Monsters of Rock: Uranium price correction masks potential of long-term bull market, believes Sprott

Pic: Getty Images.

- Yellowcake hits attractive investment point as spot prices dip to around the US$80/lb mark

- Paladin up again today as takeover dispute resumes in Canadian court

- Sprott sees long-term uranium price rise as demand to continue for years to come

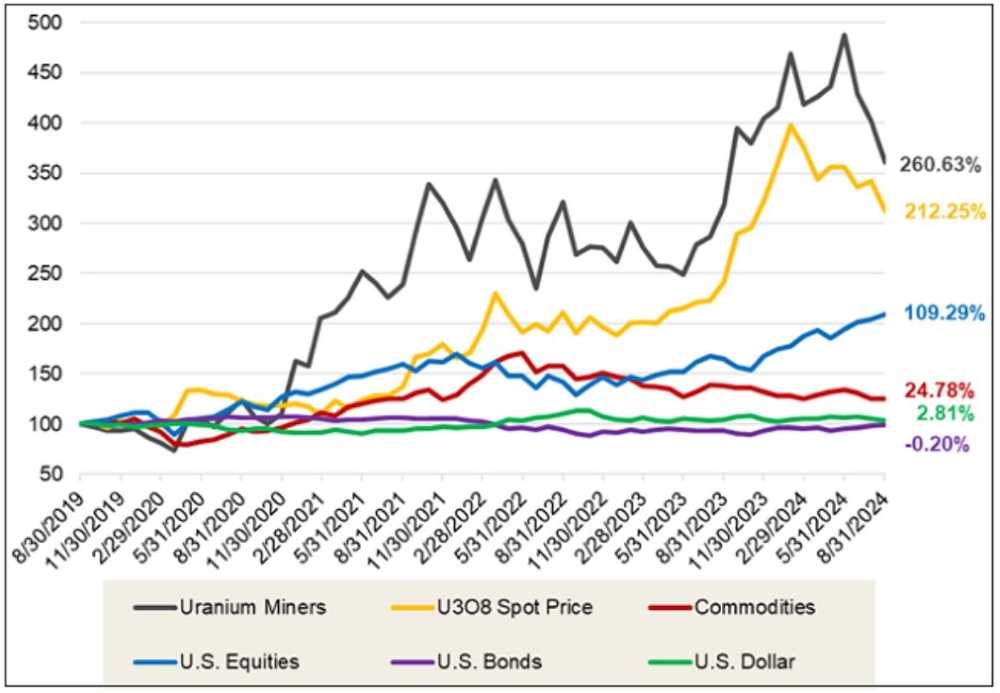

The recent broad-based selling of uranium, political uncertainty in the US and a price correction in the uranium spot price have all contributed to stagnating the market and prompting investors to sit on the sidelines, and these temporary measures mask long-term growth potential, according to global investment manager Sprott.

Jacob White, the analyst’s ETC (exchange-traded commodity) product manager, said that despite these recent headwinds, uncertainty around yellowcake is beginning to lift as investors refocus on its strong long-term fundamentals.

Price increases and Russia sanctions lead to supply uncertainty

“Following the Fed’s recent 50 basis point cut, Sprott believes the market’s attention will turn to uranium industry-specific factors, such as utilities adjusting to higher uranium prices and the sanctioning of Russian-enriched uranium by the US government,” White said.

“These two factors have caused a temporary slowdown in uranium’s term contracting cycle, leading to concerns about future supply security.”

White pointed to issues at Kazatomprom and Cameco which are unlikely to be easily remedied, due to unreliable access to sulfuric acid and construction delays in bringing new projects online.

“Sprott expects these production shortfalls will provide greater uncertainty to future supply’s ability to meet increasing demand, causing the market to likely see higher uranium prices in the future.”

With U3O8 prices in the relative doldrums of late, White said the present time could represent an attractive entry point in the ongoing bull market.

“With no meaningful supply on the horizon for three to five years, Sprott sees this bull market having further room to run.”

While the uranium spot price has stabilised, Sprott said, “finding support around US$80 per pound, the uranium term price has continued its upward climb, increasing 17.65% YTD and the term price has now surpassed the spot price as of August’s end, bringing the market back into contango.”

Bigguns in the news

While uranium giant Cameco deals with development delays, ASX uranium star Paladin Energy (ASX:PDN) has continued its heater from a six-month low of $8.33 on September 6 to gain >7% today alone, trading for $11.40 near close today and tipping over the 1000% gains mark since five years ago (>2000% since March 2020).

The $3.4bn market-capped uranium mine developer’s rise may have something to do with Microsoft’s turn toward nuclear power to support its data centres, recently signing a deal with US-listed Constellation Energy to help resurrect the Three Mile Island nuclear plant in Pennsylvania, where in 1979 mechanical failures led to a partial meltdown of the reactor core.

That’s a long time ago, and reactors nowadays are a third generation of technological advancement since it was being built in 1968, near the start of the world’s nuclear power energy generation phase.

Recently, Canada’s Fission Uranium Corp looked to buy the company out for more than $1 billion, yet was blocked by China General Nuclear Power, which has an 11.26% stake in Fission and the deal is now in front of the Supreme Court of British Columbia, where proceedings on the matter are set to resume today.

Making gains

Paladin Energy (ASX:PDN) (uranium) +7%

Mineral Resources (ASX:MIN) (multi-commodity) +4.46%

South32 (ASX:S32) (base metals) +2.92%

Liontown Resources (ASX:LTR) (lithium) 5.84%

Eating losses

Alcoa (ASX:AAI) (bauxite) -1.42%

Capricorn Metals (ASX:CMM) (gold) -0.2%

Macmahon (ASX:MAH) (mining services) -2.86%

BCI Minerals (ASX:BCI) (iron ore) -0.86%

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.