Monsters of Rock: Miners sent packing as China’s new virus threat claims resources scalps

Pic: Getty

Australia’s largest miners were marched back to the pavilion today thanks to some terrific bowling from the Omicron variant, as Covid reemerged in China’s most intense outbreak and lockdown in two years.

The tech capital of Shenzhen, a city of 17 million people, was one of those locked down.

That bad news sent iron ore prices and futures tumbling as resources investors flooded to the exits, looking more nervous than the Pakistan middle order.

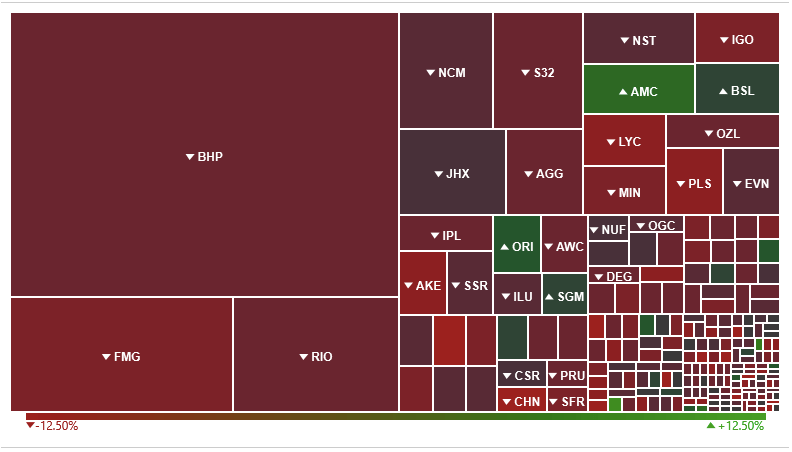

BHP (ASX:BHP), Rio Tinto (ASX:RIO), South32 (ASX:S32) and Fortescue Metals Group (ASX:FMG) were among the majors tumbling in turmoil today.

Coal stocks were also in the doghouse, with Stanmore Coal (ASX:SMR) continuing its recent volatility, down almost 23% on no news.

Yancoal (ASX:YAL) meanwhile was off 10.83%.

Talk about a collapse.

There was little to cheer outside the bulk commodities, as China and speculation Russian supply issues will be less than first thought hit the base metals complex and gold.

Nickel, copper and platinum group metals explorer Chalice Mining (ASX:CHN) was the worst performer outside the bulks, sinking 10.29% as palladium prices dived 15% after Russia’s Norilsk (producer of ~40% of the world’s palladium and a large chunk of its nickel) said it was finding ways to get its product into the market.

Monsters share price today:

Chinese economic data “better than expected”

Ironically Chinese economic data released today was stronger than expected.

That’s normally a positive signal for commodities and particularly steel and iron ore demand.

But it also informed a decision from the People’s Bank of China to avoid a cash rate cut.

Capital Economics senior China economist Julian Evans-Pritchard said the PBOC would likely start cutting rates again soon in an attempt to stimulate credit growth with the war in Ukraine, rising unemployment and Covid cases emerging as major issues.

“Data published on Friday showed that broad credit growth, a key leading indicator of activity, slowed unexpectedly last month. And the war in Ukraine will soon start to weigh on net trade due to softer foreign demand and a higher import bill,” he said.

“Even more concerning is the growing fallout from the latest surge in virus cases.

“With officials ditching targeted containment measures in favour of wholesale lockdowns, this has the potential to be even more disruptive than the Delta wave last Summer, which led to a sharp contraction in economic output.

“The upshot is that the stronger start to 2022 is likely to give way to renewed weakness over the coming months.

“And with the surveyed unemployment rate having jumped recently and already touching the government’s target ceiling of 5.5%, policymakers will have little choice but to respond.

“We continue to anticipate another 20bps of policy rate cuts by the middle of this year and a renewed acceleration in credit growth.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.