM was designed to test targeted resource upgrades and potential extensions, with Nova hoping for more results that back up the thick, high-grade grade intercepts from 2024.

Those results included 20 broad intercepts grading more than 5 grams per tonne (g/t) gold, including a standout very high-grade assay of 52.7g/t.

Initial drill holes were also completed in the RPM glacial lobe area where Nova previously reported gold grades averaging 1.1g/t over 1.7km in till samples.

At the Stibium prospect, which has already yielded results including 12 rock samples of at least 30% antimony with a high of 60.5%, plus 16 samples of more than 5g/t gold with a standout of 141g/t, a number of initial holes were drilled above identified target areas.

Further drilling planned at Stibium has been put on hold while the company awaits a decision on its well advanced US DoW grant application.

Infill reverse circulation (RC) drilling was also completed at Korbel targeting a potential higher-grade starter pit, where Nova has defined a multi-million-ounce, bulk-tonnage gold resource.

All these upcoming assays are expected to feed directly into an updated mineral resource estimate (MRE), as well as support the ongoing pre-feasibility study (PFS) at its flagship 9.9Moz Estelle project.

While targeting entry into the exclusive 10Moz gold club, Nova is focused on advancing the RPM and Korbel gold deposits toward feasibility and permitting, as well as progressing Stibium in the near-term.

Findings from the upcoming PFS and the wider project expansion studies will help Nova form a strategic decision on whether to proceed with a start-up mine at the RPM deposit or pursue a larger-scale development also incorporating the bulk tonnage Korbel deposit plus other regional prospects.

As well as the drilling at RPM, ore sorting from the deposit achieved a highly encouraging 4.3x grade upgrade (from 1.32g/t to 5.72g/t) and heap leach testing delivered up to 68.7% recovery. Optimisation of CIP/CIL circuits is continuing ahead of the PFS for RPM, which is expected to provide further upgrades to the gold recoveries.

On the antimony front

While awaiting results from initial drilling at Stibium, Nova’s fast-tracking of its highly strategic antimony assets has been boosted with the stockpiling of stibnite found across the project area and ore sorting trials from the Styx prospect producing a 60.3% antimony concentrate.

This positions Nova on track to potentially become the first fully integrated antimony producer in the US at a time when global demand, geopolitical pressure and prices are all rising.

Prices of the critical mineral have more than quadrupled to US$58,000/t since the beginning of 2024, before China’s export ban of the metal that’s essential for defence and electronics applications.

And as the US scrambles to secure stable supply, independent resources expert RFC Ambrian lists Estelle as one of nine potentially viable near-term antimony projects in the world, and one of only two within the US, the other being the Stibnite project owned by $3Bn market cap Perpetua Resources.

High-level support

Nova has been an early starter in recognising the potential of its antimony assets and this week CEO, Christropher Gerteisen has attended numerous high level meetings in Washington DC with US DoW and other US government agency officials in support of its well advanced grant applications that could accelerate progress at its Stibium prospect.

This would align with federal executive orders calling for the development of domestic critical minerals resources in the US and Alaska in particular, placing the dual commodity project in the right place at the right time.

The Nova team has additionally been strengthening ties with Alaskan lawmakers and stakeholders including Alaska Governor Mike Dunleavy and Senator Lisa Murkowski.

This has helped progress on infrastructure that will push forward year-round access, efficient logistics and clean processing energy for Estelle.

More growth in sight

Looking to 2026, Nova is preparing to expand regional exploration, testing new high-priority targets along Estelle’s vast mineral trend to unlock further district-scale potential.

Nova’s CEO Christopher Gerteisen has likened Estelle’s potential to Nevada’s prolific Carlin Trend – a district-scale mineral system hosting multiple world-class mines.

“Our Estelle Project has the underlying resources, scale and scope to unlock a trend of this magnitude,” Gerteisen said. “The geological footprint of Estelle, combined with recent drill results and ongoing resource growth, demonstrates the vast potential for multiple, large-scale gold and critical mineral discoveries.

“We are not just developing a gold project — we are building a dual-commodity critical minerals and gold hub, underpinned by robust infrastructure, low-cost scalability, and deep national relevance.”

Beyond RPM, Korbel and Stibium, an extensive surface exploration program chased other high-priority targets including coverage north of Korbel, increased sample density between Portage Pass and Tomahawk, and follow-up mapping and sampling at West Wing, Styx and the greater Train area.

Nova also has the financial flexibility to accelerate development with exposure to US markets via its NASDAQ listing and a debt-free balance sheet following the Snow Lake sale and Nebari conversion.

This article was developed in collaboration with Nova Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.