Niobium is electrifying interest in Africa’s mining industry

Africa’s got the critical mineral chills…they’re multiplying. Pic: Getty Images

- Many believe Africa is a risky jurisdiction but its mineral wealth has been the drawcard for mining companies for years

- The continent is quickly emerging as one of the world’s primary targets for new mine development

- ASX explorers like GBE, DMM, TKL, DY6 and ARN are all there hunting for niobium

Africa may hold a reputation for being a risky jurisdiction, but its abundance of under-explored, shallow and easy to mine deposits make the continent a highly attractive place to do business.

From the prolific Kalahari Copper Belt in northern Botswana, through Namibia’s ~50-year uranium production history and across West Africa’s rising gold production, Africa’s mineral wealth has been the drawcard for foreign mining companies for years.

It’s quickly emerging as one of the world’s prime targets for new mine development, especially those with exposure to future facing critical minerals like niobium.

Niobium, a lightweight metal used largely to strengthen steel alloys, is growing in prominence across a wide range of niche markets such as 5G technology, solar panels and batteries.

OEMs are experimenting with niobium in batteries across high-end commercial markets such as energy storage and EVs due to its potential to add ultra-rapid recharge and life extension properties

Globe’s niobium push

While there’s no current niobium production in Africa, Globe Metals and Mining (ASX:GBE) put the metal on the map for investors when it listed in 2007 with its Kanyika project in central Malawi.

Now, Kanyika is moving closer to development-ready status after the company received a non-binding letter of intent from Ecobank Malawi for a $US15m loan facility in late July.

Together with advanced discussions on equity funding and pre-shipment, GBE says the funding package is crystalising for Phase 1 development with the loan facility accounting for 33% of the total Phase 1 capital requirements.

As it stands, three mines in Brazil contribute to more than 95% of global mined niobium supply and no new mines have been brought into production for at least 50 years, meaning if all goes ahead, Kanyika offers mitigation against potential supply risk.

GBE is aiming to produce high-purity niobium pentoxide and tantalum pentoxide powders from a JORC-compliant total resource of 68.3 million tonnes using a cut-off grade of 1500 parts per million niobium pentoxide.

A feasibility study completed last year highlighted an impressive total EBITDA figure for a fully developed operation of US$3.74b across an initial mine life of 23 years.

DMC enters the scene in Guinea

David Sumich, managing director of DMC Mining (ASX:DMM), was previously chairman of GBE when it listed on the ASX some 15 years ago.

Back then, he said investor knowledge about niobium was virtually non-existent.

“We still have some catching up to do but the market has become more informed, particularly investors based in Perth who now have a better understanding of the metal and it’s applications,” he said.

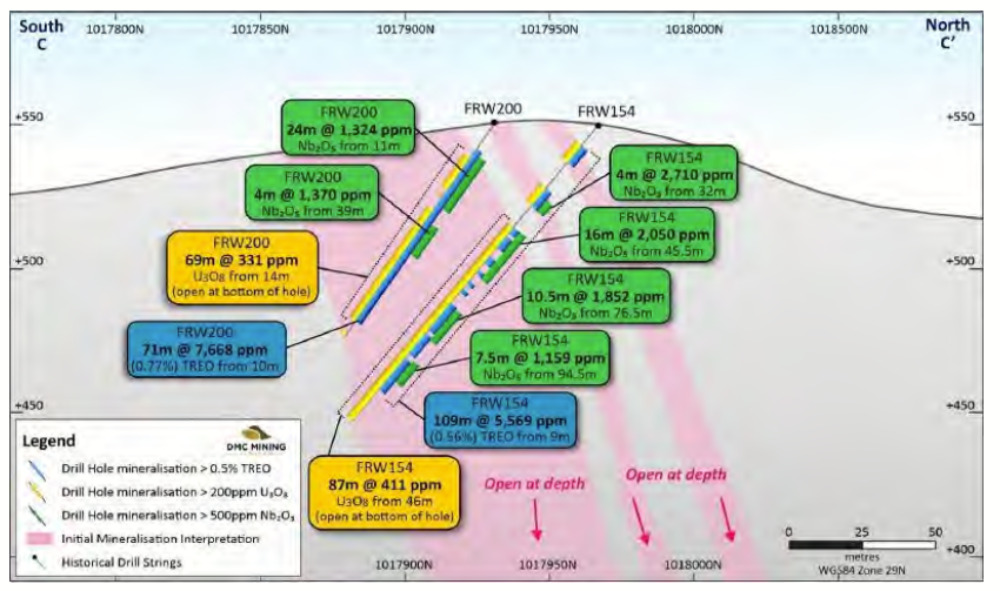

DMM, a critical metals explorer, acquired the advanced Firawa uranium-REE-niobium project two months ago when it entered into a share sale agreement to acquire 100% of the issued capital of Veridis Energy SARL.

Situated in Guinea, a pro mining jurisdiction with significant bauxite, gold and iron ore projects in production or being developed, Firawa provides DMM with a significant advantage over a greenfields site.

A large amount of exploration funds has already been spent and a uranium deposit has been identified, meaning DMM’s starting point is about five or more years into the exploration phase.

“We approached this project with a structured, four-pillar strategy, evaluating its potential as a company-maker, the commodity, the jurisdiction, and the commercial terms,” Sumich told Stockhead.

“Firawa stood out to us with 12,000m of prior drilling that revealed economic grades of uranium, rare earths, and niobium.

“The drilling results have proven the geological concept and have indicated low geological risk, offering enough data for DMC to establish a JORC 2012 uranium resource.

“This evidence not only underscores the project’s viability but also suggests it has the potential to be globally significant.”

Sumich said the company was focused on acquiring a project with exposure to current market trends such as electrification and decarbonisation and was determined to find an asset that fit perfectly within its portfolio of critical mineral claims.

The project’s location in Guinea, a well-established mining region that has seen ~A$20b invested by mining majors into projects – including a $6b commitment by Rio Tinto (ASX:RIO) at its Simandou iron ore mine – was another major plus.

“Contrary to popular belief, Africa is not as high-risk as it’s often perceived. In fact the region – and in particular Guinea – presents low risk when it comes to project permitting, heritage, and community relations especially when compared to Australia,” he said.

“Major companies like Rio Tinto and Alcoa have operated there for decades without interruption, making it an attractive destination for mining investments.”

DMM is planning to get on the ground immediately after the transaction to follow up on previous high-grade results that returned an average NdPr:TREO ratio of 28%.

Who else is exploring for niobium in Africa?

Further east in Mozambique, Traka Resources (ASX:TKL) recently signed an exclusive 90 day option agreement to acquire an 80% interest in the Mavago and Meoponda REE-niobium projects.

The projects sit within the highly prospective and emerging East African Rift Valley Zone, home to other developing REE and niobium projects including Lindian Resources’ (ASX:LIN) Kangankunde project and Chilwa Minerals’ (ASX:CHW) Lake Chilwa tenure.

Over in Malawi, DY6 Metals (ASX:DY6) owns the Machinga REE-niobium project as well as the newly acquired Tundulu asset in the southern part of the country.

Tundulu, a carbonatite complex enriched in REE and Niobium mineralisation, is comprised of several hills in a ring around a central vent called Nathace Hill where the majority of historic surface sampling and drilling was undertaken.

DY6 has engaged Perth-based consulting metallurgists Met Chem Consulting to conduct initial metallurgical evaluation, review historical testwork work programs and assess previous findings.

And Aldoro Resources (ASX:ARN) is exploring and evaluating its Kabeelburg REE-niobium project in Namibia’s Otjozondjupa region.

The company acquired a majority interest (85%) in the project last year for a total $241,000 plus 500,000 fully-paid ordinary shares.

Preparations are underway for an upcoming 2000m campaign, with the maiden program expected to begin at the end of Q3.

At Stockhead we tell it like it is. While DMC Mining is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.