Monsters of Rock: New Hope turns to profit as coal miners remain buoyant

Pic: John W Banagan / Stone via Getty Images

Timing is, as they say, everything.

Coal miner New Hope Corporation’s financial reporting period is one example of that. While most companies go by calendar or financial year, New Hope (ASX:NHC) reports from August to July.

That allowed it to soak up some of the coal bull market which has driven domestic price in China up by the hour to as high as US$670/t.

Australian producers are locked out of China at the moment due to the less-than-friendly relationship between our governments and their ability to (painstakingly) source supply from elsewhere.

Premium hard coking coal out of Australia is still up at historic highs of US$385/t though, with thermal and lower quality coking coal also generating consistently good gross margins.

While many Aussie coal miners still booked losses for FY21 while using their commentary to celebrate bullish market conditions of the 2022 financial year, New Hope gets the best of both worlds.

Production down, profits up for New Hope

New Hope’s production fell at its east coast coal assets from 11.3Mt in 2020 to just 9.6Mt in 2021, but saw its underlying EBITDA soar by 78% from $290 million to $367 million.

It swung from a $157 million loss to a net profit after tax of $79 million, backing a final dividend payment of 7c and a full year dividend total of 11c a share.

CEO Reinhold Schmidt said both improved prices for thermal coal and cost discipline underpinned the final result.

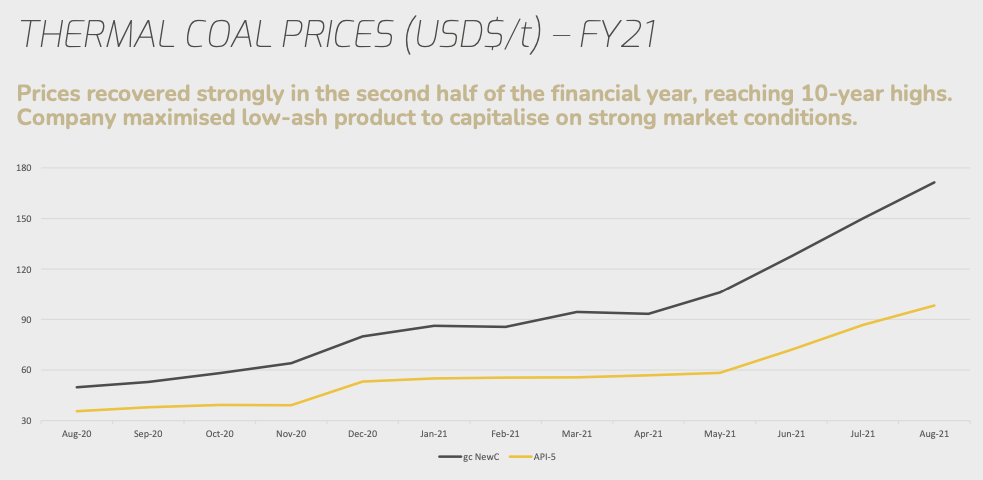

“The Newcastle 6000 Index hit 10 year highs by financial year end rapidly recovering from the depressed market conditions experienced at the start of the financial year. The Company achieved an average realised price of $101.36/t in 2021. At 31 July 2021, the Newcastle 6000 Index had almost doubled from January 2021 levels, to USD$150 per tonne, and has continued to trend upwards,” he said.

“The Company also benefited from reduced underlying Free on Board cash costs of $63.70 as a result of cost savings implemented at both Bengalla and New Acland, and the rationalisation of the Brisbane corporate office.”

New Hope’s realised prices doubled from the first quarter to the final quarter of the year, when it sold coal at an average of ~US$120/t, prices that would be mild by today’s standards, even for thermal coal.

New Hope Corporation share price today:

Is a correction coming in coal prices?

It is a largely accepted narrative that China’s ban on Australian coal has played a big role in the meltdown of its supply chain.

The trade between the nations was the sun around which the solar system of the met coal trade revolved, as BHP famously says, and the removal of 24mt of imports from Australia left China 16Mt short year on year.

The redirection of Australian rock elsewhere has seen China lean on its decrepit domestic mines, production from across the inland border in Mongolia and the US, Russia and Canada.

US, Russian and Canadian mines don’t export enough to satisfy China’s hungry steel and energy sectors, and Mongolian product has been hamstrung by Covid restrictions.

According to UBS, China’s imports are down around 16Mt year on year, leaving it well short of requirements and fuelling a squeeze on supplies.

But as we’ve seen in iron ore, what goes up must come down at some point.

“We expect met-coal prices in China to turn down before end-2021 with demand weakening and supply lifting; average met-coal prices are however set to remain elevated in 2022, averaging ~US$190/t (broadly flat y/y) as inventories are low and trade tensions between Australia & China are unlikely to ease near-term,” UBS analysts led by Myles Allsop said.

Will steel cuts come for coal too?

Steel production cuts and concerns around China’s struggling and debt-laden property sector that have hit iron ore could strike the end market for coal as well.

“We expect China steel output (and pig iron production) to slow into 2022 against a less favourable economic backdrop; there are also increasing signs that major China steel mills plan to cut output in 2H21 to achieve the central government’s directive of keeping annual production unchanged vs 2020,” UBS said.

“To this extent we have noted a sharp slowdown in crude steel and pig iron output so far in 3Q21.”

Higher prices could also bring supply on in China despite efforts to curb production due to safety concerns and pollution crackdowns.

“Given how elevated prices are, we expect met-coal supply to lift in China domestically over the coming months. This, combined with weaker pig iron production / met-coal demand and some alleviation in the power shortage, is likely to trigger a correction in China domestic prices from current record levels,” the analysts noted.

“The magnitude of the supply response in China may however be capped by 1) government control and 2) geological resource.

“Further, low coal inventories and the decline in the iron ore price may allow for increased tolerance of higher coal prices over the next 6 months.

“Outside China, we expect supply to lift in Australia with BHP able to lift production if prices stay high and Anglo to normalise supply/ debottleneck the Moranbah & Grosvenor complex.”

What happened on the markets?

The iron ore price feel even further overnight in the direction of US$90/t, but investors laid off the selling after yesterday’s $50 billion bloodbath.

Singapore iron ore futures were also largely unchanged.

BHP (ASX:BHP), Rio (ASX:RIO) and FMG (ASX:FMG) all held around yesterday’s trading levels and the ASX 200 Materials sector was up slightly.

Champion Iron (ASX:CIA), a pick from Tribeca Investment Partners head of research Todd Warren for when the iron ore price bottoms out, was one of the most productive mid caps.

$2.3 billion-capped Champion, which runs the Bloom Lake mine in Canada, was up more than 4% at 3.50AEST.

$2.8b rated Whitehaven Coal (ASX:WHC) also returned to winning ways with a similar gain.

Champion Iron and Whitehaven Coal share prices today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.