No bluff in born-again Brightstar’s future plans

Pic: Tyler Stableford / Stone via Getty Images

They say the challenging times make you truly appreciate when the good times come along.

Having had its fair share of the former in recent years, the shareholders and management team at Brightstar Resources stands to enjoy as much as anyone the better times ahead.

Previously known as Stone Resources Australia Ltd (ASX:SHK), Brightstar Resources (to be ASX:BTR) made its rebirth known to market this week as a company with a new name, a new management team and a clear pathway into gold production.

Management at the company, for years challenged by a general bear market for gold and the impact of some cultural differences, made a decision on the back of a few hard conversations early in 2020 to recapitalise.

The company’s Ben Hur project was sold to Regis Resources (ASX:RRL) and a plan agreed to by major shareholders and management to clear $53 million of debt owed to Stone’s parent company, and 433 million shares – 53% of Stone’s issued capital.

It’s been a journey, but with Ben Hur helping to clear the path and PCF Capital Group advising corporate and strategically, Brightstar is sitting pretty and looking ahead.

“It’s been a rocky ride,” PCF Capital Group managing director Liam Twigger told Stockhead.

“When they first walked through the door they had a pair of twos, which is about the lowest winning hand you can have in poker, and working together we’ve been able to pick that up.

“We don’t quite have a full house yet, but we’re well on our way.”

Even having cleared Ben Hur, Brightstar does indeed hold a compelling hand:

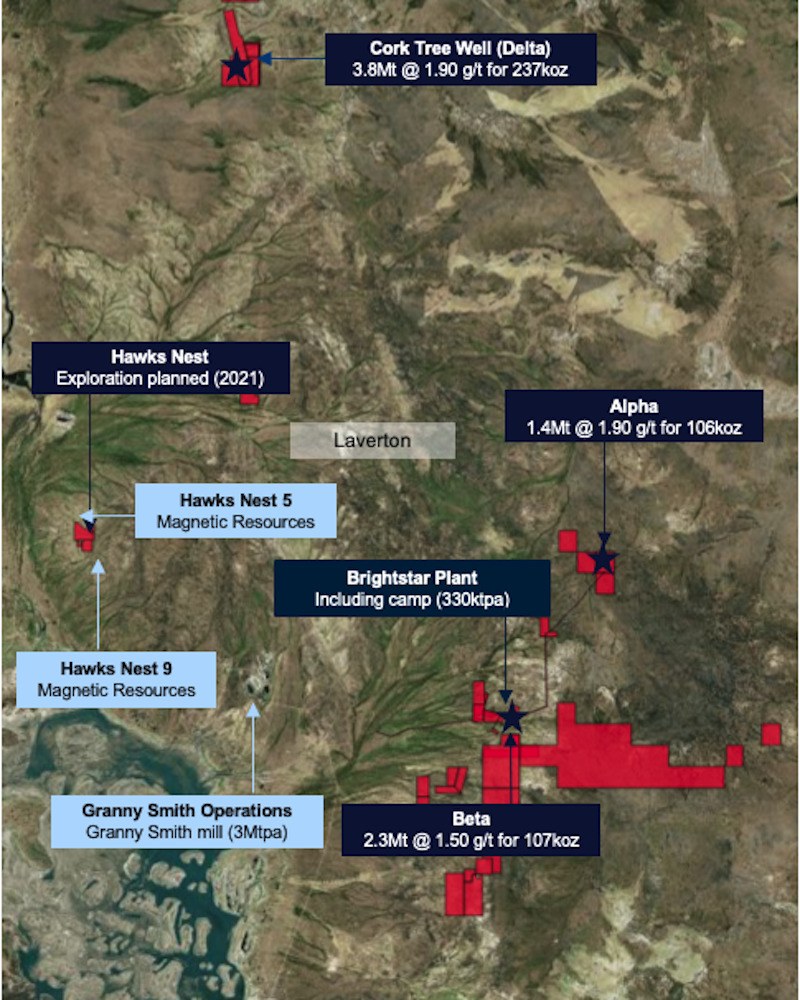

- The Brightstar project – a 445,000-ounce JORC-compliant gold resource in the world-class Laverton gold region, comprising the Alpha, Beta and Cork Tree Well deposits.

- Key tenements potentially along strike between Magnetic Resources’ (ASX:MAU) nearby and highly prospective Hawks Nest 5 and 9 projects.

- A 330,000 tonne-per-annum plant with significant throughput expansion potential on care and maintenance 33km south-east of Laverton.

The plant is key to the conversation around mining at the company’s namesake project, and one which sets Brightstar apart from many of its peers in the region.

“The plant is the point of difference – Brightstar is not just a junior drilling out resources indefinitely, it actually has a plant,” Twigger said.

“That significantly shortens a timeline to production. There might also be the option of toll milling – there are a lot of players out there and not so many with plants.”

New managing director Bill Hobba has had a long involvement with the facility and with Stone, and said there was significant scope to boost the plant’s throughput rate.

“We’ve basically got the powerhouse built from new to handle between 500,000 and 700,000 tonnes per annum,” he said.

“We’ve got all the pumps in there to handle that on variable speed drives – they’re all able to take a new flow rate, they’re all installed – there wouldn’t be much to do in that area.”

Also working to Brightstar’s advantage is a pre-existing 60-person camp.

It all lends itself to an aggressive phase of planning and development – as quick as 18 months, according to PCF senior manager Callum Twigger.

“That would be ambitious, but we are very excited to aggressively move the planning forward,” he said.

The next 12 months are expected to entail drilling to expand mineral resources, a feasibility study on the project and a refurbishment study on the plant, and the planning of a production scenario.

Bright developments indeed.

The third card in Brightstar’s hand is its ownership of mining leases immediately adjacent to Magnetic Resources’ highly prospective Hawks Nest 5 and Hawks Nest 9 tenements, from which significant gold intercepts have been reported in 2020.

Brightstar is currently reviewing historic workings on its Hawks Nest tenements, with a view to preparing renewed exploration surface and drilling work.

Experience at the table

Driving Brightstar forward is an experienced and familiar WA-focused team. Hobba, who has 40 years of experience, will lead from the front as managing director having spent the majority of his career in the management, construction and commissioning of processing plants.

Well respected corporate lawyer Josh Hunt also recently joined the board as a non-executive independent director. Hunt is an experienced capital markets and M&A partner with HopgoodGanim Lawyers who has extensive experience in the mining space.

The company’s chair, Yongji Duan, has a long affiliation with Stone Resources, and has been extremely supportive of the team’s efforts to get the company back on track.

Canaccord’s Alex Rovira is looking after the capital market side of Brightstar’s operations moving forward, with PCF in charge of the corporate and strategic elements of the business.

Already so far from where it’s come, there is still plenty on the horizon for Brightstar as it works its way into the next chapter of its business story.

“I chose the name Brightstar because I think it reflects the bright future we have ahead for the company,” Hobba told Stockhead.

“We’ve got the right team to take it forward, and everything else looks bright to me. Now it’s time to get going, and to start getting things done.”

With hurdles finally cleared and a more than decent hand to play, Brightstar could well shine bright in the months and years to come.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.