New World Resources is biting into the growing copper market

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Special Report: New World Resources is well positioned to capture the copper opportunity brought about by global stimulus spending on infrastructure.

Copper has experienced a revival in recent months as governments around the world introduce stimulus packages in response to the recession brought about by the COVID-19 pandemic.

New World Resources (ASX:NWC) managing director Michael Haynes notes that the general consensus in the resources sector for the outlook of the industrial metal over the next three to five years is very strong.

“If government stimulus goes into the development of infrastructure like power lines and new residences, then the consumption of copper is likely to increase,” he told Stockhead.

“Hand in hand with that, the supply side is falling away a little bit as grades at the big global mines slowly dwindle.

“Even though they might be mining the same number of tonnes each year, the output from those mines is slightly less copper.”

He adds that this positive outlook for the supply and demand equation will lead to higher copper prices.

Copper opportunity

Haynes believes that New World is perfectly positioned to capture this opportunity.

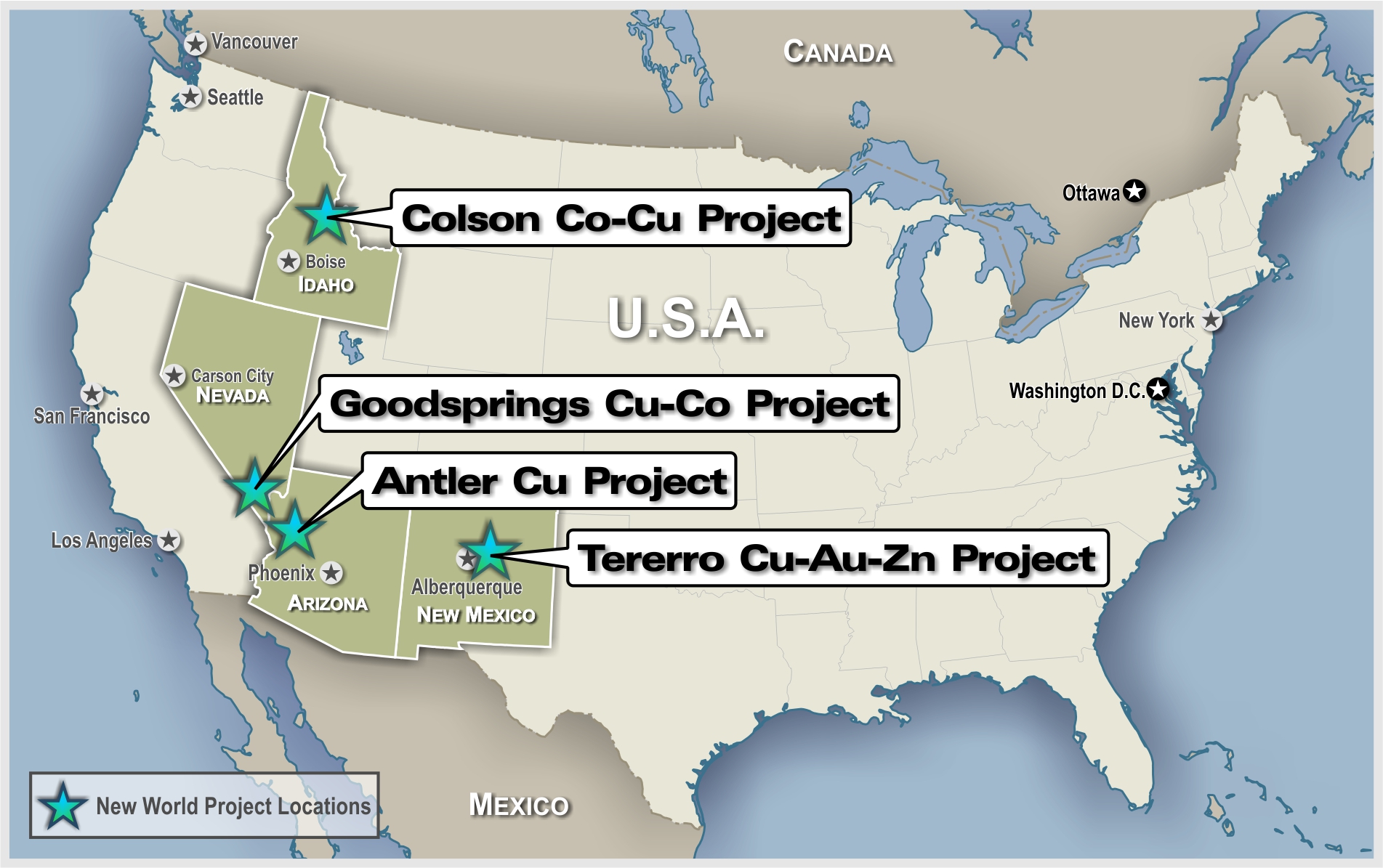

While the company has assembled a portfolio of projects in North America over the last few years, it’s the recently acquired and well-advanced Antler copper project in Arizona that he is feeling confident about.

Antler includes the historical, high-grade copper mine that produced about 70,000t of ore at about 2.9 per cent copper, 6.9 per cent zinc, 1.1 per cent lead, 31 grams per tonne (g/t) silver and 0.3g/t gold intermittently between 1916 and 1970.

Between 1970 and 1975, underground drilling delineated a panel of high-confidence, high-grade mineralisation immediately beneath historical stopes that could be quickly exploited.

However, mining never resumed and no work was undertaken at the project until the company became involved.

It is the high-grade nature of this deposit that makes Haynes confident.

“I think high-grade deposits have a much better chance of being profitable through any commodity price cycle as it makes it less important that we are capturing a high copper price environment,” he added.

And New World is certainly charging ahead to ensure that it is making the most of the opportunity.

Successful exploration

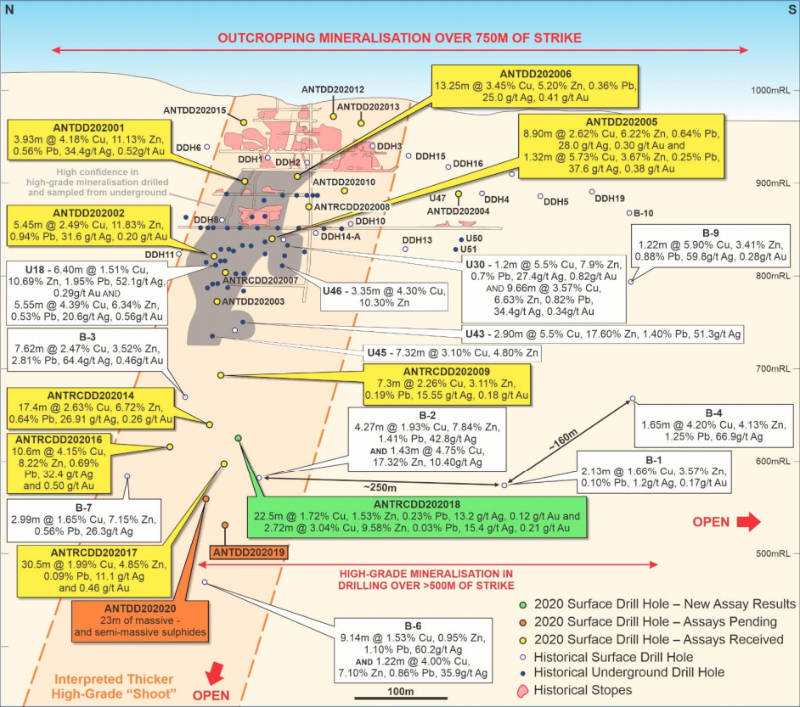

To date, the company has completed 20 holes totalling about 5,072m with drilling continuing.

The initial holes returned hits such as 13.2m at 3.45 per cent copper, 5.2 per cent zinc, 0.36 per cent lead, 25g/t silver and 0.41g/t gold from a depth of 128.3m and 8.9m at 2.62 per cent copper, 6.22 per cent zinc, 0.64 per cent lead, 28g/t silver and 0.3g/t gold from 198m.

This confirmed the presence of substantial unmined, high-grade mineralisation in areas immediately adjacent to the historical stopes.

Subsequent holes to explore for extensions of mineralisation at depth have also returned very thick, high-grade mineralisation well below the historical workings.

These include results such as 30.5m at 3.6 per cent copper equivalent and 10.6m at 6.8 per cent.

More recent drilling returned an intersection of 23m of well-mineralised massive and semi-massive sulphides grading 2.2 per cent copper equivalent.

“The discovery of thick high-grade base metal mineralisation is a very rare thing for exploration companies to encounter,” Haynes explained.

“We are consistently intersecting thick high-grade mineralisation in a geological province that we know has potential to host very large deposits and so I think the upside to this project is getting better.”

No surprise then the company remains focused on completing confirmatory and infill drilling within areas where historical drilling has demonstrated mineralisation to quickly delineate a high-grade JORC indicated resource that can be used in mining studies.

“The fact that the mineralisation is very shallow also supports the opportunity to resume production in the near-term,” said Haynes.

The high-grade results are not the only factors supporting the potential for Antler to be brought into production quickly.

Antler is also located in a top tier mining jurisdiction with Haynes noting it is on privately-owned surface rights and private mineral rights, which would help expedite the resumption of production.

It is also located close to existing infrastructure.

“We are just 20km from a railway line and an Interstate highway and high voltage power.”

Other projects

While Antler is the current focus of New World’s attention, its other projects also deserve mention.

Another recent acquisition, the Tererro copper-gold-zine project in New Mexico, is centred on the Jones Hill volcanogenic massive sulphide (VMS) deposit 8km southwest of the historical Pecos mine.

While mineralisation had been known to be present at the Jones Hill Deposit since the 1800s and small scale workings were active in the 1930s and 1940s, massive sulphide mineralisation was not discovered until 1977.

In fact, Haynes notes that Tererro currently has all the hallmarks of being an even bigger VMS deposit than Antler, though he noted that the latter project also has significant potential for further growth.

However, Tererro is less advanced than Antler.

“We don’t yet have the permits to undertake our initial drilling program there,” Haynes added.

The company has submitted maiden program applications to obtain permits required to start drilling at the Jones Hill Deposit.

This drilling is intended to facilitate calculation of an inaugural JORC resource and explore for extensions to the deposit.

“Terrero is an advanced exploration play that we see as a great asset to continue to grow the company with and certainly something that we firmly intend drilling a lot more holes at in the not too distant future.”

New World’s older projects are the under-explored Salmon Canyon cobalt-copper deposit in Idaho and the Goodsprings copper-cobalt project in southern Nevada.

Salmon Canyon covers more than 6km of prospective strike at the northern end of the Idaho Cobalt Belt – the most endowed high-grade cobalt district in the Western world.

Goodsprings covers 930ha and includes several historical copper-cobalt deposits as well as extensions of the geological sequences that host those and other copper-cobalt deposits.

Haynes says these projects are essentially in hibernation and waiting for the cobalt price to improve.

“For investors, these projects provide exposure to the cobalt sector once prices run again.”

This article was developed in collaboration with New World Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.