Monsters of Rock: Macquarie says iron ore shipments are picking up after weak March quarter

Pic: Getty

- Macquarie says iron ore shipments look healthier after weak March quarter

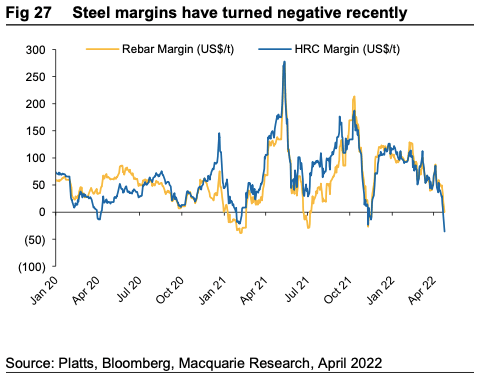

- Steel margins turn negative with high iron ore and coking coal prices

- Coronado boss Gerry Spindler says coal prices will continue to be impacted by Russian sanctions

Fortescue Metals Group (ASX:FMG) is yet to deliver its results but, so far, iron ore miners have been less than impressive.

But reporting is subject to lag, and the latest data from Macquarie’s trading desk suggests iron ore mining operations are looking a little healthier in the June quarter.

Weekly shipments from Australia are up 3% week on week (WoW), according to Macquarie, while Vale’s are up 39% WoW to 6.2Mt, after hitting only 20% of its full year results in the March quarter.

What this means for iron prices is uncertain. More supply is generally negative when it comes to pricing, and weak export numbers have undoubtedly provided a floor for the bulk commodity in recent months, if not years.

China is struggling on the demand side, with a 9% drop on Monday to US$136/t prompted by Covid-related lockdowns in the Middle Kingdom which have now hit Beijing.

That prompted a drop in prices across the commodities complex, arrested by reports that China will ease monetary policy and look to stimulate its economy to hit its now threatened 5.5% growth target in the backend of the year.

Regardless of the recent volatility, Macquarie still thinks the big boys are big buys.

“We remain positive on stocks with iron-ore exposure. BHP (ASX:BHP) is our preferred large cap exposure, and we remain positive on RIO (ASX:RIO),” they said in a note.

“Mineral Resources (ASX:MIN) and Champion Iron (ASX:CIA) are our key mid-cap picks and offer unique leverage to both the iron- ore price and capex cycle. Deterra Royalties (ASX:DRR) offers low volatility exposure to iron-ore via its royalty derived from BHP’s production at Mining Area C.”

Perhaps more worryingly, the high prices paid for commodities and uncertain downstream steel demand has seen margins for steel turn negative in China, with coking coal and iron ore prices both at high levels.

Iron ore miners share prices today:

More impact to come from Russian coal madness

Coronado Global Resources (ASX:CRN) has the good fortune of being one of the few ASX-listed coal stocks diversified with exports into China.

It is able to have the best of both worlds given much of its met coal production is based not in Australia but in the United States, which has been able to supply the stuff into China while Australia’s product has been locked out since October 2020.

The company delivered record quarterly revenue of $947 million, up 22.3% on the December quarter after prices for its coking coal surged 24.4% to a record US$267/t.

Its sales are normally conducted on a price lag, meaning higher prices are more than likely for the June term.

Coronado has adopted a new dividend policy with a fixed payout of US1c per share a year in two 0.5c instalments, with the potential of special dividends in line with its aim of paying out between 60-100% of free cash flow.

CRN says that will provide flexibility to chase strategic growth initiatives after the company hit record liquidity levels and net cash of $571m and $257m as of March 31.

Could coal prices remain strong across 2022 in the wake of Russia’s invasion of Ukraine?

Coronado boss Gerry Spindler says we may not have seen the peak of the disruption to global coal markets.

“Europe imports about 10% of met coal from Russia and 30% of their PCI consumption comes out of Russia so it’s a lot that’s coming out of Europe,” he said.

“As you may know the European Union’s embargo on Russian coal comes into effect only in August. So we don’t really see that embargo yet so that will put more pressure on the met coal prices.”

He said PCI supply was particularly strained, with prices for that brand of coal now fetching 92% of the benchmark low vol coking coal price, compared to historic levels of 70-73%.

On top of a potential lockout of Russian coal in Europe, gas prices and oil prices could go even higher given Russia’s dominance in those markets, providing support also for thermal coal prices.

Spindler said the outsourcing of fossil fuel supply to Russia had proven to be a “failed concept”.

While Chinese demand has been impacted by Covid lockdowns, Spindler said Europe was now driving met coal prices.

“There’s increased demand out of Europe for met coal, and that was quite profound even days before this conflict started,” he said.

“On previous calls I mentioned that we received a number of phone calls from existing customers and customers we haven’t heard from before. So there is increased demand out of Europe.

“China has at the moment retreated from the market, China’s very quiet at the moment and you can see that that’s also reflected in a relatively low seabound China price so Europe is really supporting the current price.”

Coronado Global Resources (ASX:CRN) share price today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.