Monsters of Rock: Gold producers Westgold and Ramelius are fighting about a takeover or something, it’s a little unclear right now

Pic: Via getty

- Materials handily outperforms broader ASX with a gallant ~0.2% loss

- A Takeover Panel release to the ASX today reveals gold producers Ramelius and Westgold entered confidential M&A talks November last year

- Westgold subsequently announced acquisition of TSX-listed local miner Karora in a deal which could make it a 400,000ozpa producer

- Ramelius is mad

In another tough day on the bourse – the ASX plunged -1.0% for the second time in four days – Materials handily outperformed with a gallant ~0.2% loss.

This is thanks to healthy base metals, gold, and iron ore prices, which were all up overnight despite flaring tensions in the Middle East.

Copper futures notably rebounded 2% “as the prospect of interest rate cuts, a weaker US dollar, and some robust industrial profits data from China encouraged buying”, says CommSec.

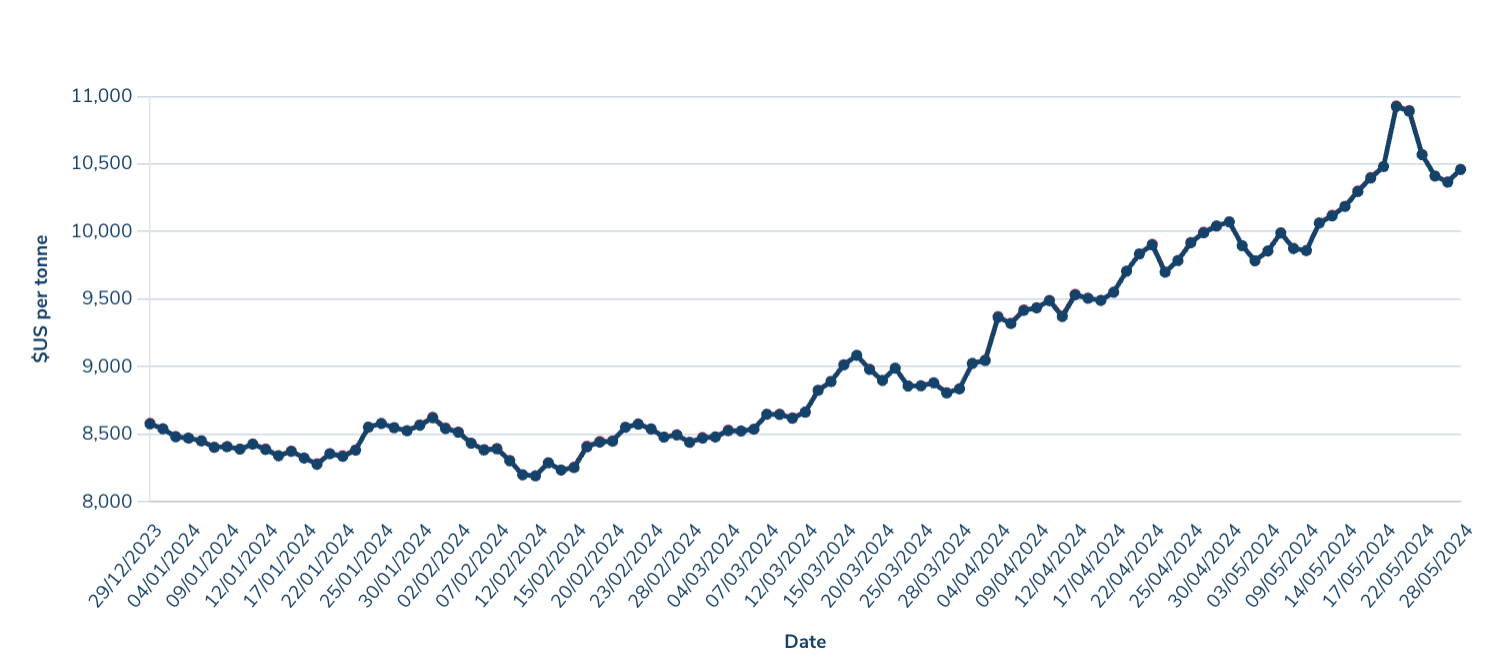

The year-to-date price chart now looks something like this:

Some good news for critical minerals as well:

Australian miners of critical minerals, including Pilbara Minerals $PLS and Lynas Rare Earths $LYC, may get a boost on Wednesday after the nation and the EU struck an agreement to increase cooperation and investment in the sector. #ausecon #auspol

— CommSec (@CommSec) May 28, 2024

Both Pilbara (ASX:PLS) and Lynas (ASX:LYC) enjoyed small gains.

And its looks like WA gold producers Westgold (ASX:WGX) and Ramelius (ASX:RMS) are butting heads, with RMS shooting off a complaint to the Australian Government’s Takeover Panel.

A Takeover Panel release to the ASX today reveals ~280,000ozpa RMS and 230,000ozpa WGX entered confidential M&A talks November last year.

In April this year WGX announced the acquisition of TSX-listed local miner Karora in a deal which could make it a 400,000ozpa producer.

This appears to have rubbed RMS the wrong way, but the details are blurry. All we know is WGX has gained over 6% today, while RMS is down a similar amount. Stay tuned.

Meanwhile De Grey (ASX:DEG) wrapped up the retail component of its monster ~$600m raise, with punters tipping ~$85m in the gold developers pockets at $1.10/sh.

The equity raise is a key milestone towards debt funding development of its giant +10Moz, 530,000ozpa Hemi gold deposit. The cash will increase DEG’s cash balance to $919m which the company says is more than sufficient to fund the equity part of the mine development.

Approved term sheets from debt financiers remains on schedule for mid-2024, the company said earlier this month.

Monster share prices today:

Today’s Best Miners

South32 (ASX:S32) (diversified) +1.3%

Westgold (ASX:WGX) (gold) +6%

Resolute Mining (ASX:RSG) (gold) +3.8%

Genesis Minerals (ASX:GMD) (gold) +3.6%

Today’s Worst Miners

Ramelius Resources (ASX:RMS) (gold) -6.8%

Adriatic Metals (ASX:ADT) (silver, base metals) -4.5%

Fortescue (ASX:FMG) -3.3%

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.