Monsters of Rock: Why do your iron ore miners suck today?

Pic: Getty Images

- Iron ore falls, taking materials sector with it

- Westpac sees prices for Australia’s headline commodity heading to US$85/t

- Chalice Mining lifts as palladium prices rebounds

Iron ore is flirting with US$90/t and below, yet again, as China stimulus hopes again fade.

The 2% dive in Singapore has all the big iron ore producers in the red today, with Mineral Resources (ASX:MIN), Mount Gibson Iron (ASX:MGX), Fenix Resources (ASX:FEX) and Champion Iron (ASX:CIA) also negative.

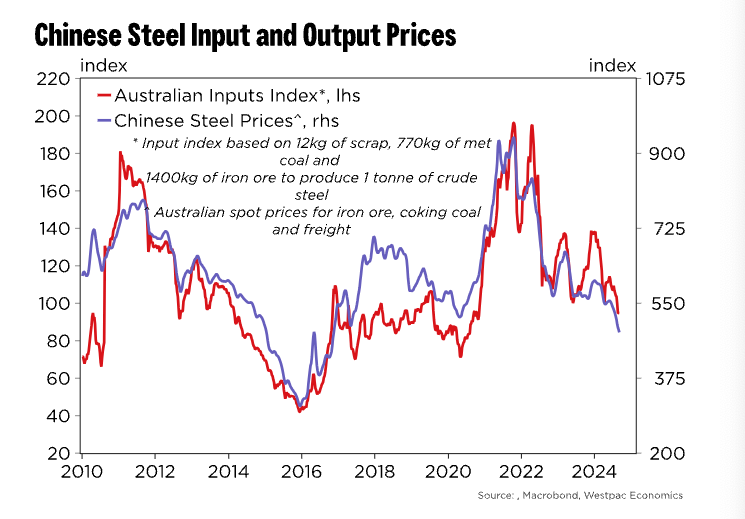

Westpac senior economist Justin Smirk said indicators in China pointed to ‘ongoing weakness in demand for iron ore.’

“We suspected that the recent bounce in iron ore prices back into the low $100s would be temporary before prices moved back down to $90 and then into the mid-$80s,” he said in a note today.

“Through August we noted that port inventories of ore surged to a fresh 29-month high while steel inventories at major mills grew to a seasonal two year high. Chinese port stocks are up around 35Mt year to date and now back to levels, relative to steel production, last seen in 2022.

“At the same time steel mill profitability dropped to a multi-decade low in late August (despite falling met coal prices offering some offset) while blast furnace operating rates dropped to the lowest seasonal level since 2018.’

The same issues have hampered met coal, which has fallen from over US$270/t a couple months back to US$188/t yesterday.

“Met coal prices continued to fall into September, the market plagued by a glut of premium hard coking coal,” Smirk said.

“Supply has recovered from the major suppliers while demand in China continues to soften as steel production adjusts to the continuing correction in Chinese construction.

“It does appear that this correction in met coal prices may offer some modest support for iron ore prices that remain at levels higher than you might expect given current market conditions.”

On the other hand thermal coal has been stable, coming in at US$139/t yesterday.

That commentary came as Bank of America Merrill Lynch put further pressure on iron ore miners, saying the commodity could drop south of US$80/t next year as strong supply and weak demand built up a 190Mt surplus.

Copper would move the other way, the bank suggests, lifting above US$10,000/t.

Is lithium the new nickel?

Westpac is similarly cautious on lithium, saying the rise of supply from China and Africa, processing low grade lepidolite to counter Chinese batterymakers’ reliance on higher priced feedstocks like Aussie spodumene and Latin American brines is resembling in a sense the upending of the nickel market by Indonesian producers.

There are probably some nuances here not picked up in Smirk’s coverage, though he highlights three areas of concerns for LATAM and Aussie producers.

They are Chinese efficiencies, faster permitting processes and lower investment hurdles through integration downstream.

“It is true that Africa remains a challenge from a logistical perspective (but) a recent report from UBS suggested that African lithium productions could grow from zero in 2022 to around 290kt LCE in 2028,” he wrote.

“Some estimates have Africa production growing to the point where it is supplying around 10% of total global production. While some dispute these estimates we are cautious as we note similar comments were made about Indonesian nickel, and its use in batteries, when the battery let nickel boom started.”

Australian and Canadian explorers are among those who have questioned the numbers being bandied about for African producers.

The bloodshed in the bulks sent the materials sector 0.54% lower.

That overrode gains elsewhere in resources, with beaten down Chalice Mining (ASX:CHN) up almost 15% as palladium prices rose again, a 20% lift in a little over a week to ~US$1100/oz.

Making gains

Chalice Mining (ASX:CHN) (PGEs) +14.6%

New Hope Corp (ASX:NHC) (coal) +4.6%

Ora Banda (ASX:OBM) (gold) +4.4%

Zimplats Holdings (ASX:ZIM) (PGEs) +3.9%

Eating losses

Mader Group (ASX:MAD) (mining services) -3%

Resolute Mining (ASX:RSG) (gold) -2.1%

Mineral Resources (ASX:MIN) (lithium/iron ore) -2%

Aurelia Metals (ASX:AMI) (gold/copper/zinc) -5.9%

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.