Norwest launches into multiple ‘shallow dipping gold lodes’ at Bulgera

Pic: Tyler Stableford / Stone via Getty Images

Special Report: Norwest’s very first RC drilling campaign at Bulgera has returned grades up to 29.3 g/t below and along strike of the old open pits – proof that historic mining barely scratched the surface.

When Norwest Minerals (ASX:NWM) shelled out $220,000 for the Bulgera project mid 2019 chief exec Charles Schaus called it “an advanced development opportunity for the equivalent cost of a used Porsche 911”.

But if Bulgera was a car then previous owners barely drove it off the lot.

Norwest was able to announce a maiden 65,500oz gold resource using an extensive historic database, but the real excitement lay in drilling the Bulgera mafic-ultramafic mine sequence — below 100m from surface.

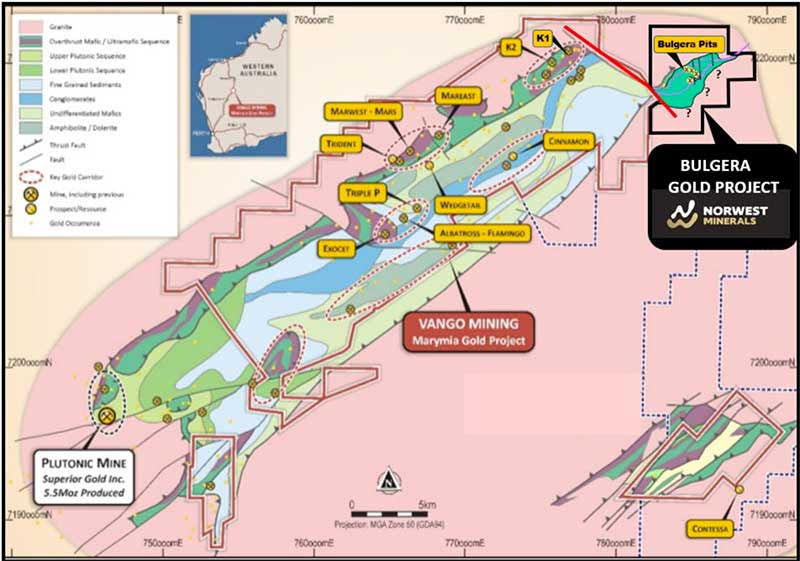

This is where higher-grade gold occurs elsewhere along the Plutonic Well Greenstone belt, like the Tier 1 +5moz Plutonic operation and Vango Mining’s (ASX:VAN) Marymia mining centre:

And yet just 140 of the 422 historic drill holes at Bulgera extended below 50 vertical metres. Only eight penetrate below the 100 vertical metre level.

Norwest believed that the old data revealed the projected positions of multiple gold lodes below the shallow pits and along Bulgera’s 5km strike.

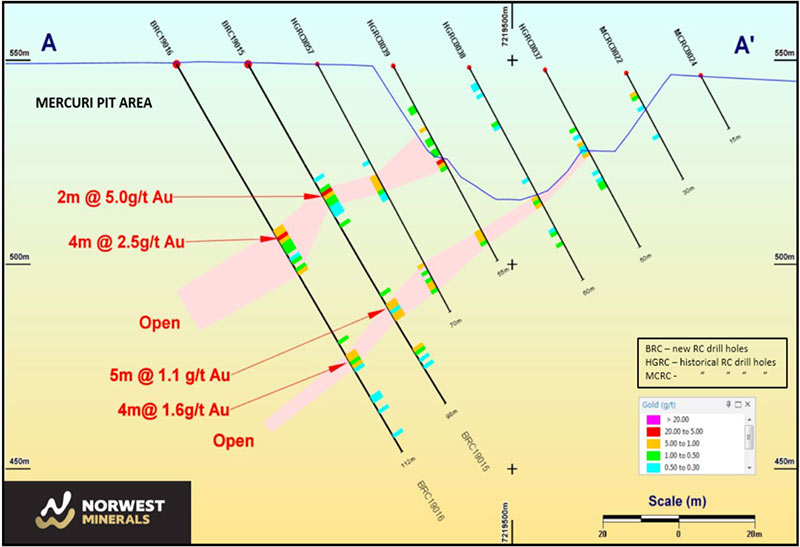

That’s been confirmed by a maiden 46 hole, 5856m drilling campaign which returned intercepts like 3m at 10.5g/t from 84m; 4m at 6.8g/t from 71m; and 2m at 5g/t from 37m underneath and along strike of the Bulgera and Mercuri open-cut pits.

Anything above 5g/t is generally considered high grade.

Drilling intersected gold in 42 of the holes drilled down-dip of the Bugera and Mercuri pits. All were within 120m of surface.

Bulgera cross section showing gold intercepts from Norwest RC drilling below the Bulgera open cut.

Mercuri cross section showing gold intercepts from Norwest RC drilling below the Mercuri open cut.

The results of this maiden drilling program at Bulgera speak for themselves, Charles Schaus says.

“The down-dip extension of the multi-lode gold mineralisation has been confirmed in almost every new drill hole with the majority occurring above 100 vertical metres of surface,” he says.

“The positive economics of mining multiple, shallow dipping gold lodes has the potential to develop into a win-win situation for Norwest and those operating hungry mills in the area.

“Norwest is certainly looking forward to the restart of drilling at Bulgera during the March quarter 2020.”

Importantly, the “overall tenor” of gold mineralisation appears to be increasing with depth, similar to the gold encountered by Vango during their long- running drilling campaign at the Marymia project, just a stone’s throw away.

This could be Marymia 2.0

The Vango share price is up almost 200 per cent since January 2018, thanks to their ongoing exploration success at Marymia.

Historical mining between 1992 and 2001 produced 580,000oz, almost entirely from open pits.

There was an extensive drilling and geophysical database, but the ground was largely untested below 100m depth until Vango got involved.

Sound familiar?

After ~3 years of successful drilling Marymia now has the potential to become one of Australia’s largest high-grade gold production projects, underpinned by the flagship 410,000oz, 8g/t Trident resource – which remains ‘open’ at depth and along strike.

Prepping for a drilling barrage

Norwest is now planning a follow-up RC drill program to further test gold mineralisation down-dip and along strike of the open pits.

A separate 5000 metre air core (AC) drill program will also test numerous targets — away from the mining centre — along the 5-kilometre strike of the Bulgera sheared greenstone package.

Meanwhile, Hyland Geological & Mining Consultants (HGMC) is incorporating the new Norwest RC drilling and geological data into an updated resource model database.

The aim is to produce and report a new resource during the March 2020 quarter, followed by engineering studies including pit optimisation which will assist in determining future drill hole placement “as well as develop potential cashflow scenarios”, the company says.

This story was developed in collaboration with Norwest Minerals, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.