Navarre unlocks more high-grade gold in Victoria’s ‘Golden Triangle’

Pic: Schroptschop / E+ via Getty Images

Special Report: Navarre Minerals is leading the race to deliver Victoria’s next major gold deposit after unearthing a second high-grade gold structure next door to a multi-million-ounce-gold mine that was once Victoria’s top gold producer.

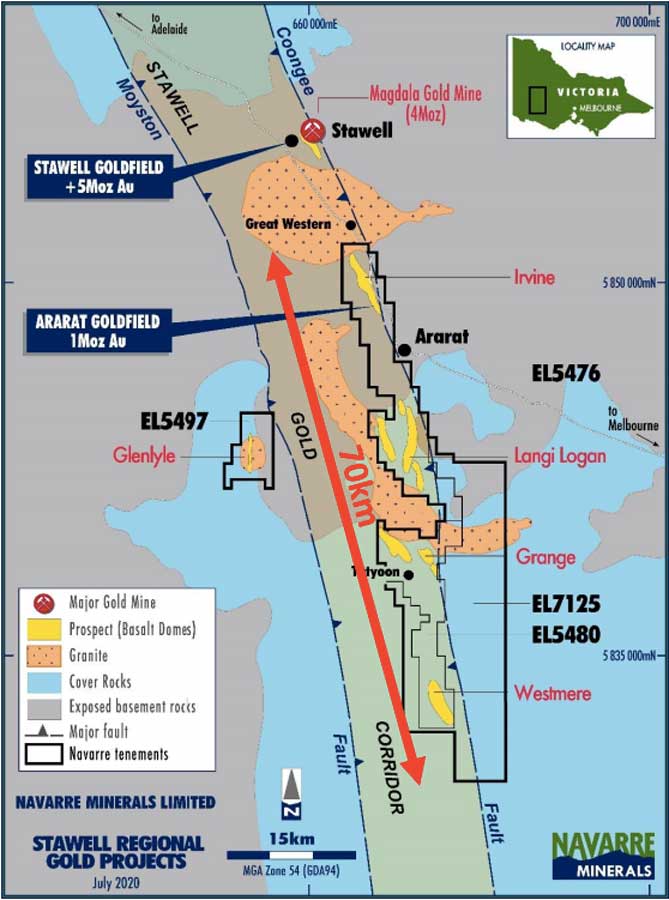

Navarre Minerals (ASX:NML) has a suite of projects in and around Victoria’s ‘Golden Triangle’, which hosts multimillion oz gold mines like Stawell and Fosterville and collectively contains around 80 million oz of gold.

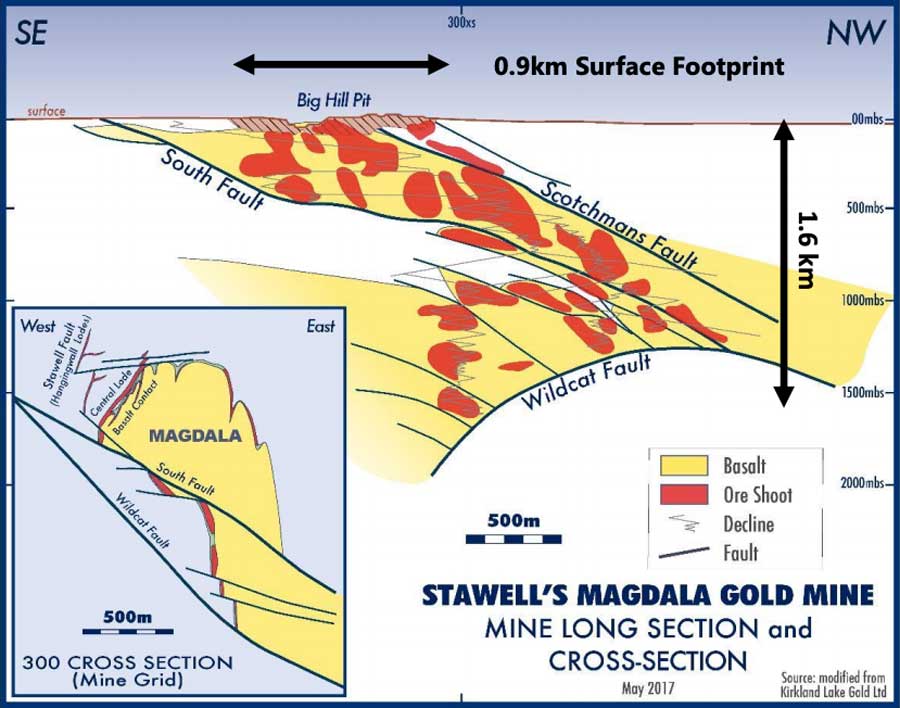

Before Fosterville, just east of Bendigo, came into production and claimed the title of Victoria’s largest gold mine, the 4 million oz Stawell mine was the state’s premier gold producer for 30 years.

This is the reason why Navarre is searching for large gold deposits near Stawell in an extension of a corridor of rocks that host the 5 million oz Stawell and 1 million oz Ararat goldfields.

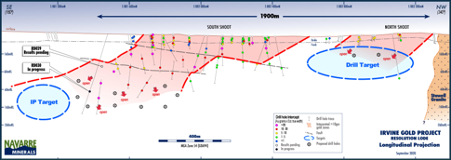

And the company is fast proving it could be onto the next big gold mine in the region with new high-grade hits from the 1.9km-long Resolution Lode of 5m at 10 grams per tonne (g/t) from 273.9m; 9.4m at 5.3g/t from 355.6m, including 3.4m at 9.2g/t; and 10.8m at 4.5g/t from 483.6m, including 4.2m at 7.5g/t.

Drilling also delivered an intercept of 0.9m at 9.4g/t from 251.4m that featured visible gold.

“Resolution Lode continues to deliver consistently strong intersections of high-grade gold mineralisation from within a well-defined lode channel extending from surface to beyond 350m depth,” managing director Ian Holland said.

“It remains open down-plunge.”

Holland is the same mining executive that helped build Fosterville into a multimillion oz gold mine.

The most recent drilling has extended the known limits of the gold lode system by another 200m south-down-plunge and demonstrates the strong potential to build a substantial resource.

A second zone of gold mineralisation has also been confirmed sitting 50m west of the main zone and results indicate both zones are strengthening towards the south.

“The geometry and style of gold mineralisation at Resolution Lode is similar to the nearby 4 million oz Magdala gold deposit, where gold has historically been mined from surface to 1.6km depth, indicating the potential for a similar large gold deposit at Resolution Lode,” Holland said.

Ramping up exploration attack

Navarre is already well advanced with its 10,000m drilling program, which is about 60 per cent complete, and is on track with its plans to deliver a maiden resource for the Stawell Corridor gold project in early 2021.

So far 15 holes have been drilled across 6000m at the Resolution Lode.

But the company is keen to ramp up its drilling attack further with extra rigs.

Diamond drilling is continuing, and a second rig will be mobilised to start drilling in early October.

Navarre is also exploring its options to deploy a third diamond drilling rig, subject to availability.

“Resource definition drilling continues to evaluate the size, continuity and tenor of gold mineralisation at Resolution Lode as Navarre looks to deliver Victoria’s next major gold deposit,” Holland said.

“We look forward to sharing the next round of results as we continue our drilling strategy.”

Undervalued compared to ASX peers

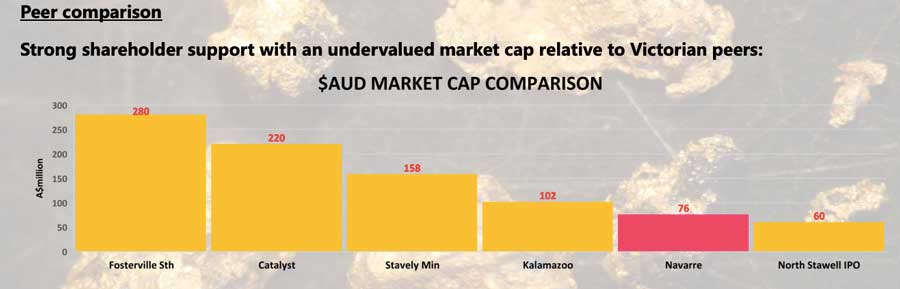

Despite having several highly prospective projects in a region with multiple large mines and delivering very promising early drilling results, Navarre has a market cap of just $70m.

That ranks the company’s value only slightly higher than North Stawell Minerals, which has ground to the north of the Stawell mine and lit up the ASX boards on Thursday with a market cap of $60m at 50c a share.

While Navarre’s market cap is slightly higher, its share price sits at a 74 per cent discount to North Stawell’s IPO price.

Navarre also looks undervalued compared to its Victorian peers Kalamazoo Resources (ASX:KZR), Stavely Minerals (ASX:SVY), Catalyst Metals (ASX:CYL) and Fosterville South, which have market caps ranging between $100m and $300m.

Navarre was started by the same two mining executives that worked for the various companies that owned Stawell Gold Mines over the years.

The company has dominant ownership of 70km strike of the Stawell Corridor, where it has so far made three big gold discoveries at the Irvine and Langi Logan projects.

Navarre also recently scored itself some hotly contested ground in the resurgent Victorian goldfields.

It was granted “priority status” by the Victorian government over a key exploration licence where a ‘bonanza’ hit of 1m at 1,174 grams per tonne gold including visible gold was made but never followed up on by previous owners.

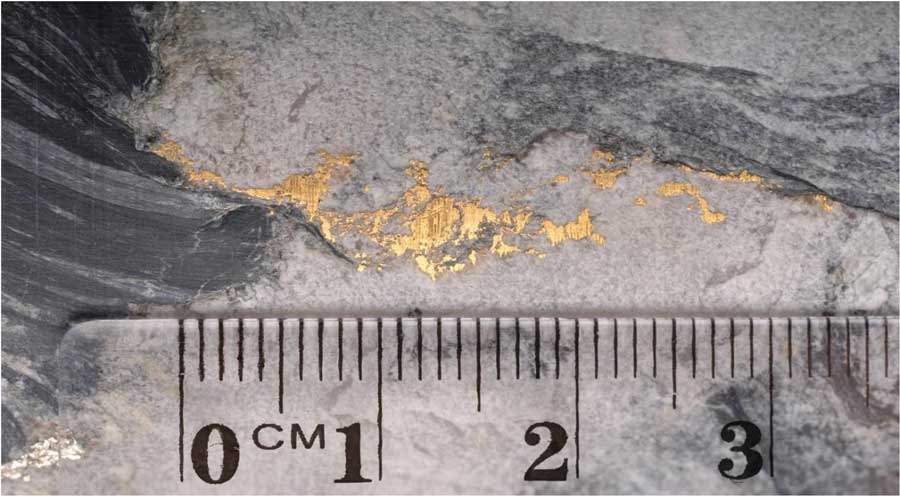

Here’s what that looks like:

On top of that, Navarre has strengthened its skillset with the addition of Holland along with Victorian gold specialist Sarah Cochrane as senior exploration geologist.

Cochrane has a “deep understanding of central Victorian gold”, Navarre says.

And the company is fully funded to continue resource definition drilling at the Resolution Lode with a current working capital balance of about $12m.

This article was developed in collaboration with Navarre Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.