Next Frontier: Perpetual stakes a big presence in Brazil’s ‘Lithium Valley’

Perpetual formally acquired almost 9,000km2 of prospective lithium tenure in Brazil in late September. Pic via Getty Images

- Perpetual confirms admission to Brazil’s “Lithium Valley”

- Initial fieldwork identifies pegmatites with similar characteristics to existing spodumene deposits

- Fellow ASX-listed explorer in Brazil, Latin Resources, recently raised $35 million to expand established lithium resource

Perpetual Resources is shaping as the next major player in Brazil’s “Lithium Valley” following the discovery of extensive outcropping pegmatites across its newly acquired project areas in Minas Gerais.

With a strategic review currently under way over its longstanding flagship Beharra silica sand project in WA, Perpetual (ASX: PEC) has officially joined a small but growing list of explorers and advanced developers which have generated significant value for shareholders in recent times.

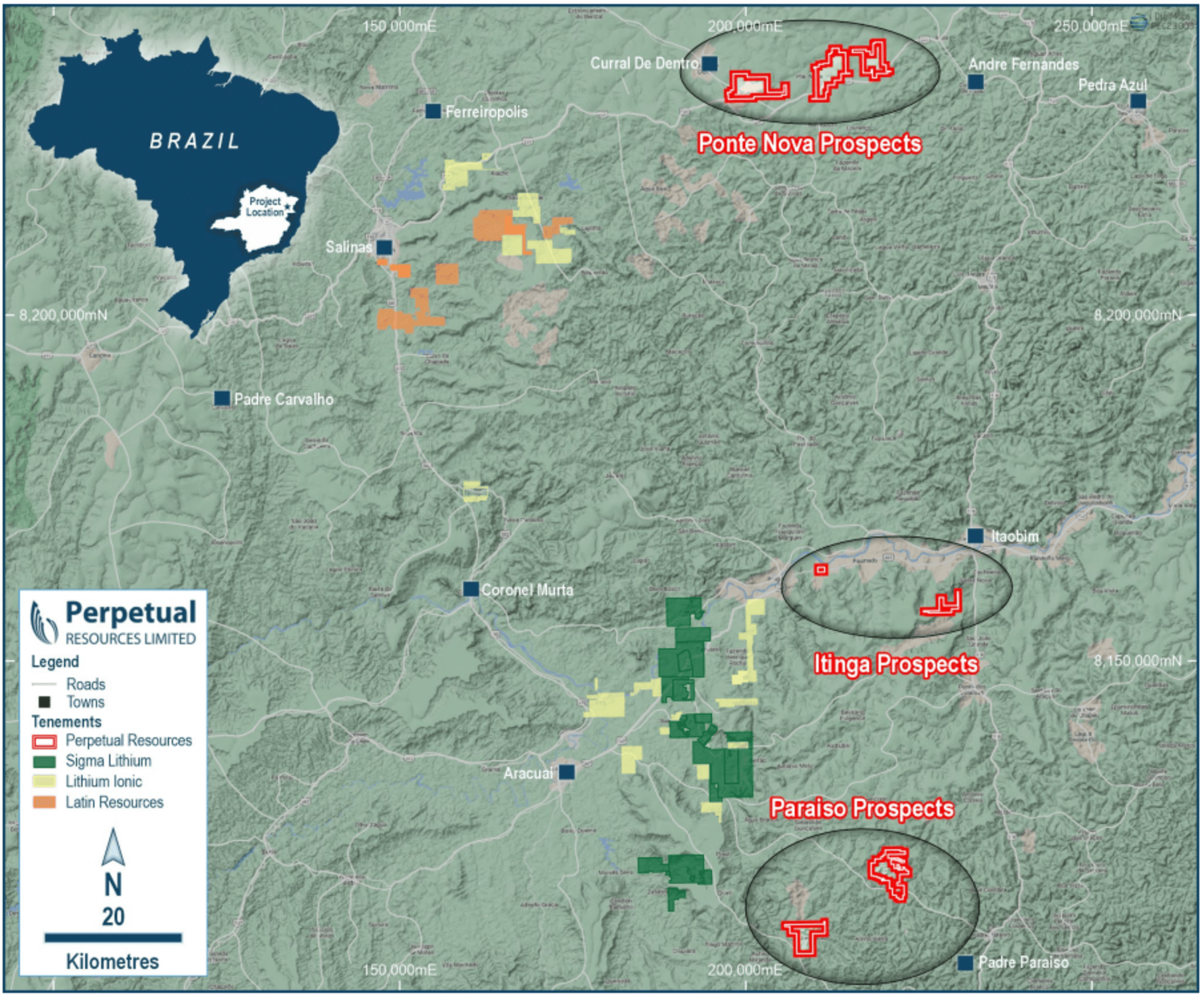

PEC formally acquired multiple key tenement packages in late September, having spent several weeks undertaking due diligence and preliminary exploration work over the Itinga, Padre Pariso and Ponte Nove prospects.

Confirmation of widespread pegamites across all project areas is critical given the company’s tenure is proximal to established lithium projects held by the likes of Sigma Lithium, Lithium Ionic Corp and ASX-listed Latin Resources (ASX: LRS).

PEC now holds almost 9,000ha of spodumene-rich ground in Brazil and has not ruled out expanding its regional footprint in the near term.

Pegmatites on par with established lithium deposits

Initial fieldwork confirmed a multitude of pegmatites identified at Itinga exhibited similar characteristics to those found at nearby spodumene projects such as Sigma’s Grota do Cirlo mine and Lithium Ionic’s deposits of the same name.

PEC’s technical team believe these pegmatites are consistent with a north-east strike and a sub-vertical dip, hosted both concordantly and dis-concordantly within the schists of the all-important Salinas formation which has underpinned many previous lithium discoveries in the region.

During the multi-week exploration field trip, PEC also uncovered numerous pegmatites within the formation which appear to match what is known as the Novo Cruzeiro Leucogranite.

Leucogranites are widely viewed as the ideal geological setting for lithium concentration due to its low iron and magnesium content, higher potential lithium fertility and association with hydrothermal activity.

Ponte Nova remains relatively underexplored despite attracting the likes of LRS and Lithium Ionic to the area which is situated within the lithium-prospective S-Type granite Curral de Dentro formation.

LRS recently raised $35 million via an institutional placement which will ensure the Chris Gale-led company is funded for the foreseeable future to expand its existing 45.2Mt resource at its Salinas project.

Having spent several weeks in Brazil recently while the field work was completed, PEC managing director Robert Benussi is excited about what lies ahead for his company and its new projects.

“I can attest to the potential prospectivity of our tenement package within the world’s next frontier for lithium exploration,” he said.

“The company now awaits the results of the rock chip analysis to confirm the presence of lithium in highly prospective pegmatites. Our team is enthusiastic about exploring further as we feel we have only just commenced the process of uncovering the full potential of this region.”

Beharra on hold as Brazilian future beckons

PEC has collected a significant number of rock chip and grab samples which will be used to not only confirm the presence of lithium-bearing minerals but also assist with follow-up exploration programs.

Assay results from those samples currently being tested at laboratories in Belo Horizonte are expected in mid-December.

PEC anticipates returning to site for a second field program before the end of the year.

Meanwhile, the company is exploring various options for its Beharra project, less than 100km south of Geraldton, ranging from continued project advancement to care and maintenance, joint venture agreements or potential divestment.

PEC said the strategic review was in response to feedback from potential customers amid a general cyclical softening of silica sand prices.

PEC share price chart

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.