Nickel’s bright future is shining a light on Corazon’s legendary, 100%-owned Lynn Lake

Pic: Tyler Stableford / Stone via Getty Images

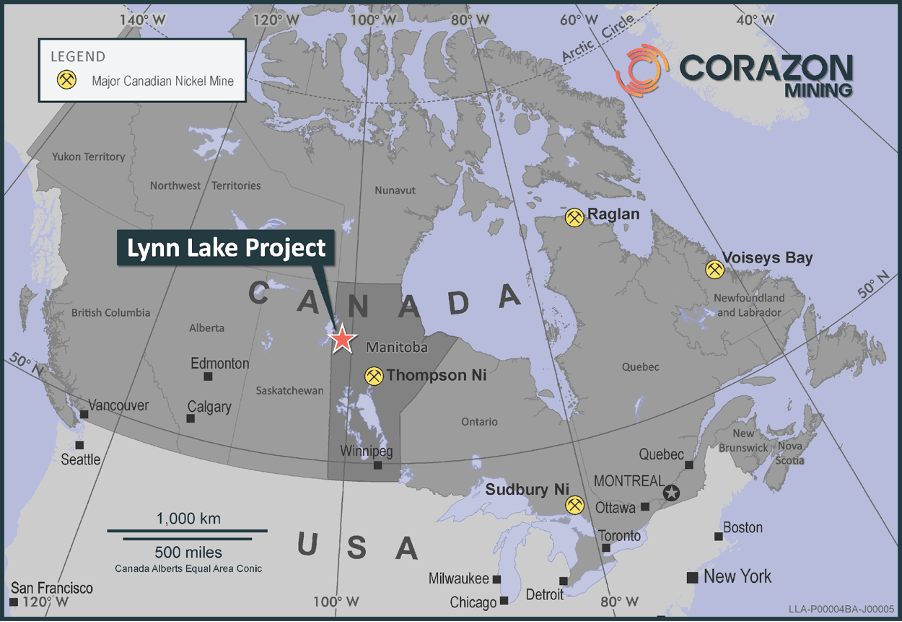

Located in Manitoba, Lynn Lake was once one of the largest nickel mining centres in Canada.

Predating the Kambalda nickel boom, Sherritt extracted the metal for 23 years between 1953 and 1976 when producers lost their pricing power and the market went into decline.

Since then it has been a forgotten secret until it was eventually consolidated by Corazon Mining (ASX:CZN).

The ASX listed explorer is the first company to hold the Lynn Lake complex in its entirety since its closure.

During that time the nickel price sunk as low as US$3.50/lb – in early 2016 – a level at which most of the world’s nickel producers were losing money.

Fast forward half-a-decade, and how times have changed.

Nickel’s bright future

The commodity is running extraordinarily hot due to low supplies and an intense, burgeoning demand from the transition to an electric vehicle future and the lithium-ion battery market.

With prices now at US$15/lb – levels at which existing producers would be making money hand over fist – the outlook for Lynn Lake has been transformed.

$20 million market-capped Corazon just raised $7.6 million in a rights issue, the most capital it has ever collected in a single go, to bankroll the most expansive campaign it has ever attempted in the forgotten Canadian mining hub.

Nickel prices drive excitement

“It’s quite exciting with nickel where it is at the moment in the market,” Corazon managing director Brett Smith told Stockhead.

“There’s definitely a shortage of class one, high-quality sulphide nickel, that’s for sure. So users will need to source high-quality nickel from elsewhere, because existing mines just can’t supply enough.”

Securing nickel supply has become a core focus of battery makers and car manufacturers who have been caught asleep at the EV wheel by the strained growth of raw materials supply.

All new models released by Audi from 2026, for example, will be battery powered, while Volvo will only make fully electric cars from 2030.

That ambition is being replicated across the spectrum, before even mentioning market leaders like China’s BYD and Tesla, whose iconoclastic boss Elon Musk has been on record calling for new nickel mines and has lined up offtake with companies like BHP and even Prony Resources in New Caledonia.

Nickel, still at a trickle

They will need a lot more nickel from all sources, but especially the nickel sulphide ores like Lynn Lake that currently form the bulk of supply into the battery market.

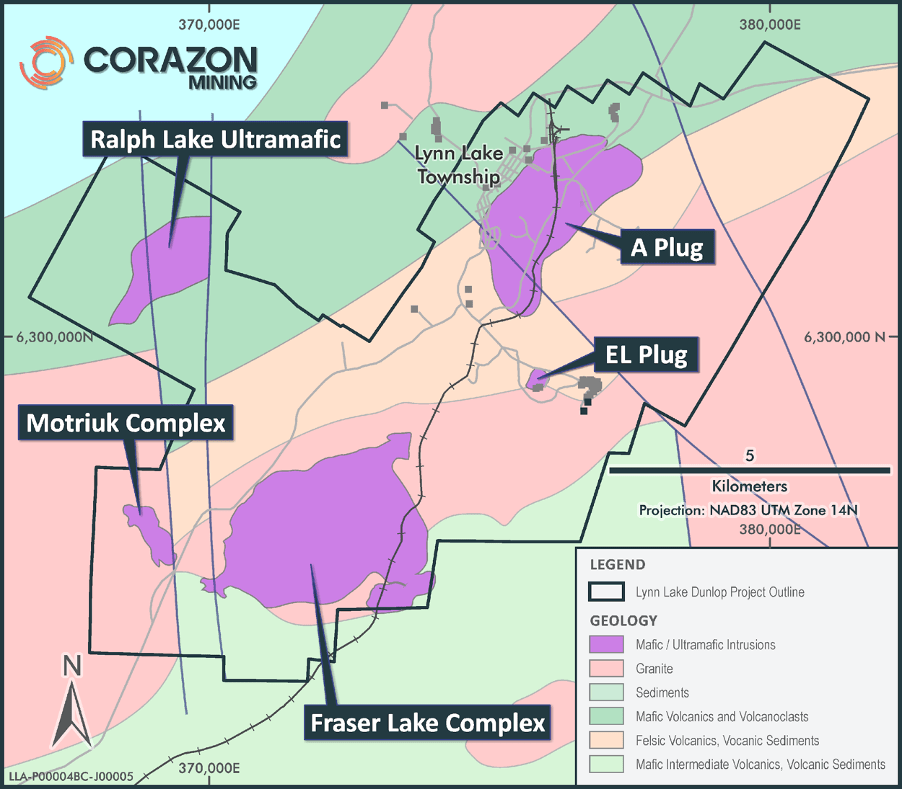

Lynn Lake is a large nickel-copper sulphide district which delivered historic production of 22Mt of ore at 1.02% nickel and 0.54% copper. Despite being a long time between drinks, Lynn Lake remains Canada’s fifth most prolific nickel province after Voiseys Bay, Thompson, Sudbury and Raglan.

Corazon has resources across six of its 20 deposits, upgrading it last year to a total of 16.3Mt at 0.72% nickel, 0.33% copper and 0.033% cobalt at a cutoff of 0.5% nickel for 116,800t of nickel, 54,300t of copper and 5300t of cobalt.

That’s a good launchpad for future exploration, but Corazon’s focus at the moment is not on incremental improvements to the brownfields resource.

Smith and Co. are looking for the big fish, a major new nickel sulphide discovery close to surface with large-scale potential.

Welcome to Fraser Lake

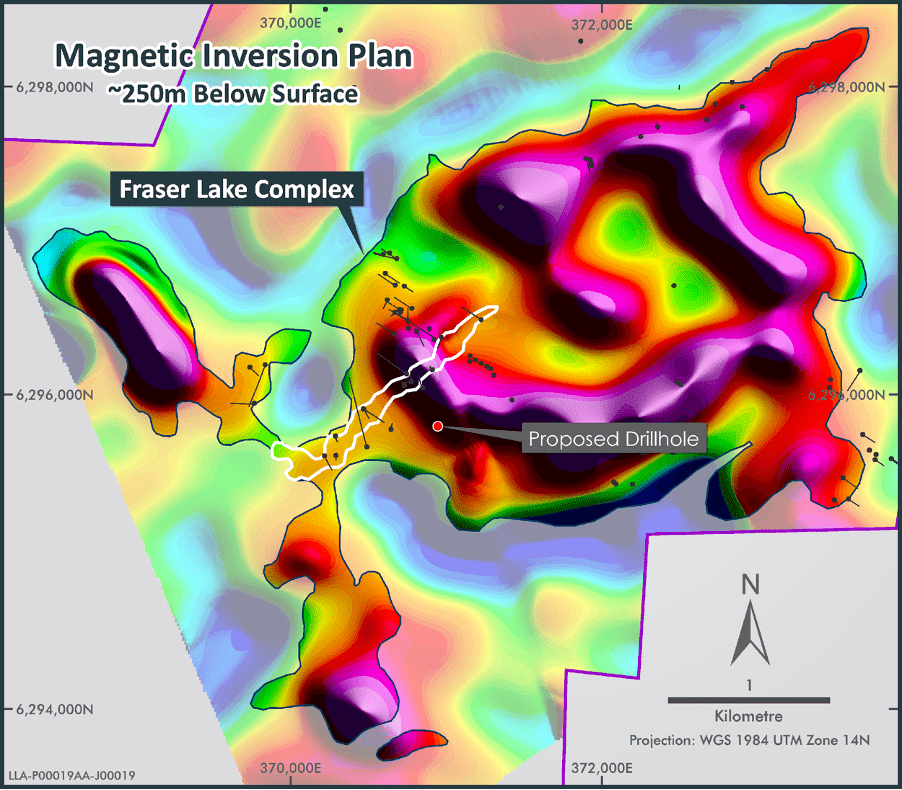

That may well come from the Fraser Lake Complex, 5km from the main Lynn Lake Mining Centre, where Corazon recently launched a 3000m drilling program over at least four targets.

Fraser Lake is strikingly similar to the EL deposit at Lynn Lake, which was mined to 200m below surface and produced 1.9Mt of ore at 2.4% nickel and 1.15% copper, well above the standard grades at Lynn Lake.

“It’s pretty hard to go past Fraser Lake as an exploration play. We know we can identify more tonnage in the mine centre, that’s a given, we’ve resources on six out of the 20 known deposits,” Smith said.

“We know that there’s more mineralisation at depth but we’re really looking at something that’s potentially closer to the surface.

“When you look at Fraser Lake it’s the same kind of intrusive system as the mining centre except bigger. And the old timers believed that’s where the next big deposits in Lynn Lake would come from.”

Smith said Fraser Lake is a difficult place to explore, but exploration to date has delivered evidence of massive nickel-copper-cobalt sulphides.

A detailed aerial gravity survey conducted over the Lynn Lake project in January found features not highlighted by historic gravity data, particularly multiple discrete, dense, sub-vertical pipe-like bodies that appear to join up at depth forming a large dense magnetic body within the core of the intrusive complex.

“Testing these things is a process of drilling, seeing what’s there, and then pulling the other data sets in together and continually improving the exploration strategy,” Smith said.

“What it looks like to us is that you’ve got these fingers of high density rocks that have come up from a central mass in the Fraser Lake Complex, and that’s very exciting for us.

“We haven’t seen this before and they haven’t been drilled.”

Big bang discovery

Smith says some of the best drill holes at Fraser Lake have been drilled close to these anomalies.

“We have intercepts like 20-plus metres at 0.7% nickel, along with small zones of massive and semi-massive sulphides. We’ve got some fantastic evidence of nickel sulphide throughout Fraser Lake,” he said.

“We see a lot of sulphide, it’s just that big accumulation that we’re lacking. It almost looks like we’re looking at the froth of a beer and what we’re after is below.

“It’s a 5km by 3km area we’re looking at, and these drill holes are like little pinpricks into that big area.”

With the nickel price up around 70% and market outlook improving significantly in 2022, Smith said Corazon is well placed to both progress mining studies on the existing resource base at Lynn Lake and chase a big find.

“With the nickel price where it is and the forecast demand for nickel, we’ve gone back and we’re accelerating mining studies and really trying to reinvent the wheel with respect to the mining operation,” he said.

“So it’s definitely a two-pronged focus.

“Exploration gets the limelight because that’s what investors and that’s what our shareholders are there for. They’re not there for organic growth of the mining centre.

“They’re there for the big bang, the big buck of a discovery.”

Investor support

Those investors have backed Corazon in a big way.

The company has raised almost $10 million over the past couple of months, both through the rights issue and a $2 million placement from nickel sulphide explorer Blackstone Minerals (ASX:BSX) that gave the Vietnamese nickel play a 14.32% interest in Corazon.

“This is the most money that Corazon’s ever had and it really does change us from a program by program type company, continually looking for support from the market,” Smith said.

“We can commit to longer term, more encompassing studies in the mining centre as well, instead of just taking little steps, and engage staff and contractors on a longer-term basis in Canada.”

The Canadian technical team is led by the company’s nickel expert Dr Larry Hulbert, who completed his honours on the geology at the Lynn Lake Mining Centre as a hands-on young geo in 1974 before moving to the Canadian Government, studying similar systems globally for the next 23 years.

If Corazon is successful in progressing mining studies at Lynn Lake and making a big new discovery at Fraser Lake or one of the myriad of targets in Manitoba, it is well placed to capitalise.

The Lynn Lake Project has strong ESG credentials with the area supplied by clean hydropower, while Vale’s Thompson Nickel Operation is just 320km down the road.

New operators have the opportunity to “reinvent the wheel” as far as mining goes, Smith said, with nickel producers facing increasing scrutiny from EV makers wanting to ensure ethical and sustainable supply chains.

Smith said both including the community of Lynn Lake and reducing the environmental impact from its operations would be ‘critical going forward’.

Back in the land down under

Corazon is also working to make major new nickel discoveries closer to home in Australia.

While it has explored the Mt Gilmore cobalt project in recent years, its most recent signing is the Miriam nickel project near Coolgardie in WA.

Last week Corazon announced the completion of a deal to acquire Miriam, located just 10km from Coolgardie on the same ultramafic trend as the historic Nepean nickel mine.

It has shades of the Lynn Lake story and while Miriam wasn’t a producing mine, a deposit of nickel sulphides was discovered there by Anaconda Nickel back in 1969.

“That’s a 1969 discovery that hasn’t had any nickel exploration over the last 20 or so years, so we believe that with modern geophysics we’re going to be able to identify the mineralisation quite well,” Smith said.

Corazon expects the grant of the prospecting licences to come through soon from the WA Government.

“We’re still completing target generation in preparation for geophysics and drilling,” Smith said.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.