Monsters of Rock: Limit down on iron ore in China as port stocks rise

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Are your iron ore stocks tanking today?

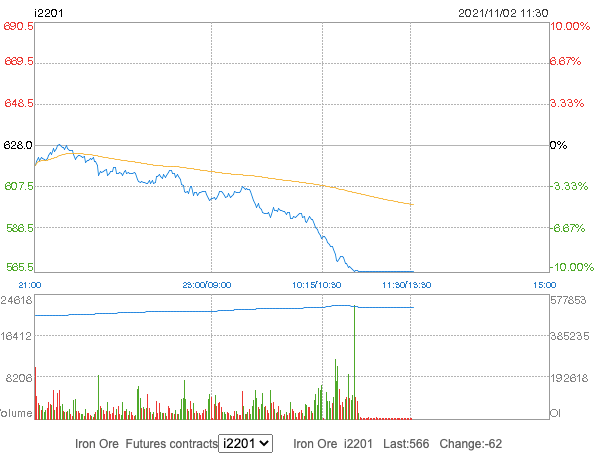

It may be because the Dalian futures did this.

That’s called limit down, when the futures drop 10%, a level they’re not allowed to tip below.

While it’s happened with coal futures over the past few trading days, those have come off an extraordinarily high base.

Iron ore futures for January delivery were fetching around US$88.50/t.

According to Fastmarkets spot prices were down 3.7% to US$103.43/t.

With steel production crimped by government intervention portside iron ore stocks in China have climbed from 126.28Mt in mid-August to 144.92Mt as of October 28, according to MySteel.

The MySteel survey for the last 11 days of October showed steel production among the 247 Chinese blast furnaces and 71 electric arc furnace factories it spoke to fell 2% on mid-October to 2.58Mt a day.

Investors in the big miners will be nervously awaiting the price changes in China tonight.

Big losses for Rio Tinto (ASX:RIO) (2.54%), BHP (ASX:BHP) (2.34%), Fortescue (ASX:FMG) (2.65%), Mineral Resources (ASX:MIN) (3.91%) and Champion Iron (ASX:CIA) (7.22%) headlined a day of pain for the materials sector, which fell 2.1% to drag the ASX 200 to a 0.63% loss.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.