New World’s exceptional copper hit delivers potential for Antler resource growth

New World’s new intersection exceeds further increase both tonnes and grade in that part of the Antler resource model. Pic: Getty Images

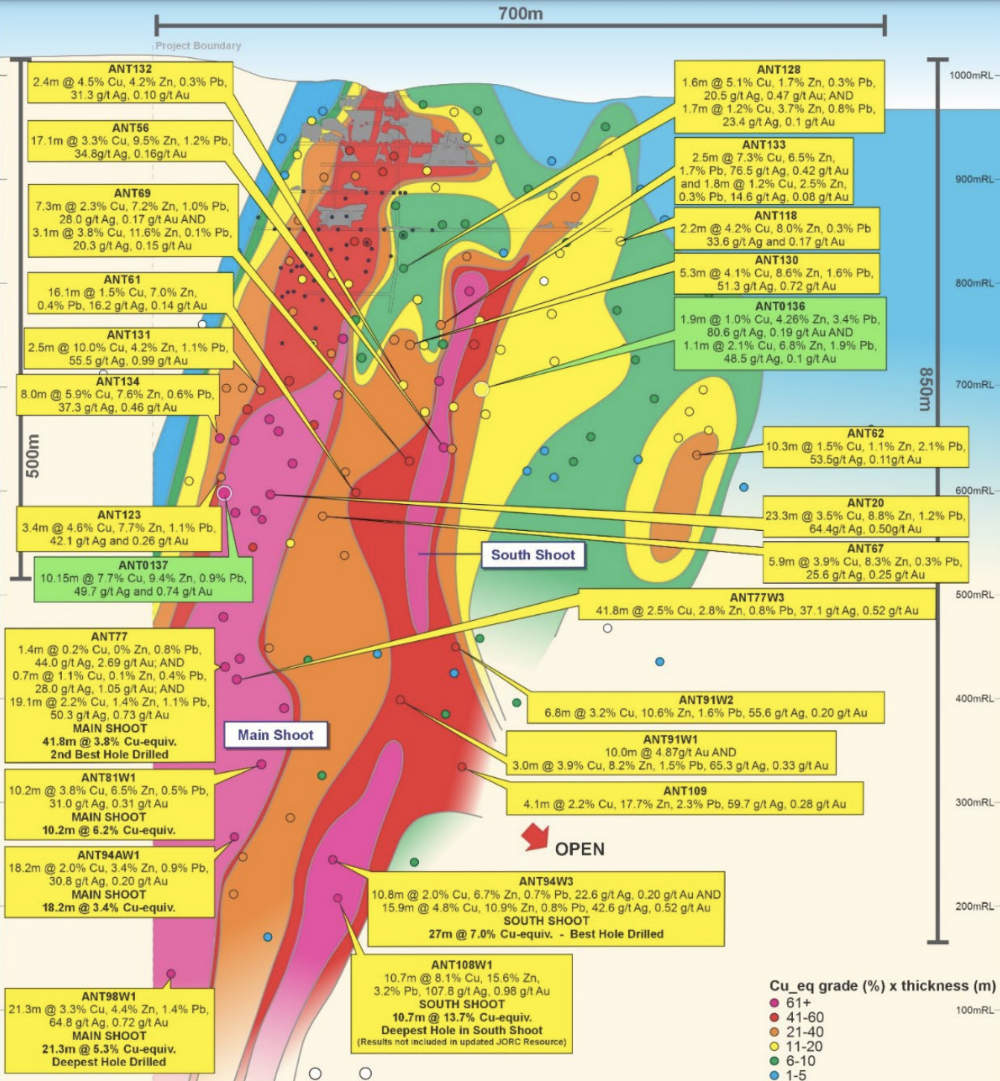

- New World Resources drilling returns ultra-high grade intersection of 10.15m at 10.8% copper equivalent

- Result exceeds tonnage and grade expectations in this part of the Antler resource

- Drilling also finds new zone of mineralisation in deeper target area of the Antler deposit footwall

Special Report: New World Resources expects to upgrade the tonnage and grade of parts of the Antler deposit after its reserve drilling program intersected an ultra-high grade intersection of 10.15m at 10.8% copper equivalent.

The intersection – consisting of 7.7% copper, 9.4% zinc, 0.9% lead, 49.7g/t silver and 0.74g/t gold – was made in the footwall at the north end of the deposit and exceeds expectations from the reserve model.

This is exceptional even by the standards of the Antler deposit, which has routinely seen high-grade intersections such as 8m at 8.3% copper equivalent and 2.5m at 11.8% copper equivalent reported towards the end of August.

New World Resources (ASX:NWC) has also uncovered evidence of a new mineralised lode with one of the first holes drilled to intersect the footwall intersecting a 3.9m zone of mineralisation grading 0.7% copper, 3.91% zinc, 0.2% lead, 9g/t silver and 0.06g/t gold about 130m into the footwall.

“10.15m @ 10.8% copper equivalent in hole ANT137 is an exceptional intercept by any measure – even more so when you consider that it will further increase both tonnes and grade in these parts of the Antler Resource model,” managing director Nick Woolrych said.

“Seeing more thick intercepts of exceptionally high-grade mineralisation at Antler is yet another exciting development which underlies the quality and endowment of the deposit.

“The reserve definition drilling program has exceeded our expectations. The quality of the orebody at Antler is the primary reason we are advancing the project to production as quickly as possible by getting all permits in place, updating the resource model and completing the DFS.

“Meanwhile, other drilling at Antler, particularly the significant deeper result in ANT131, has highlighted the opportunity for further Resource growth. We are very excited to discover an additional mineralised lens in such close proximity to the planned underground mine workings.”

Antler – situated in a sparsely populated part of northern Arizona, ~200km southeast of Las Vegas – currently hosts a resource of 11.4Mt at 2.1% copper, 5.0% zinc, 0.9% lead, 32.9g/t silver and 0.36g/t gold (11.4Mt at 4.1% copper-equivalent) –one of the highest-grade copper deposits in the world on a copper-equivalent basis.

Reserve definition drilling

The recent reserve definition drilling was aimed at further increasing the confidence in the components of the mining inventory that are scheduled to be mined in the first 4-5 years of operations according to the pre-feasibility study, which had outlined robust margins.

It was also designed to obtain core samples for additional metallurgical testing to support a definitive feasibility study.

ANT137 returned its exceptional intersection from mid-to-shallow depths at the northern end of the Main Shoot.

Meanwhile, hole ANT136 that was drilled to better define the southern extents of the South Shoot intersected two intervals of 1.9m at 3.4% copper equivalent and 1.1m at 4.55% copper equivalent – in line with expectations for this part of the orebody.

The results increase the company’s confidence in its resource model, which is hugely positive given that copper demand growth is expected to jump from 1.9% annually over the 15 years to 2021 up to 2.6% annually until 2035.

Other activity

NWC currently has one rig drilling at the Antler copper project, testing exploration targets immediately along strike to the north and south of the Antler deposit.

It is also completing an induced polarisation survey alteration associated with mineralisation has been mapped at surface over and around the Pinafore deposit at its Javelin project.

This is expected to be completed in November with results to follow later that month.

Additional mapping is also scheduled for the month of November near and along strike to the Pinafore deposit before the company resumes drilling.

This article was developed in collaboration with New World Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.