Nickel could soon be a US critical mineral – and this expert says we’ll need to find another 1.5mt, quickly

Pic: Schroptschop / E+ via Getty Images

Driven by the global push towards electric vehicles (EV) and the movement towards high-nickel cathode, Blackstone Minerals managing director Scott Williamson said at Australia’s Nickel Conference in Perth last week that as an industry, explorers “need to find, discover and develop 1.5 million tonnes of nickel to feed the demand that is coming.”

To put that into perspective, Williamson said some of the largest players in the industry, such as Russian nickel company Norilsk Nickel, are “only producing just under 250,000 tonnes”.

“That is no mean feat and as an industry, I think we are up against it,” he said.

“But even that is not a dent on the demand that is coming.

“I think it’s a challenge that we all need to step up to, particularly for the benefit of our children and grandchildren.”

‘Nickel will become a dominant metal’

Positioned in northern Vietnam and on the doorstep of major, global players such as China, South Korea and Japan, Blackstone Minerals (ASX:BSX) is embarking on a globally significant nickel refining business at the Ta Khoa Nickel Project.

The refinery would process up to 400ktpa (base case) of nickel concentrate to produce battery grade NCM811 precursor for the lithium-ion battery industry amid a very supportive ESG, macroeconomic and fiscal backdrop.

NCM811 includes nickel, cobalt, and manganese and according to Williamson, trades at a 20–40% significant premium.

Addressing the audience at Perth’s nickel conference, he said cobalt “will become less and less of a component and nickel will be the dominant metal required.”

“Blackstone is taking this very seriously,” he said.

“This is the reason why we went to Vietnam; we’ve got the largest hydro power plants in Southeast Asia right on our doorstep near the mine, the mine is already hooked into the hydro renewable power, and we want to be looking for low, zero fossil fuel replacement and electric mine equipment.

“We are aiming to start at zero carbon, not moving towards zero as everyone else is trying to do.”

In the company’s PFS released in July, BSX said Ta Khoa would run on power generated from Southeast Asia’s largest hydro plant, the Son La power station.

A final investment decision is earmarked for 2022 following a DFS and pilot plant testing.

At current Shanghai Metals Market spot prices of US$19,559/t, Ta Khoa’s post-tax NPV would rise from US$2.01bn with an IRR of 67% to US$3.51b with an IRR of 98%.

Down-stream nickel focus

While BSX has a two-part business – the upstream, which revolves around the Ta Khoa Nickel-Copper-PGE mine and the downstream, Williamson said it is the downstream business that sets the company apart from its peers.

“Blackstone is going to bring nickel from Australia, Canada, Africa, all around the world, into this globally significant refining business and we are going to do it with the lowest power costs in the industry and some of the most competitive label costs as well.

“We are looking to produce the NCM811 product – the first stage of the lithium-ion battery.

“A lot of people don’t realise that that is actually more important than lithium, which is the next stage. You combine the NCM with the lithium to produce your cathode.”

Market outlook

Analysts at Wood Mackenzie believe the size of the nickel market is going to mutate over the next two decades.

Currently, around 70% of the nickel market is funnelled into stainless steel (an end market up 14% on its own this year) while just 7% goes into battery precursor.

Jump to 2040, battery precursor will be 30% of that first use end market, with stainless steel shrinking, in percentage terms, to just 53%.

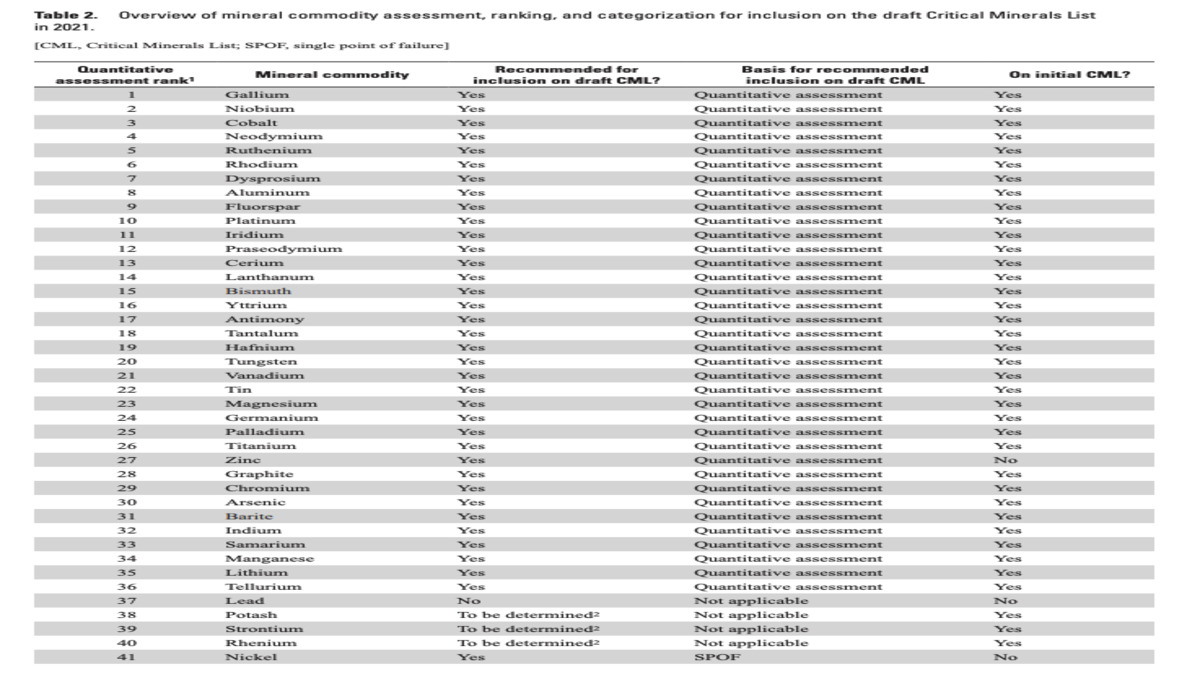

The United States Geological Survey (USGS) has also recently highlighted nickel as one mineral “recommended for addition to the critical minerals list”.

This list, as reported in the Australian Financial Review, will guide the final list likely to be released by the US Department of Interior later this month.

The report says while “demand for nickel in lithium-ion batteries is currently only a small percentage of its total demand, that demand is expected to grow markedly as demand for electric vehicles increases in the coming years.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.