Morgan Stanley: Lessons from the iron ore bear market

Pic: Joanna McCarthy via Getty Images

The July/August iron ore bear market has been led from the demand-side, as investors assess the outlook for steel production cuts in China.

But in research this week, Morgan Stanley analysts said those negative demand catalysts may steady by the end of the northern summer (late August/early September).

However, investors should monitor for a “slower supply-driven bear market” which could take hold later this year.

Medium-term, the bank expects prices for benchmark 62% fines to ease back towards US$100/tonne by the end of 2022.

Iron ore bear market – some recent history

In their assessment of the market, MS analysts Marius van Straaten and Susan Bates put the current selloff in some historical context.

From unprecedented highs above US$230/tonne, iron ore started the week back at the ~$US170 level.

“A correction of the unsustainably high iron ore price was widely anticipated by us and the market,” the pair said.

But they added they were “somewhat surprised” by the pace of the selloff.

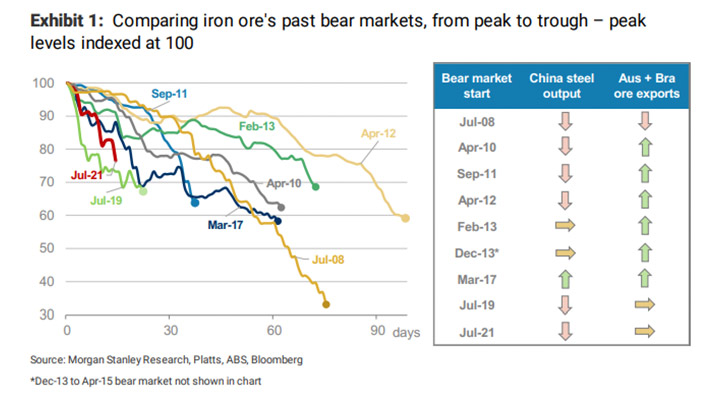

Still, in comparison to previous bear markets, this one is still in its relative infancy:

Since China commenced using iron ore spot prices in 2008, there have been eight extended iron ore selloffs.

Not including the extended 2013-2015 downturn, the average iron ore bear market has lasted 120 days with price declines of around 40% (current bear market; 25-30%).

In historical context, Morgan Stanley said the current downturn more closely resembles three previous selloffs; April 2010, September 2011 and July 2019.

Each lasted around two months and they “were all in an environment of weakening Chinese steel production”, Morgan Stanley said.

Chinese steel… will they or won’t they?

The dominant demand-side narrative in the current iron ore bear market centres around Chinese steel production, after policymakers signalled an intention to cut 2021 steel output to 2020 levels in order to reduce emissions.

CBA commodity analyst Vivek Dhar has highlighted that in order to do so, China will need to cut output by 12% in the next six months — a severe reduction.

On the flip-side, they have to manage how reduced steel output may flow through to higher prices (and hence inflation).

“A nationwide policy to cut steel output to reduce emissions may also irk China’s politburo, who have flagged their concern over ‘campaign-style’ carbon reduction by local governments,” Dhar said yesterday.

Morgan Stanley said increased steel production at the end of this month, following “the quiet summer period”, may help the market to steady.

However, for prices to find extended support, “more clarity on China’s environmental production cuts would also be required”.

If the current downturn bottoms out in line with previous demand-side selloffs, MS said prices can be expected to fall to the low-US$130s.

The supply issue

While the current iron ore bear market has so far followed the path of recent history in its shape and scale, Morgan Stanley said those looking further out should focus on the supply side.

During prolonged iron ore downturns, Chinese demand still picks up. But it’s offset against the forces of “expanding supply driving the price gradually lower”, MS said.

“We think the market will start focusing more on supply, as Q4 is likely to see the strongest shipment volumes of the year,” the analysts said.

That could mark the start of the next extended downturn, particularly with Vale’s stated goal to increase exports by another 65 million tonnes per annum.

“However, Vale’s production recovery has been far from smooth so far, and we expect a relatively slow normalisation of the iron price through 2022,” van Straaten and Bates said.

By the end of next year, a steady increase in supply is expected to see see prices revert back towards the US$100/t level — “still well clear of the US$70/t cost support level”, MS said.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.