Monsters of Rock: What the hell is going on with lithium stocks?

Pic: Via Getty/Stockhead

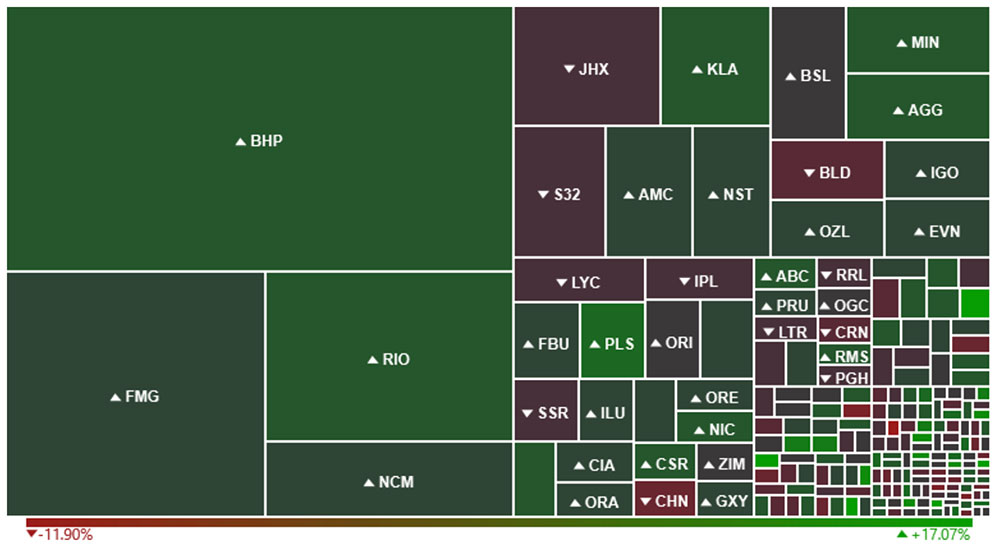

Materials had a strong day, beating out the other sectors to post a solid ~1.3% gain by mid arvo.

The big boys of iron ore – including Rio Tinto (ASX:RIO), BHP (ASX:BHP) and Mineral Resources (ASX:MIN) — bounced back to recover yesterday’s losses after the benchmark price stabilised at $US184.15 a tonne.

Those bright green boxes you see above? All lithium stocks.

Outrageous.

Leading lithium producer Pilbara Minerals (ASX:PLS) was up almost 5% today for a year-to-date gain of 135%.

Boss Ken Brinsden’s presso at Diggers and Dealers yesterday must’ve gone down a treat.

Being a lithium miner is getting better and better in 2021. Plus presenters speak gold, nickel and copper on @Diggersndealers Day 2. https://t.co/1DKy9mRhWo $NST $MCR $PLS #diggersanddealers pic.twitter.com/pb8pkl4Lno

— Stockhead (@StockheadAU) August 3, 2021

The $5.9 billion market cap stock has now surged 1,260% since hitting lows of 15c per share back in March 2020.

NEW HOPE CORP (ASX:NHC)

$1.6 billion market cap coal producer New Hope is selling its 90% of the Lenton JV in NSW — which includes the mothballed ‘Burton’ mine and associated infrastructure, plus the high-quality ‘New Lenton’ development project – for up to $77.5m.

The new acquisition will turn small cap Bowen Coking Coal (ASX:BCB) into “a significant multi-mine coking coal producer”, the $97m market cap stock said today.

Because of the further strengthening of thermal coal pricing and demand, New Hope expects its EBITDA for FY2021 to be $330 million to $390 million, it said in June.

The company’s production guidance for the full year remains on track.

The company added that it was not its policy to comment on, or engage with, recent media speculation regarding its potential interest in coal mine acquisitions.

“The company regularly examines opportunities aligned with strategy which may create value for shareholders,” it added.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.