“No Peers”: Brazilian Critical Minerals says its Ema project could be the lowest cost rare earths mine ever built in the West

BCM’s Ema could blow the rare earths game wide open if it can deliver on cost metrics in a landmark scoping study. Pic: Getty Images

- BCM’s Ema will produce close to 100,000t of rare earths over 20 years

- Scoping study shows life of mine costs of US$6.15/kg TREO and US$16.95/kg NdPr

- That would make the US$55m development the cheapest rare earths mine to build and run globally

Special Report: Brazilian Critical Minerals has run the numbers on its Ema rare earths deposit in Brazil’s Amazonas state, declaring the project has ‘no peers’ after a scoping study which showed it would generate over US$900 million in life of mine cash flow even at depressed spot prices.

The first look for Brazilian Critical Minerals (ASX:BCM) investors at the economic potential of the Ema project has delivered what could be the lowest capex and opex costs in the industry, promising to payback its $51 million construction bill – inclusive of a 35% contingency – in just the first 28 months of a two decade mine life.

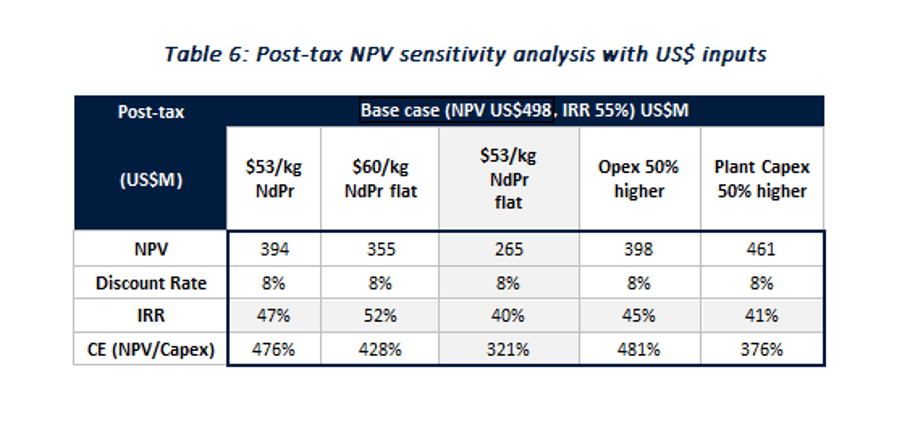

At spot levels of US$60/kg NdPr oxide, the project boasts a net present value at an 8% discount rate of US$355 million with a 52% internal rate of return, prices modelled for the first four years of the operation’s life.

With still conservative life of mine average prices of US$74/kg, that becomes US$498m and 55%, with the mine set to deliver 95,651t of total rare earth oxides and 36,252t of magnet rare earth oxides over its lifespan with costs of just US$6.15/kg TREO and US$16.95/kg NdPr.

That equates to 4800tpa TREO over the mine’s two decade existence, with a high grade 55.3% mixed rare earth carbonate product expected to contain 37.9% magnet rare earth oxides for each kilo of TREO, driving high recovery yields.

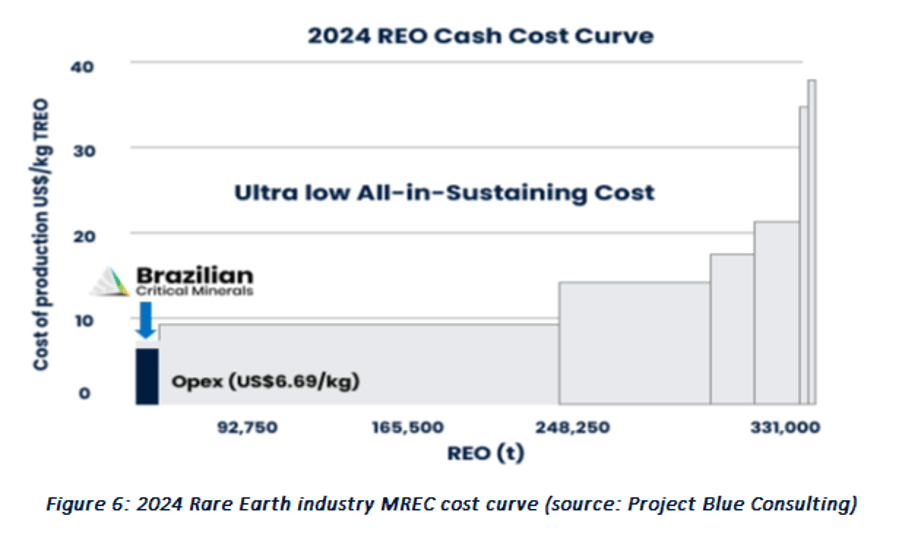

“The results from this scoping study are so good that in terms of Capex, Opex and NPV at current spot prices this project has no peers compared to those looking to develop rare earth projects in the western world,” BCM managing director Andrew Reid said.

“The team at BCM have developed a project leveraging the unique characteristics of the Ema mineralisation through ISR extraction and delivered a project with a CAPEX of only $51M whilst able to produce a high value mixed rare earth carbonate. OPEX at US$6.15/kg TREO is uniquely low and positioned in the very lowest portion of the cost curve.

“Capital Efficiency, IRR and NPV at current spot prices generate outstanding, meaningful and solid returns with good cash flows.”

Turning the tables

One of a host of clay-based rare earths deposits uncovered in Brazil over the past five years, Ema contains a massive 943Mt at 716ppm TREO, including 341Mt at 746ppm in its key Central Starter Zone.

Importantly, some 90% of its basket price of metals in BCM’s mixed rare earth carbonate comes from magnet rare earth oxides, the high value commodities used in EV motors, wind turbines, air conditioners and defence applications powering a battle for mineral supremacy between China and the West.

BCM is planning to use an in-situ extraction technique, turning the tables on Chinese and Southeast Asian suppliers who have utilised the method to beat Western competitors on costs.

“The ISR extraction technique, prevalent throughout China, Myanmar and other parts of SE-Asia is simple, effective, quick to build, and when coupled with the use of magnesium sulfate turns the Ema Project into a highly compliant ESG project with little disturbance to the local environment, local biodiversity and ecosystems when coupled with ZERO mine waste, tailings, air pollution, noise and hazardous substances to contend with,” Reid said.

“We will now forge on with field pilot trials, complete environmental baseline assessments and commence engineering studies as part of a larger more detailed feasibility study which we aim to complete throughout 2025.

“A big thank you to the team, our consulting partners and everyone involved in pulling this unique project together, which will be a first of its kind for rare earths in the western world and the ASX, but common elsewhere.”

With just US$55m of capital anticipated to be needed to start the project, BCM is confident it could raise the capital required from debt and equity, adding that a strategic partnering process could also offer an attractive funding pathway if it maximised shareholder value long-term.

Expansion potential

Delivered by leading engineering consultants Ausenco with met testwork from ANSTO and hydrogeological development, modelling and well field design by WSP, there is serious clout behind the consultants engaged on the study.

It sets up BCM to deliver a much more detailed feasibility study, to be completed over the course of this year.

And it’s clear the Ema resource is not done growing, both in terms of scale and confidence levels.

A substantial inferred resource exists over 82km2 over the tenement base, with infill drilling likely to see those converted to indicated level.

Indicated resources are considered to have been drilled with enough density to be converted into reserves and incorporated in a mine plan, meaning additional tonnes could boost the scale or life of the mine.

The Ema plant will run at a rate of 2660tpa over its first four years, escalating to 5313tpa from year 5 on, but drilling could outline the potential to expand beyond that and achieve greater economies of scale.

BCM is also bullish on the permitting pathway for the project, which is following in the footsteps of its adjacent Tres Estados project, a project the company says “has similar or identical environmental, social, and geological settings, are being actively applied and utilised for baseline studies, stakeholder engagement, impact assessment and permit applications with respect to the Ema Project.”

While mining is permitted in buffer zones, the company has already said it does not plan to explore or mine in the southern part of the Ema project tenement, which straddle and in some places overlaps the 3km wide buffer zone between the resource and the Jutuarana National Forest.

The regulatory approval process will start this quarter, with the feasibility study expected to commence in Q2.

This article was developed in collaboration with Brazilian Critical Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.