Nickel may be the next big Pilbara rush if mining tycoon David Lenigas is right

Pic: Tyler Stableford / Stone via Getty Images

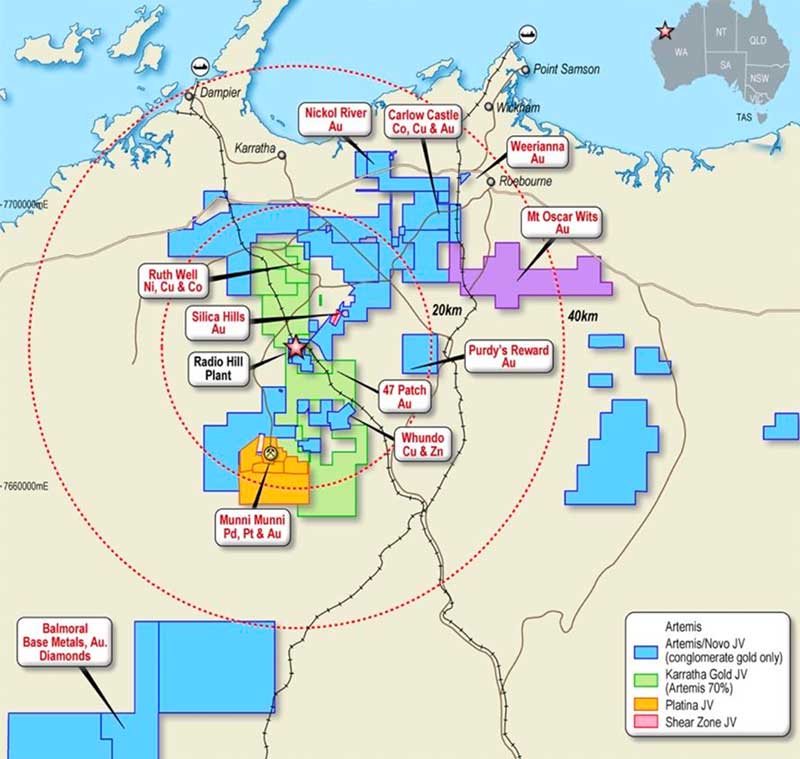

Mining tycoon and Pilbara gold pioneer David Lenigas says his popular explorer Artemis Resources is more than just a gold play following a recent nickel find.

Artemis kick-started a Pilbara gold nugget rush last year with Canadian partner Novo Resources. What are the big challenges now as you move towards production?

When I got involved the nickel and copper prices were roughly half of what they are now and there was a lot of rhetoric about the [Radio Hill] plant being flogged or rusted. But in reality it is all just surface-level. The engineers have been through it all and the plant is in great nick.

Everyone talks about conglomerate gold in the area, but there’s a lot still to be done.

What are the next steps for Artemis in developing its Pilbara gold projects?

When it comes to our conglomerate play I am letting our Canadian joint venture partner Novo Resources take the running of that.

What we did with the CSIRO [calling in scientists to help unravel the Pilbara gold mystery] was a different move. It just just comes down to the fact that I want to understand what is happening from an Australian scientific perspective — why the gold is there and how it got there.

The way I see it, of all of the conglomerate plays in the Pilbara, nothing compares to what we have with Purdy’s Reward. But there is still so much work to be done to get our heads around it.

I want to create a company that makes real money — not something that stands on exploration — 99 per cent of prospectors goes broke.

Artemis has potential to be a real revenue-producing jewel in the crown for the Pilbara.

Besides gold, what other minerals are you hoping to produce in the Pilbara area?

I want to get the gold circuit going at Radio Hill [processing plant] first, but then I want to move into nickel-copper-cobalt because the surprising thing is that nobody thought of opening it up as an open cut mine previously.

We’ve drilled probably nearly 100 holes and it is the dirt here that we will look to put through the Radio Hill plant in the long term.

On the back of that we have a lot of work on a very exciting nickel play — which has the potential to make a whole new nickel region for the area.

[Artemis recently identified nickel targets over a potential 3.5km area which it described as “a potential game changer for the company and the region”.]

Nickel prices will be continuing upwards because it is vital in the lithium-ion battery and many say it can’t be replaced.

That being said, only half the world’s nickel supply is suitable – and Radio Hill is just the right stuff. It is a clean concentrate and the smelters are familiar with it.

I think we’ve got some of the highest-grade nickel intercepts globally and what is on the verge of a new nickel province people have not been aware even existed.

What we are finding up in the Pilbara, now that we are spending millions on exploration, is that we have no idea what is going to be the biggest resource.

You can forget about conglomerate gold — I am really excited about the nickel discoveries we are finding.

The way I see it, there’s not many billionaires in WA that have made their money on gold. One thing Australia does understand is big nickel.

What originally excited you about Artemis?

It was a fund manager that got me to look at Artemis because they needed someone to shake it by its bootstraps.

I had raised well over billions internationally out of London, the US and Africa and I hadn’t done anything in Australia for many many years.

I used to be a mines inspector — for most of the 1980s — so I know nickel well and gold well.

I could see that the project had the potential, only if it was bolted together with the Radio Hill plant, to make a very substantial company. Together we could unlock the treasure chest in the area.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

I ran the Emperor gold mine back when it was ranked in the top 50. What a lot of people don’t know is that I was a mining engineer first and foremost.

Despite the fact I haven’t done mining in a long time, I still understand the area very well.

When we started exploring the area, we were largely on our own – now, I see that there are too many that will not go to production.

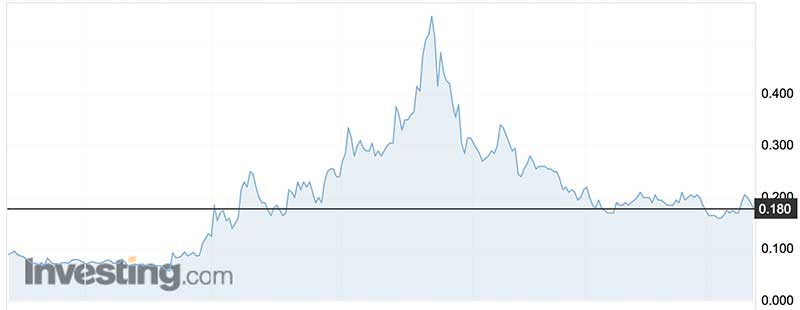

Investor support for Pilbara gold explorers has waned somewhat since last year. How would you describe investor support for Artemis and the Pilbara gold theme?

The problem with the retail investor here is that there is no patience –you get the run of enthusiasm and then everyone expects good results.

In reality, it takes a long time to get permits in place, but the retail punter here is just waiting on the next news release.

I remember when I first joined Artemis – it traded by appointment, had minus 400k in the bank – and it is now market capped at $100 million with just shy of $20 million in the bank.

I think the thing that frustrates me about Artemis is that the whole enthusiasm about the conglomerate play came and went because the retail shareholder here doesn’t take the long-term vision.

It is very difficult to keep the retail punter engaged on where we are going because they want you to come up with another miracle.

We keep rolling along and although the market has been terrible, I need to keep the company going at 100 miles an hour.

The global retail investor has a longer-term view.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.