Monsters of Rock: Miners drown in sea of red as iron ore futures tumble

Pic: Biwa Studios/The Image Bank via Getty Images

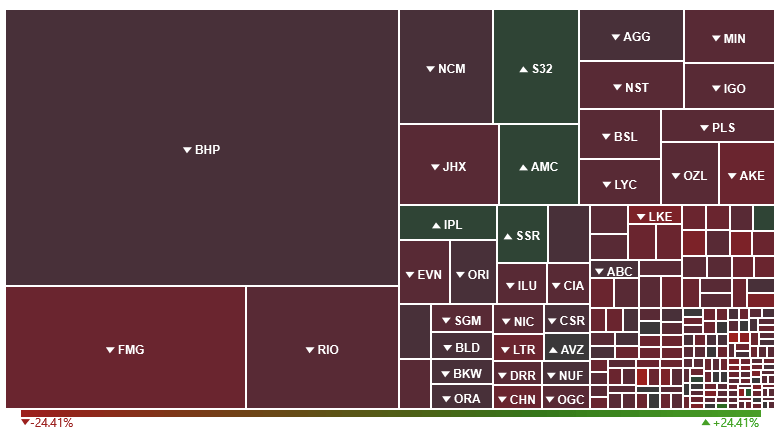

- Materials sector a sea of red as miners hit by falling iron ore prices

- Both Dalian and Singapore futures fell over 5% on continued concerns about China demand

- Aurelia Metals gets approval for Great Cobar project to extend NSW gold and copper mines out to 2035

If you were hoping Friday’s disastrous share market performance would be met with a Monday bounce we’re sorry to say you need to pray harder.

Here’s how the big cap materials stocks are faring today; most of them the big miners of the ASX 200.

A sea of red so thick not even Moses could part it.

There are some very dim lighthouses among the storm. South32 (ASX:S32) is the sole mega miner in positive territory.

But stocks that are heavily exposed to iron ore prices or trade with China are continuing to look dull with China doubling down on its Covid Zero strategy as outbreaks of the virus persist.

Iron ore prices fell 4% to recent lows on Friday and if the futures markets are any indicator today’s price indexes will not be healthy either. Dalian iron ore futures for September fell 5.6% while Singapore futures for June are off 5.7% to US$129.90/t. They were trading over US$150/t not too long ago.

Andrew Forrest’s Fortescue Metals Group (ASX:FMG) was among the worst performers in the big boy category, falling 5.35% to 3.30pm AEST.

Gold and lithium miners were similarly weak, with Northern Star Resources (ASX:NST) shedding almost 4% and Allkem (ASX:AKE) down over 6%.

Hope was delivered to the market as China’s trade data was broadly more positive than expected, with export growth of 3.9% year on year in April against consensus estimates of 2.7% and import growth even.

However, Capital Economics senior China economist Julian Evans-Pritchard said China’s export volumes would have been harder hit due to inflation, estimating export growth was at its weakest level since October 2020.

“Hopes that exports will rebound once the virus situation improves are likely to be disappointed,” he said. “Instead, we expect export volumes to fall further over the coming quarters.”

Aurelia Metals gets development approval at Great Cobar

$463 million capped copper and gold miner Aurelia Metals (ASX:AMI) has been quietly but tidily going about its business at its Hera, Peak and Dargues mines in New South Wales in recent times while other gold producers have been stumbling.

AMI’s performance has been steady, maintaining all in sustaining cost forecasts for 2021-22 after its March quarter results of $1350-1550/oz.

While Covid, labour shortages and extreme rainfall along with lower grades did see production at its Cobar mines slips from 27,400oz in the December quarter to 21,800oz in the March quarter, Aurelia is still making good headway with its growth projects.

Aurelia completed the first box cut blast at its Federation project in early April and was today awarded regulatory approval for the grandiosely named Great Cobar mine by the NSW Government.

The approval will extend the life of the Peak gold and base metals operations to 2035, paving the way for the development of the New Cobar Complex, which will amalgamate exiting approved underground mine developments at the Chesney and Jubilee deposits with new workings at great Cobar and Gladstone.

Great Cobar is expected to deliver 47,000t of copper and 61,000oz of gold over a five year period, with $65 million to be invested in the development of the initial mine and more exploration potential beneath the current ore reserve.

Aurelia CEO and MD Dan Clifford said the approval was a critical milestone in the company’s pivot to copper, a metal prized for its role in the decarbonisation narrative.

“Our team has done a great job in bringing the project online at a time where copper prices are collecting more than US$9,000/tonne,” he said.

“We are also excited by the fact Auerlia is one of the only producers in the region to bring a new copper deposit into production in just two years’ time – a catalyst that will deliver significant value for our shareholders and stakeholders, in particular the communities where we operate.”

Aurelia Metals (ASX:AMI) share price today:

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.