Multi-tasking Black Cat doubles tenure at Paulsens, chasing repeat of antimony rich Mt Clement deposit

Black Cat’s out to prove they mean serious business, doubling its landholding around Paulsens in WA. Pic via Getty Images.

Black Cat Syndicate has moved to double its landholding around the Paulsens gold mine in WA’s Pilbara, one of Australia’s highest grade gold deposits, consolidating ground surrounding one of Australia’s largest antimony deposits which also sits under its control.

Black Cat (ASX:BC8) is weighing up a restart of the Paulsens mine, which previously produced over 900,000oz of high grade gold, where a new high grade underground resource of 258,000oz at 10.8g/t this year highlighted its development potential.

But it also owns the Mt Clement mine in the Ashburton Basin, 30km from Paulsens’ processing plant and prospective for gold, copper, antimony, silver and lead.

In particular its antimony endowment is exciting.

Mt Clement represents the third largest resource in Australia of the rare metal, largely produced in China and a critical mineral thanks to its use in flame retardants, lead acid batteries and plastics and importance to the defence, auto and construction industries.

It is also the second highest grade in the country.

The new tenure is around 15km from Mt Clement and covers similar rocks, doubling Black Cat’s Paulsens ground position to around 1000km2.

There is plenty going on at Mt Clement, even with the work ongoing to firm up the main Paulsens mine for an investment decision by the middle of this year.

Activities at Mt Clement include bedrock mapping and sampling ahead of extensional drilling in mid-2023.

Growing potential

“We are excited by the growing potential at Mt Clement. The area has excellent gold, base metal and critical mineral potential with high-grade lodes exposed at surface and negligible drilling along obvious extensional trends,” Black Cat MD Gareth Solly said.

“Our Mt Clement deposit is already the largest undeveloped antimony deposit in Australia with high-grades and a substantial mix of other valuable metals like copper, lead, gold and silver.

“We expect to build on this considerable Resource base with our next drilling campaign starting in mid-2023. Significant polymetallic anomalism exists throughout the Ashburton Basin which has seen little systematic exploration.

“This tenement consolidation adds ~500km2 of highly prospective ground to Mt Clement and we are looking forward to additional exploration and drilling later in 2023.”

One big deposit

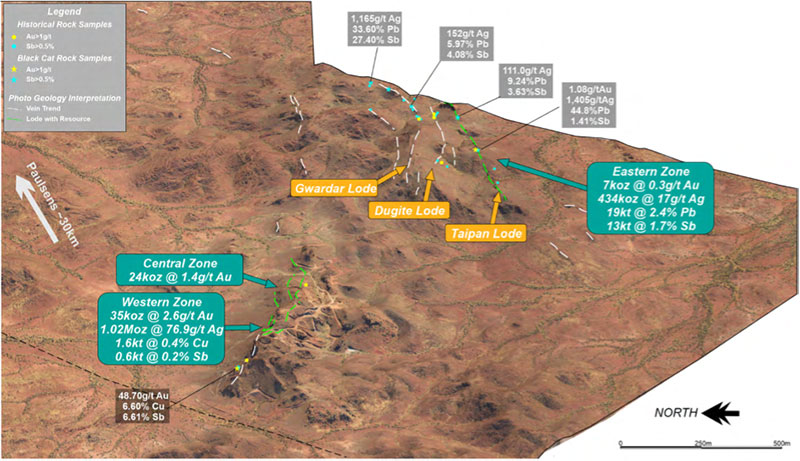

In searching outside Mt Clement for additional deposits of a similar nature, Black Cat has also reimagined the Mt Clement model in the short time it has held the Paulsens asset under its control.

Previously Mt Clement was viewed as two discrete deposits.

But now an updated geology model shows both are rather part of a single large polymetallic system.

That lends itself to the discovery of new lodes including in an untested 1km zone between the Central and Eastern Zones of the deposit, as well as along strike of known mineralisation.

It currently boasts a total resource across the Western, Central and Eastern zones of 1.74Mt or ore containing 66,000oz of gold, 1600t of copper, 13900t of antimony (with the Eastern Zone containing as much as 1.7% Sb), 1.46Moz silver and 18,700t lead.

Little drilling has been done outside those known resources, building anticipation for the 2023 program.

New targets

The new tenement applications will take Black Cat’s tenure in the Ashburton Basin from 8km2 to 500km2, bringing the Kooline West and Blue Rock South target areas into its prospect pipeline.

Historical reviews have already started, identifying high grade rock chips along with an untested 250m by 500m VTEM anomaly at or adjacent to Kooline West.

Kooline West is immediately along strike and northwest of the historic Kooline mineral field, known for its lead, silver and gold prospectivity along the Blair Fault.

Rock chip results have returned 17.15g/t gold just off the tenement boundary and are associated with a VTEM anomaly extending onto Kooline West, with wide spaced stream sediment sampling having returned anomalous samples upwards of 1ppb gold.

Blue Rock South straggles the Talga Fault, a major regional structure along the western margin of the Ashburton Basin.

Limited historical surface exploration has taken place along the trend, with a single historical stream sediment sample returning 2ppb gold.

Black Cat also owns the high grade Coyote gold mine at the Western Tanami project and the 1.3Moz Kal East project in WA, two other gold projects with major development potential.

This article was developed in collaboration with Black Cat Syndicate, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.