Monsters of Rock: The battle for quality nickel projects heats up

Pic: Schroptschop / E+ via Getty Images

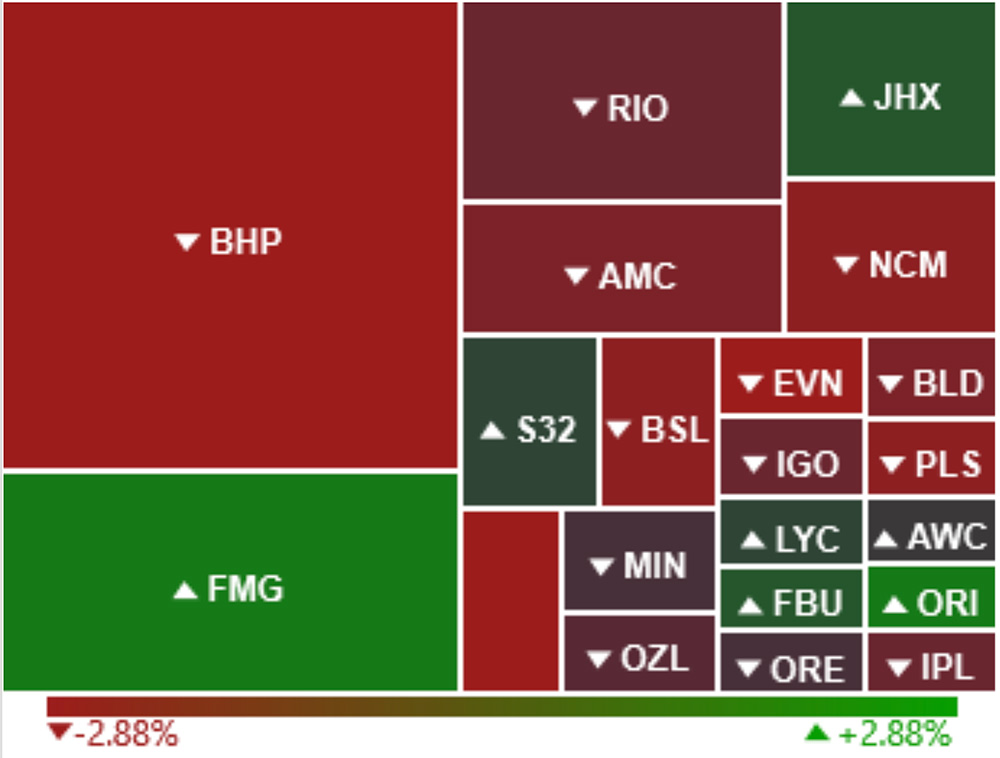

The market was predominantly weighed down today by heavyweight names trading ex-dividend, like BHP.

Materials fell ~2.55%, with goldies Northern Star (ASX:NST) and Evolution (ASX:EVN) also amongst the biggest losers.

Fortescue Metals (ASX:FMG) bucked the large cap trend with a ~1.9% gain.

BELLEVUE GOLD (ASX:BGL)

There was good news in the mid-cap gold space, with near term producer BGL now fully funded through to production in June quarter 2023.

An institutional placement ($106 million) and share purchase plan ($25m), at a small 10% discount to the last traded share price, will raise up to $131m.

BGL’s namesake WA mine will be one of the highest-grade, lowest cost mines in Australia, producing +200,000ozpa over the first five years at a world class All in Sustaining Cost (AISC) of $1,014/oz.

That’s expected to result in sector leading EBITDA margins of 66% and $1.8b of pre-tax free cash flow, the company says.

The $807m market cap stock has packed on 2,262.5% over the past 5 years, from 4c to 94c per share.

NICKEL MINES (ASX:NIC)

$2.52bn market cap Nickel Mines is looking to secure additional nickel supply through a “commercial in confidence” acquisition of the ‘Siduarsi’ project in Indonesia.

Commercial in confidence means we don’t know how much they are paying, or what the terms are.

Siduarsi is in the same rocks as the large Ramu nickel-cobalt operation in neighbouring Papua New Guinea.

In 2020, Ramu produced 33,000t of nickel and 3,000t of cobalt in MHP (Mixed Hydroxide Precipitate) at an average cash cost of US$4,600/t per tonne of nickel equivalent, placing it in the first quartile (cheapest) of global nickel producers.

“With the significant growth in Indonesia of downstream nickel processing facilities, both RKEF and HPAL, the value of, and competition for nickel ore resources is increasing, intensifying the requirement for securing high-quality, long-life resources for security of supply,” NIC managing director Justin Werner says.

The company had previously executed a deal with partner Shanghai Decent to acquire 80% in the ‘Angel’ nickel project for US$557.6m, which should be finalised by December this year.

This acquisition – on track for commissioning in the second half of 2022 – would place NIC within the top 10 nickel producers globally, it says.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.