Nordic Resources snares major Finnish gold projects in transformative deal

Nordic Resources is set to make a major push into Finland’s gold scene. Pic: Getty Images

- Nordic Resources diversifies with transformative deal for Northgold’s three Finnish gold projects

- Three advanced assets in Finland’s Middle Ostrobothnia gold belt, including the 814,800oz gold equivalent Kopsa deposit

- 4500m drill program planned at Kopsa after deal closes

Special Report: ASX explorer Nordic Resources is poised to awaken a sleeping giant of northern Europe’s underappreciated gold scene, inking a deal to secure a large-scale gold resource in central Finland.

Kopsa is one of three advanced gold projects along the underexplored Middle Ostrobothnia gold belt in Finland that Nordic Resources (ASX:NNL) will acquire for a cash outlay equivalent to $330,000 and a share issue that will give shareholders in the Swedish-listed vendor Northgold a 32% stake in the company.

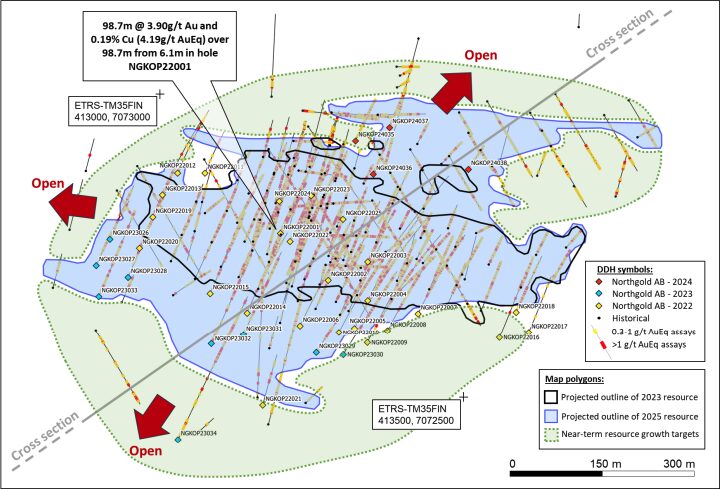

That compares to the enormous in-ground value of Kopsa at current gold prices flying in excess of $5100/oz, with a JORC 2012 compliant resource of 23.2Mt at 1.09g/t gold equivalent for 814,800oz AuEq, 69% of which sits in the higher confidence measured and indicated categories.

On top of Kopsa – which has a conditional mining lease, an auxiliary mining lease under application to allow road access to site and weather conditions to allow year-round drilling – NNL will also acquire the Kiimala Trend and Hirsikangas gold projects.

Both have historic, non-JORC compliant near surface gold resources which NNL intends to validate to JORC status via a review of the historic exploration database and resource modelling parameters.

“Nordic has been pursuing a transaction on these three exciting gold projects for some time in order to productively deploy our in-country exploration capability,” NNL executive director Robert Wrixon said of the transformative gold transaction.

“We have been impressed with the remarkably efficient drilling at Kopsa in particular, with its resource base having increased 150% just a couple of years.”

Resource growth continues

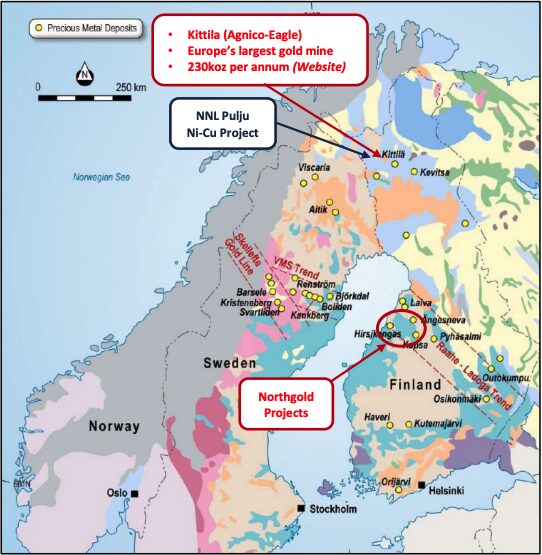

Finland is already a substantial gold producer, hosting Europe’s largest gold mine operated by the world’s largest capped gold producer Agnico Eagle, located south of the town of Kittila in northern Finland.

A preliminary economic assessment at Kopsa was conducted by Belvedere Resources in 2013, but trouble in its nickel business sent that firm to the wall.

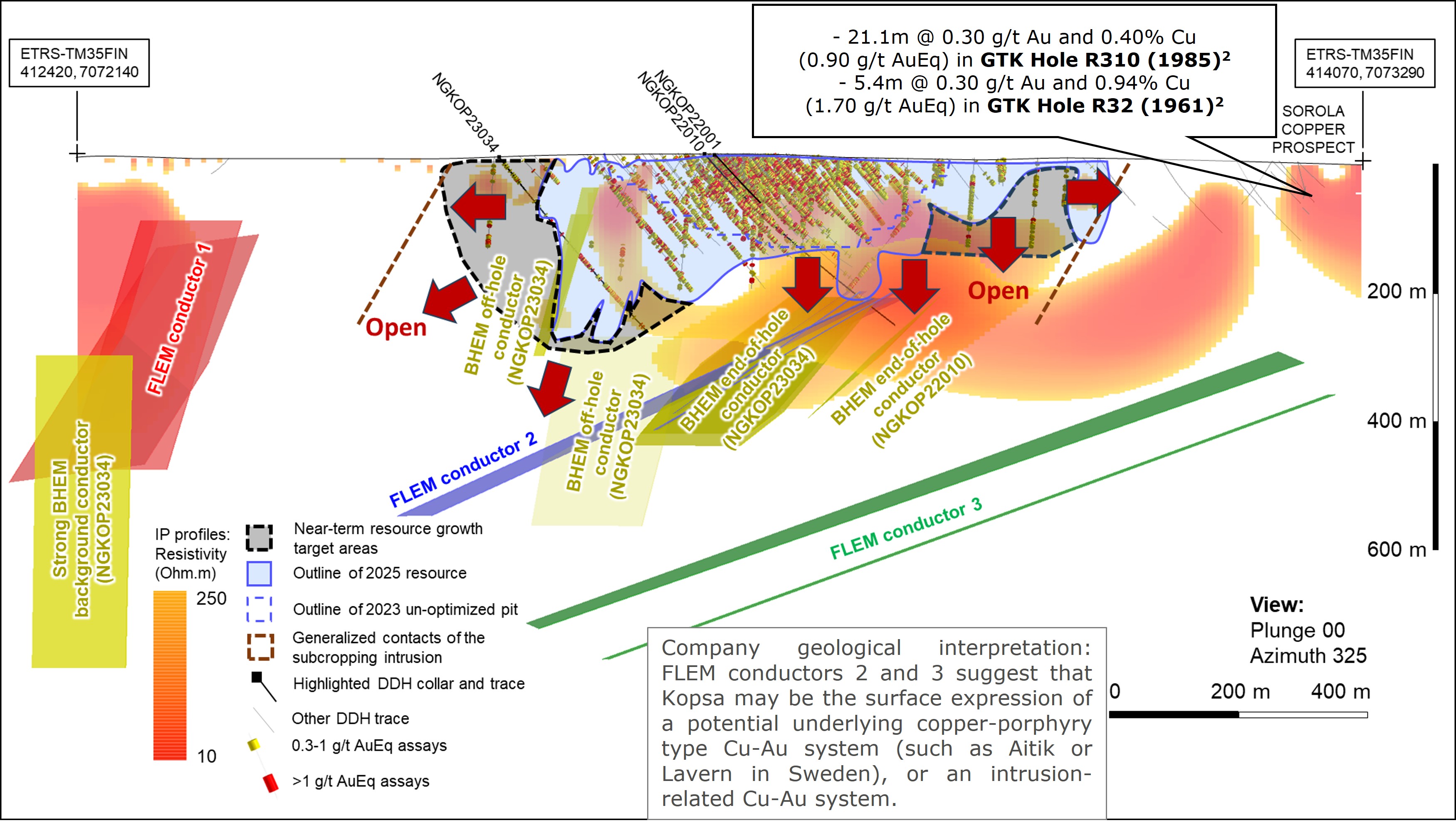

Since being picked up by Northgold, the true potential of the near-surface, orogenic gold-copper deposit has been revealed, with just 6623m of shallow drilling adding a whopping 482,000oz of gold equivalent to its resource base. And recent geophysical results suggest the potential for a larger mineralised intrusive body lying underneath.

The more than doubling of the bounty has taken gold metal in the ground to 631,300oz and copper tonnes to 38,360t, with the recent resource growth “a major reason” for the excitement Wrixon and the NNL board holds over its future.

Funded by a placement to sophisticated and professional investors, around 4500m of drilling is planned after the deal completes is expected following EGMs hosted by both NNL and Northgold in May.

Previous drill hits close to surface provide a window into Kopsa’s open-pit mining potential. Highlights include:

- 98.7m at 3.90g/t Au and 0.19% Cu from 6.0m (NGKOP22001);

- 87.6m at 3.31g/t Au and 0.26% Cu from 12.9m (BELKOPDD043);

- 54.5m at 2.49g/t Au and 0.18% Cu from 19.0m (BELKOPDD102); and

- 20.3m at 4.61g/t Au and 0.36% Cu from 32.0m (BELKOPDD065).

Talk about thick. And recent geophysical results suggest there is further potential at depth and along strike.

“The Middle Ostrobothnia Gold Belt of Finland is unusually under-explored, but gold and base metal exploration activity has expanded recently with Kingsrose Mining, Laiva Gold and Gemdale Gold now active in the region,” Wrixon said.

“The Company is pushing to complete this transaction in the coming weeks and to drilling the outstanding shallow and deeper targets at Kopsa in the coming months, in order to see what Kopsa can become.”

Kopsa’s proximity to Laiva, a mothballed 2.2Mtpa gold plant located just 120km northwest, and Pyhasalmi, a copper and zinc mine 45km to the east of Kopsa, is also significant, presenting multiple treatment options for Kopsa ore.

Across the belt

Elsewhere along the Raahe-Ladoga trend that runs through central Finland and sits across the ditch from the VMS trend which hosts the Boliden mines in Sweden, Nordic Resources will also pick up Northgold’s Hirsikangas and Kiimala Trend projects.

Kiimala Trend has been explored by a number of companies and state institutions, including Outokumpu, and hosts multiple drilled and undrilled gold prospects along a 15km trend within a 27km2 land package consisting of eight active exploration licences and one exploration licence application.

Two prospects – the Angesneva and Vesipera prospects – are known to host near-surface non-JORC gold resources.

Hirsikangas is at a similar stage, with one prospect hosting a known non-JORC near surface resource and multiple drilled and undrilled prospects along a 10km long trend of the Himanka Volcanic Belt.

Both projects present exciting growth opportunities beyond Kopsa, the limits of which remain unknown itself.

They will bolster the portfolio of the previously base metals focused explorer, which will continue to hold the Pulju nickel-copper deposit.

Located 195km from Swedish major Boliden’s Kevitsa nickel-copper-gold-PGE mine, NNL says Pulju will remain an important focus. Pulju’s Hotinvaara deposit hosts a large resource of 418Mt at 0.21% nickel, 0.01% cobalt and 52ppm copper for 862,800t of contained nickel, 40,000t of cobalt and 22,100t of copper.

NNL is continuing JV discussions at Pulju, with its newfound diversity offering leverage to upswings in both precious and base metals price cycles.

“Joining these three advanced gold-copper projects with our important Pulju nickel-copper-cobalt exploration tenure (containing the large Hotinvaara nickel-cobalt deposit) creates an enviable growth portfolio within a rare Tier 1 European mining jurisdiction,” Wrixon said.

This article was developed in collaboration with Nordic Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.