Monsters of Rock: This is why BHP is nuts about copper

Pic via Getty Images

- BHP sees copper demand growing by 70% to more than 50Mt a year by 2050

- This is due to the concurrent adoptions of copper-intensive technologies around the world

- That means copper production will need to grow by 10Mtpa within 10 years

The Big Australian is flying the flag for the red metal once again, stating why it believes global copper demand will grow by around 70% to more than 50Mt a year by 2050 in its latest Insights report.

BHP’s top brass have had big plans for the commodity since acquiring copper producer Oz Minerals for $9.6b last year, which included the take-over of the Carapateena mine, close to BHP’s Olympic Dam asset and smelting operations in South Australia.

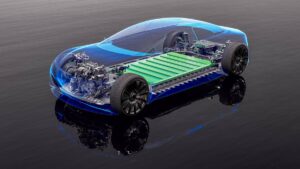

Copper also overtook coal in BHP’s earnings mix in FY23 as the miner pivoted towards future facing commodities needed for electric vehicles, wind turbines and solar panels to support the energy transition.

Unlike the 20th century, when the adoption of cars, electricity, consumer electronics and white goods occurred at different times across various regions, BHP said it expects to see concurrent adoption of the copper-intensive technologies of EVs, renewables and data centres around the world over the next 25 years.

“Demand from electrification, decarbonisation and digitisation will cut across high, middle and lower-income economies alike,” it said in the report.

Due to this concurrent adoption of new copper intensive technologies, the miner said it anticipates a re-acceleration of copper demand to 2035 of 2.6% CAGR versus a 1.9% CAGR over the past 15 years.

“In absolute terms, this is roughly 1Mt copper demand growth per year, ever year, until 2035 – double the 0.5Mt annual growth volume of the last 15 years,” BHP said.

By 2050, it sees global copper demand growing around 70% to over 50Mt per annum, an average growth rate of 2% per year.

10Mtpa copper needed over next 10 years

From a supply point of view, although scrap supply is set to increase from around one third of global copper today to around 40% by 2035, BHP estimates that the world will need about 10Mtpa of new mined copper in the next 10 years.

“We expect to supply growth over the next 10 years to be dominated by the same regions – Latin America, Africa and Asia Pacific – with Africa having the highest growth rate and Latin America continuing to make the most significant contribution in abolsolute terms,” BHP said.

“Against optimistic supply forecasts, which include the development of all probable copper projects, a significant gap to expected demand in 2035 is evident, even with our positive view on copper scrap supply.”

While operating mines are likely to provide more than half of the copper required to meet future global demand over the next decade, BHP expects existing mines to be producing around 15% less copper in 2035 than they do today.

This is because these mines are already mature and will need additional investment to replace or upgrade aging infrastructure or processing facilities.

Alternatively, they may take advantage of new technologies that can improve their efficiency or recovery (e.g. converting oxide leaching plants to sulphide leaching or recovering copper from waste).

“Existing copper mines also typically face declining grades, as higher grades are usually mined first, and lower grades are left for later,” BHP said.

“We estimate the average grade of copper mines has declined by around 40% since 1991.”

Overall, the company expects to see between one-third and one-half of global copper supply to face grade decline and ageing challenges over the next decade, which will drive increased unit costs and the requirement for capital reinvestment.

Making gains

Deep Yellow (ASX:DYL) ) +4.73%

Vault Minerals (ASX:VAU) +3.08%

Stanmore Resources (ASX:SMR) +2.50%

Eating losses

Fortescue (ASX:FMG) -3.48%

BHP (ASX:BHP) -2.87%

South32 (ASX:S32) -2.65%

Rio Tinto (ASX:RIO) -2.63%

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.