Niobium pandemonium: ASX explorers are going crazy for the mineral in Brazil

Pic: Getty Images

- Brazil is the world’s premier source of niobium, a metal suddenly capturing the attention of ASX investors

- St George Mining recently made a major splash, acquiring the Araxa project adjacent to CBMM, the company supplying 80% of the world’s material

- Several other juniors are seeking out new sources of niobium in Brazil’s Minas Gerais State

Niobium, a rare critical mineral, is recapturing investor interest as the world’s largest producer of the metal begins testing its role in improving electric vehicle batteries in Brazil.

As is the case with most critical minerals, many people have never heard of niobium despite its use in advanced technology and a wide range of industrial and green energy applications that the world is increasingly in need of.

A large proportion of niobium (~90%) is consumed as ferroniobium in high-strength, low-alloy (HSLA) steel for automobiles, aviation, oil pipelines and construction.

But it’s the metal’s growing use in niche markets such as 5G tech, solar panels, batteries and nuclear energy that gives niobium the game changing edge and potential to become the next best thing.

Currently, production of ferroniobium is just under 100,000tpa from a handful of operations globally – in fact, only three mines in the world produce niobium as their primary product, the largest being Brazilian miner and processor CBMM.

CBMM accounts for ~80% of the world’s niobium supply at their Araxá operations with CMOC Group– also located in Brazil – following next behind and Canada’s Niobec mine in Quebec ranking in third place.

Niobium-based batteries by 2025

In a bid to boost demand for niobium-bearing batteries in high-end commercial markets, including heavy trucks and equipment, rail operation and energy storage, CBMM has been ramping up sales of niobium products to battery materials producers.

The company started to test a niobium-based battery on Volkswagen electric trucks in June, which it claims can be charged faster than others in the market and boasts a longer life (three times the length of conventional batteries).

CBMM’s test project, in collaboration with both Toshiba and Volkswagen, involves a six-year partnership to develop mixed titanium oxide technology in which niobium is added to the anode in lithium-ion battery cells – referred to as NTO.

Expected to be available on the market in 2025, NTO batteries are part of CBMM’s broader diversification strategy that will see 25% of its revenue coming from non-steel products by 2030.

St George picks up a niobium winner

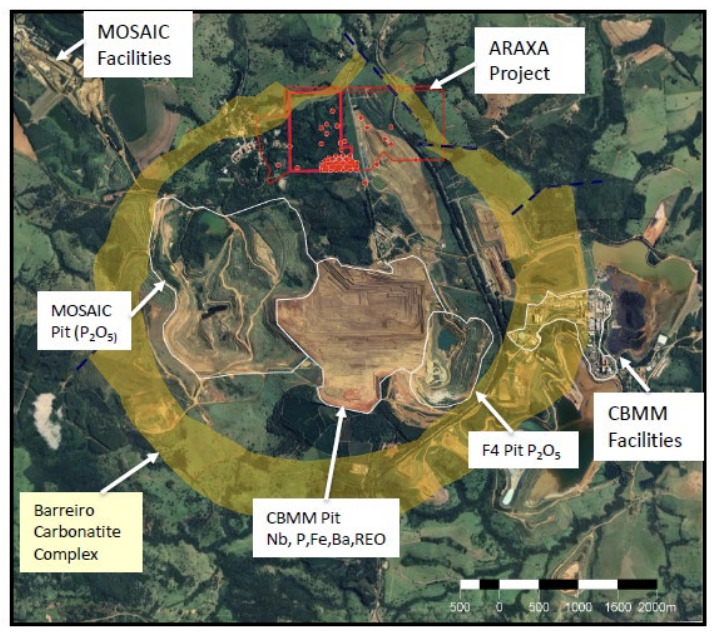

Niobium newcomer St George Mining (ASX:SGQ) spurred a 33% re-rate in its share price earlier this month when it acquired the high-grade Araxá project in Brazil right next door to and within the same carbonatite complex as CBMM.

With commodities across the board showing signs of volatility, SGQ executive chairman John Prineas told Stockhead the company focused its attention on acquiring a project with exposure to a stable, long-term commodity.

“Araxa is that project for us. Investors understand the value of niobium and it’s a great market to be in because there’s only three suppliers at the moment,” he said.

“Niobium is supply concentrated and has a stable price because of that. Currently the price is sitting at $45,000/per tonne which it has hovered around for the past two decades.

“We’re lucky enough to have a project in an experienced mining state like Minas Gerais where you can get permitting through, plus mineralisation starts at surface, so it is going to be very easy to drill out a simple open pit.

“Our location in an established mining region, with Brazil already the world’s biggest producer of niobium, means we can latch into the existing infrastructure, roads, power and workforce which will make it easier for us to add value.”

Another major drawcard for SGQ was the fact that extensive high-grade niobium mineralisation had already been discovered at Araxá, with more than 500 intercepts of niobium grades above 1%.

“It’s a significant deposit and is already proven which means the pathway to development is much easier for us than some of the other explorers,” Prineas said.

“Historical drilling has uncovered grades of up to 8% niobium as well as up to 30% TREO and we’re confident the metallurgy is going to be good because our neighbours CBMM have been doing it for 50 years.

“We will eventually have to work out how we are going to monetise it. We could end up doing a deal with CBMM where they process our material so we don’t have to develop our own processing plant or someone else might come in and help us develop it.

“But only 10% of the tenement has been drilled so there’s potential to add more resources from step out drilling which we hope to start in November-December this year.”

Brazilian niobium hunters

Summit Minerals (ASX:SUM) is another example of a junior explorer that recently picked up strategic ground in Brazil with niobium exposure, but unlike SGQ, the company’s tenements are based in the Paraiba and Rio Norte states further north.

One of the newly acquired tenements (848283/1999), adjoins SUM’s Equador niobium-tantalum project where exploration work is ongoing.

Internal studies conducted by the company have already indicated that the Equador North tenement is likely a continuation of the geology at SUM’s existing Equador project.

Planning is now underway for a LIDAR survey to expand the coverage of the new mining lease area and allow for detailed mapping of prospective pegmatite outcrops.

Australian Mines (ASX:AUZ) owns the Jequie North and Jequie South rare earth-niobium projects in Brazil’s Bahia state, right next door to Gina Rinehart-backed Brazilian Rare Earth’s (ASX:BRE) 510Mt at 1513ppm total rare earth oxide inferred resource within the Rocha da Rocha project.

Rocha da Rocha is comparable to the world’s biggest non-Chinese rare earth clay project, Serra Verde.

AUZ carried out a third exploration program of soil and rock chip sampling during the quarter which resulted in the successful identification of two high priority targets for follow up auger drilling.

And Ironbark Zinc (ASX:IBG) entered the Brazilian niobium scene in July with the acquisition of the Perseverance project, consisting of seven key assets in northeastern Minas Gerais.

The company is strategically located near several high profile developers and explorers including lithium exponents Sigma Lithium and Latin Resources (ASX:LRS). The latter showed the demand for Brazilian new energy metals companies when it recently entered into a scheme deal for Pilbara Minerals to acquire the junior and its Salinas hard rock lithium project.

At Stockhead we tell it like it is. While St George Mining, Summit Minerals and Australian Mines are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.