Montezuma Mining rides manganese revival amid battery metal buzz

Mining

Mining

Making money consistently from manganese has always been tough.

But with a new market developing for what has traditionally been a steel-hardening mineral, better times could be ahead — and that’s putting a spark into manganese explorers such as Montezuma Mining (ASX:MZM).

Earlier this month the thinly-traded Montezuma hit a five-year share-price high of 35c after climbing 10c in a matter of days.

The rise coincided with an announcement that the company had applied for a mining lease on its Butcherbird project, south of the town of Newman in the north of WA.

What interested investors was the potential for Montezuma to monetise Butcherbird via a value-added process being developed with the CSIRO; growing interest in manganese as a battery metal; and the return to Australia of a once-prominent South African miner with strong connections in both countries and a big manganese project on his plate.

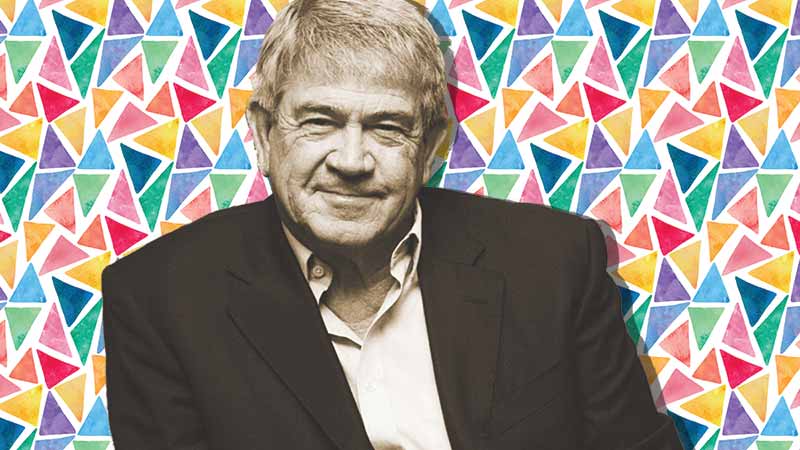

Brian Gilbertson, a one-time chief executive of BHP (when it was called BHP Billiton), is in the process of re-listing Jupiter Mines on the Australian stock exchange.

Its prime asset is a major stake in the Tshipi manganese mine in the Kalahari Manganese Field in the Northern Cape region of South Africa.

For a mineral which rarely makes headlines, except when the price booms or busts, the sudden surge of activity in manganese is a sign of growing international interest as well as a relatively strong price.

Other signs of a manganese renaissance include a re-start of mining at the mothballed Woodie Woodie mine in WA by its new Chinese owners, and a booming share price for OM Holdings which owns the Bootu Creek mine in the Northern Territory.

Over the past 10 months OM has risen from 15c to $1.29 — a 760 per cent gain.

Gilbertson’s decision to re-list Jupiter four years after it was removed from the ASX — partly so Tshipi could be developed without day-to-day pressure from investors — is a comment on the current strength of the manganese market which has been boosted by Chinese production controls limiting output in that country.

Against that background of rapid change in a normally sleepy market for manganese, Montezuma has decided to push ahead with its plans for Butcherbird.

Butcherbird is not a high-grade deposit like Tshipi which mines ore grading around 40 per cent manganese.

So the key to Butcherbird’s commercial success will be the CSIRO process to convert material assaying an average of 10.8% manganese into a high-purity product for sale to battery makers.

Promising early results from the work of the CSIRO prompted Montezuma’s mining lease application and the start of a scoping study to assess development options, potentially leading to a preliminary feasibility study later this year.

Butcherbird has a long way to go before it can be considered commercial but it is one of the biggest manganese deposits in Australia, albeit low-grade compared with overseas rivals such as Tshipi, in which OM also has a stake, and which adjoins the Hotazel manganese mines co-owned by ASX-listed South 32.

The next few weeks should see growing interest in manganese, a mineral which has a checkered reputation with Australian investors.

In earlier periods of strong demand, such as the China steel-making boom of a decade ago, Australia saw a manganese rush thanks to the mineral’s use in specialty steels such as those used by the oil industry and in stainless steel.

A big winner back then was Consolidated Minerals, a company which worked the Woodie Woodie mine until the outbreak of a bitter dispute among major shareholders led by Ukrainian billionaire Gennadiy Bogolyubov, which forced the closure and then sale of the mine to China’s Ningxia Tianyuan Manganese Industry Company.

Jupiter’s re-float, which is being handled by a syndicate of brokers and financiers that includes Perth-based Hartleys and the boutique Sydney firm of Aitken Murray, has a fund-raising target expected to be around $200 million and re-listing date of April 18.

When Jupiter hits the market it’s reasonable to expect a fresh wave of interest in manganese producers and explorers which is when Montezuma might earn a headline, or two.

But, for more cautious investors it is worth remembering past periods of strong demand for manganese, and how they can end quickly, sending the price into a tailspin.

Macquarie Bank in review of the manganese market earlier this year noted how the benchmark price for the material (ore grading 44% manganese) had risen sharply to around $US7 per metric tonne unit thanks to Chinese production cutbacks of the sort affecting a number of commodities.

But, that high price should “incentivise” more supply with the price likely to slide later this year.

“Longer-term, we expect a moderation in steel demand growth, undermining China’s total imports (of manganese), to allow the price to revert to $US4/mtu by the fourth quarter of 2018,” Macquarie said.

But, where manganese could get a lift is in demand for batteries which use a mix of nickel, manganese and cobalt, a formula preferred by big car makers such as Daimler Benz.

Whatever develops in the manganese market it is battery demand and the re-listing of Jupiter which will return a usually dull mineral to investor radar screens and that’s when explorers such as Montezuma, and the even smaller Bryah Resources, could get a lift.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.