Not your average cowboy: Fertiliser prices are on the up and this company is cashing in

Pic: Getty

From growing food to driving the new battery revolution, fate has given phosphate an outsized role in more than just our future world economy. And this Australian-listed firm is positioned to perfection.

Phosphates are the naturally occurring form of the element phosphorus. They’re inside rock or ore in the form of phosphate ions and at the moment around 90% of phosphates end up in agriculture as a key fertilizer.

Due to its strategic importance in global food production, the US and EU have declared rock phosphate a critical commodity at a time when maximising yields has never been more important.

About 40% of the world’s food production is linked directly to fertiliser use but with the world’s population set to increase by 30% in 2050 and with arable land per person continuing to decline – from 4,500m2 in 1960 to just 1,800m2 in 2050 – demand for the commodity will continue to rise.

Right place, right time

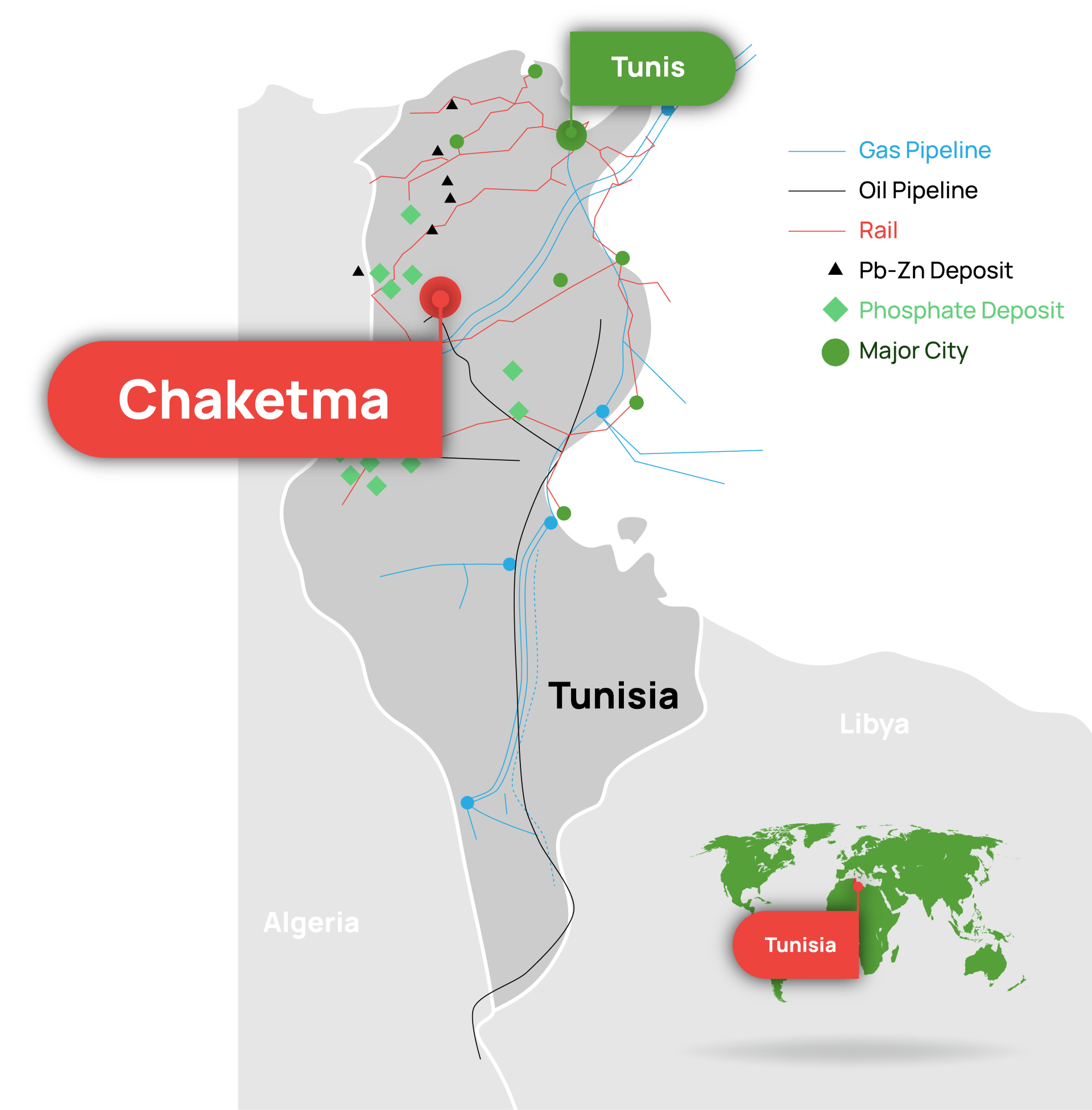

ASX-listed PhosCo (ASX:PHO), is looking to become a leading producer of sustainable fertiliser by developing the Chaketma phosphate deposit in Tunisia – Africa’s northernmost country and one of the most established trading partners of the EU in the Mediterranean region.

Against the backdrop of booming fertilizer prices – currently sitting at over US$170/t, and a corporate rebrand, PhosCo executive director Taz Aldaoud told Stockhead the planets are aligning at the perfect time to be in the market.

“The global fertiliser market is controlled by just five countries – the US, Morocco, Jordan, China, and South Africa and we have seen in the last 12 months how quickly the price responds to a supply squeeze,” he said.

“It’s anyone’s guess how high prices will go – You look at China, which commands 30% of the world’s fertiliser trade, they have imposed an export ban.

“Russia has done the same and it’s a double-edged sword for the European market which relies on Russian gas to produce their fertiliser products – everywhere you look, there is a disruption to supply. The dynamic here is putting a lot of strain on the market of a commodity which is critical.”

Scratching the surface of a massive resource

PhosCo has a 50.99% interest in the Chaketma Phosphate Project, where the company has just announced an increase in the JORC resource to 148.5Mt at 20.6% phosphate oxide from drilling at only two of the project’s six prospects – the flagship KEL deposit and the neighboring GK deposit.

The KEL phosphate deposit now sits at 55.5Mt at 21.2% phosphate oxide, with 49.1Mt in the measured category and 6.4Mt in indicated, meaning a potential 30-year mine life at an initial production rate of 1.5 Mtpa.

“The KEL phosphate resource is now 50% bigger, and that’s from drilling which has only covered about half of the surface area of the known mineralisation – it’s very exciting due to how shallow the mineralisation is,” Aldaoud explained.

“We are getting thick, consistent widths of phosphate mineralisation from less than 20m in some holes, which is super close to surface, and that is the reason why the KEL deposit is our first priority.”

Around 80 drill holes were used to update the KEL resource, following the restart of technical work at the beginning of the year.

Now, the nearby GK deposit awaits a new resource estimate using an additional 20 holes.

“We are just scratching the surface, the deposit is already massive but with further drilling, it will only get bigger,” Aldaoud said.

Previous high-grade drilling results

Previous drilling results at KEL have returned hits of up to 37.6m at 21.9% phosphate oxide from 56m, 33.6m at 22.2% phosphate oxide from 65m, 35.3m at 21% phosphate oxide from 23m, and 33.8m at 21.6% phosphate oxide from 42m.

At GK, intersections such as 49.6m at 21.1% phosphate oxide from 135m, 31.9m at 21.08% phosphate oxide from 120m, and 30.4m at 20.20% phosphate oxide from 67m were returned.

Plans are afoot with consultants to conduct a GAP analysis on the available drilling data to advance Chaketma towards an upcoming bankable feasibility study which PhosCo is aiming to begin in the second half of 2022.

Ticks all the boxes

“So, it’s big, it’s meaningful in size, and ticks all the boxes,” Aldaoud said.

“And phosphate ion is of course one of the three ingredients in the lithium-ironphosphate (LFP) batteries, at the heart of zero net emission economy.”

Lean, mean, green and nicely surrounded by all the right infrastructure

The project is 200km by sealed road from Tunis and 35km from rail that connects to two ports with gas and grid power nearby.

Plans are also underway to investigate green options for energy using wind and solar, with an ESIA in compliance also looking into the ways PhosCo can reduce water consumption and produce zero phosphogysum as a waste product.

“We are committed to research that will facilitate a green shift in the way phosphate fertilisers are being produced and various proposals are being considered,” Aldaoud added.

This article was developed in collaboration with PhosCo, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.