Monsters of Rock: Gold miners are enjoying stronger margins on rising prices, but costs are still like quicksand

Pic: Getty Images

- New figures show gold producers’ costs rose to a new high in the December quarter of 2023

- Increased diesel prices and ongoing labour shortages are likely to keep pressure on margins even as prices hit new highs

- Lithium miners run on Friday despite reports of weak Chinese chemical demand

Gold miners are continuing to see costs explode, with North American producers sitting on the stickiest wicket in the game.

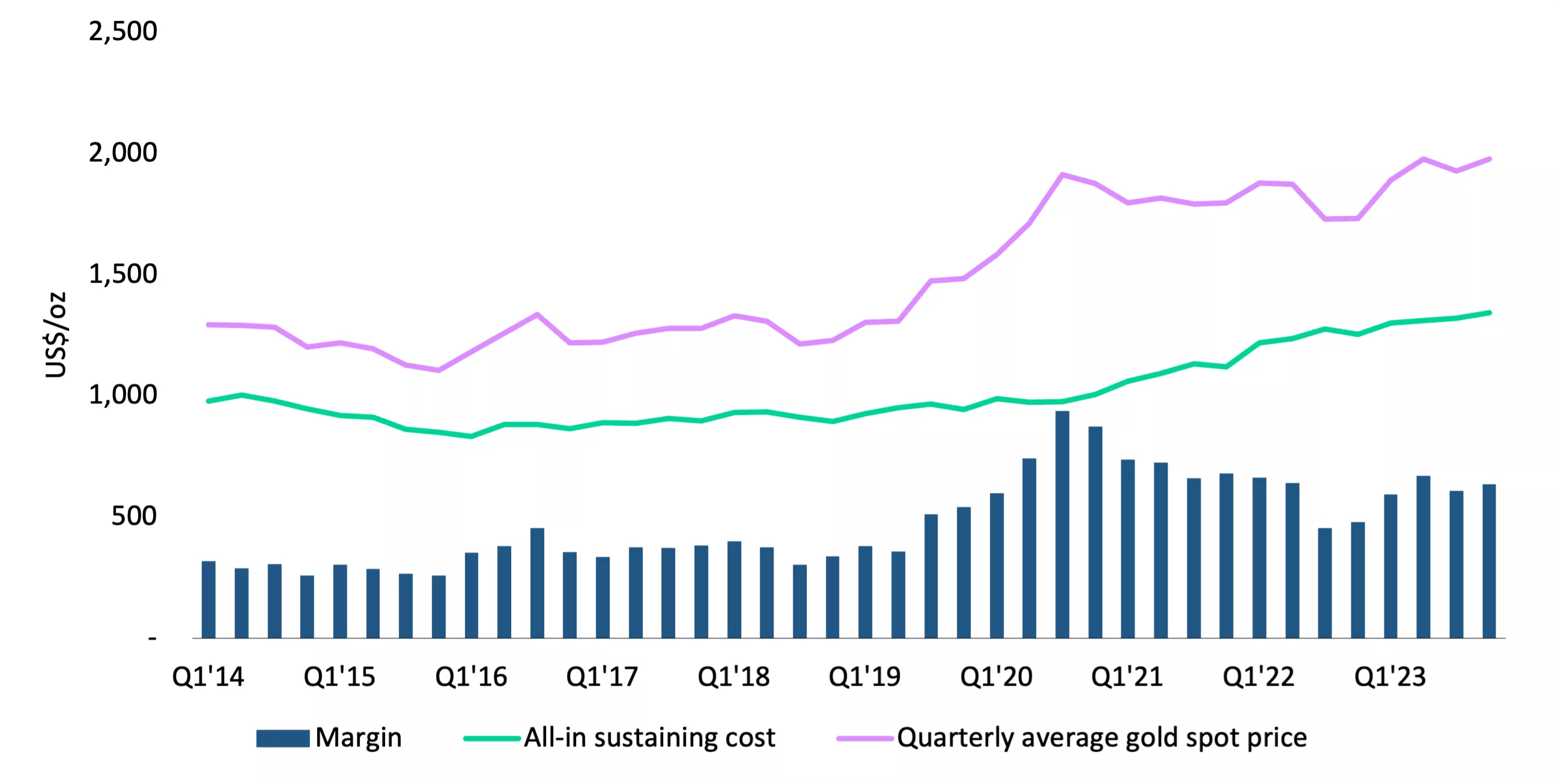

But a hard run in prices has helped goldies keep the wolves at bay, with margins lifting to their highest level since the first half of 2022 in the December quarter at US$635/oz.

That should inch closer to the record margins seen in 2020 after prices rose to record levels in recent months, close to US$2400/oz.

Sarah Tomlinson, Metals Focus Group’s Director of Mine Supply, said all in sustaining costs rose 2% QoQ in December to US$1342/oz as labour costs put their foot on miners’ throats.

“Local inflation within numerous producer countries fell throughout the year. Additionally, oil, natural gas and cyanide prices all trended downwards, which one would expect to have contributed to lower operating costs,” Tomlinson said.

“Yet any benefit was likely negated by higher employee related costs (a result of the ongoing skills shortage within the industry), continuing elevated prices for some consumables and the strengthening of local currencies against the US dollar.

“Furthermore, those companies operating in higher risk areas have experienced a rise in their security costs. Consequently, costs continue to fluctuate and regional variations persist.”

But the average quarterly spot price of US$1977/oz, now far higher again, helped shield and even lift margins.

North American Scum

The worst performers were the North Americans, eating average costs of US$1522/oz in the fourth quarter of 2023, with margins well below the global average at US$454/oz.

South American producers were sitting at US$1372/oz, down 3% on the prior quarter, with margins sitting at US$604/oz. That was aided by higher average processed grades, led by Newmont’s Yanacocha mine in Peru.

AngloGold Ashanti’s Cerro Vanguardia was a disappointment though thanks to runaway inflation in Argentina.

The Oceanian gold miners meanwhile were the pick of the pinch, with AISC up just 1% QoQ to US$1132/oz, with margins up 7% to US$692/oz.

Even as gold prices lift to previously unsighted levels, Tomlinson says inflationary pressures are still going to put a limit on margin growth.

“Costs – and subsequently margins – are expected to remain under pressure in the near term,” she said.

“The Brent Crude oil price increased by 13% between January and mid-April and although it has fallen back a little, it is still trading over US$80/barrel.

“In some regions the cost of consumables remains high and all regions are subject to rising employee costs as a result of the industry-wide skills shortage.”

Can gold stay in vogue?

The message is gold miners need prices to stay where they are, or move even higher, to actually capture the benefit from rising prices, which have come about as central banks have displaced institutional investors as the whales in the bullion market.

It’s happened despite a strong US dollar, something bulls hope will give way if September rate cuts can become a reality after a downward shift in US inflation last month.

Having already warned a run in copper prices could be overdone for the same reason, Commbank mining expert Vivek Dhar has warned the gold price has become unglued from a longstanding inverse relationship with the US dollar since March.

That has come back round this week, with the most recent gold run seemingly tied to rate cut hopes.

Dhar said could go several ways from here. CBA thinks 50bps of rate cuts are coming, which would suggest upside from here.

Gold could track higher regardless, with its movements in the past two months largely untethered from the fundamentals of rising or easing inflation.

“This is much harder to justify but would require the market to believe gold is an inflation hedge when inflation is persistent, and gold is a superior asset class relative to US‑interest bearing securities when inflation is easing,” Dhar said.

A third scenario would see gold return to normality and fall in line with a strong Greenback.

“Finally, gold prices may correct lower as markets look to re‑establish the historical relationship between gold and the US dollar. It goes without saying that uncertainty will likely persist in gold markets in coming months,” Dhar said.

Let’s go to the markets

Powered by iron ore stocks again, the materials sector was in positive territory, up 0.6% to end of a strong week.

Lithium and battery metals stocks also ran higher as China’s industrial production grew 6.7% YoY on official numbers in April, more than 1% above analysts’ forecasts.

That same enthusiasm wasn’t seen from consumers, with retail sales only up 2.3%.

Lithium producers and developers all ran higher despite a mid-month assessment from Benchmark Mineral Intelligence showing prices had flatlined in China, with the leading price agency’s price index sliding 0.7% over the past fortnight.

Its spodumene assessment was up 1.1%.

“Contacts reported that spodumene purchasing interest remained fairly strong, however, market participants are not expecting prices to continue to rise given the softening in the chemicals market,” BMI analysts said.

Today’s Best Miners

AIC Mines (ASX:A1M) (copper) +7.5%

Liontown Resources (ASX:LTR) (lithium) +4.2%

Iluka Resources (ASX:ILU) (mineral sands and rare earths) +2.8%

Nickel Industries (ASX:NIC) (nickel) +2.5%

Champion Iron (ASX:CIA) (iron ore) +2.5%

Today’s Worst Miners

Resolute Mining (ASX:RSG) (gold) -3.6%

Red 5 (ASX:RED) (gold) -2.7%

Monstars share prices today

ASX 300 Metals and Minings Index today

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.