Monsters of Rock: Gold demand and production surges in first quarter, experts say tasty prices are here to stay

Gold's looking pretty tasty right now. Pic: Getty Images

- World Gold Council says first quarter gold demand rose 3% YoY with mine production hitting a first quarter record

- Demand from central banks and investors in the East could provide a platform to sustain an epic 2024 gold rally

- Nickel Industries, IGO, Metals Acquisition, Sandfire and more report March production

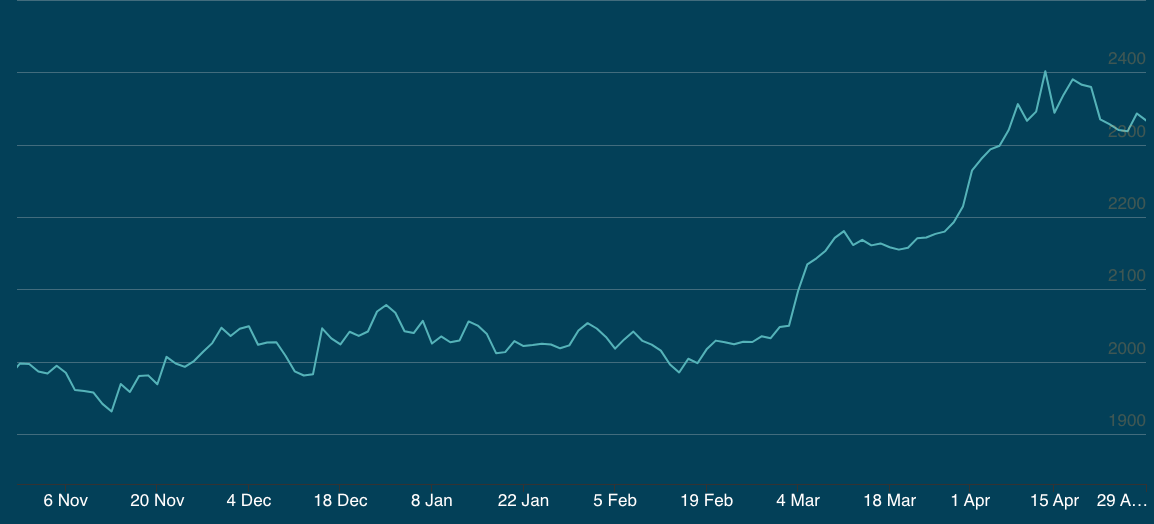

The World Gold Council (WGC) is confident gold’s price environment will remain strong after the yellow metal stunned with as many as 8 record highs through the first quarter and a bit of 2024.

Bullion was fetching US$2333/oz (~A$3550/oz) overnight as the WGC said strong demand indicators and high prices suggested returns would be far stronger than initially imagined this year.

Speaking from Washington, WGC North America market strategist Joe Cavatoni told Stockhead the price was being supported by persistent strong central bank demand coming off a near record 2023, a shift in investor interest in bullion from West to East and physical buying in bars and coins as investors eye future interest rate cuts.

While opaque, Over-The-Counter demand — the main source of private investor gold purchases — surged strongly to help overall gold demand lift 3% YoY to 1238t.

International Monetary Fund data reflecting just a part of central bank gold holdings along with Metals Focus and WGC data showed sovereign states added 290t net to official holdings.

Jewellery consumption was down just 2% to 479t YoY despite the strong price environment, while bar and coin demand rose 3% to 312t, rising used of gold in AI saw tech demand lift 10% YoY to 78.6t and OTC demand was up 220% YoY to 136.4t.

“I think we’ve hit about seven or eight record highs in the first quarter heading into April as well … but those numbers are strongly supported because the demand is there,” Cavatoni said.

“It’s really there at central banks. It’s really there in the eastern investor market and it’s actually also been a reasonably decent first quarter, considering how high the prices are, for jewellery.

“I think you’ see that in China and I think you see that also in India, so it’s strong across the board.

“I wouldn’t say that OTC means that it’s … a confusing thing. It’s actually a thing where the physical gold is likely trading and making its way into the hands of people who are interested in being long gold.”

Net long positions in physical gold, according to the WGC, were at their highest level in two years in March.

Where to from here?

One concern in the gold market is the fear that a rate cut cycle previously anticipated to start as early as May this year could be held off after stronger than expected economic and inflation data in the US.

ETF holdings in the traditional investment markets of Europe and North America have continued to see outflows, with global ETF outflows of 114t ameliorated slightly by flows into Asian funds.

Is this a sign money men think gold has overshot and could be in for a fall, or flex that more demand could come into the market once rate cuts begin.

Cavatoni said redemptions had slowed in the US market, with ETF prices still strong on a dollar basis.

“In Europe, what you’re seeing is probably an investor set that really is looking to increase their allocations to ETFs or gold through ETFs, using the rates cycle as a big signal for when they want to make an increase in allocation,” he said.

“If you’re an investor and you’re able to achieve a higher rate on your cash or you have alternatives, the opportunity cost to look at other assets, the chances of you raising an allocation to gold is probably less likely.

“So I think that that’s what we’re seeing amongst the western investor community that uses ETFs. There are possibilities that the OTC market flow is going into some of these European investors we’re just not able to track it as simply and easily as we can the ETF market.

“To put it into context as well, it’s only about a 6-7% of total investment demand that gets purchased through the ETF market. So while it’s an important number, a big number, it really doesn’t speak wholly to the entire investment community.”

Cavatoni said bets on US Fed rate cuts which look now as though they will be pushed to later in 2024, at least, had added a speculative element to this year’s massive upwards movement in gold prices. But he said demand fundamentals were far better than they were before, say, the 2013 crash.

“You’re still seeing strong support and that comes from that form of demand that comes in from central banks, where they have a very strong case for the continual consumption of gold in their reserve portfolios,” Cavatoni said.

“That’s what’s keeping that price up. This time back in 2011 and 2012, when the investment demand was weak back in those days, that was really watching the floor drop out of the gold price.

“What you’ve got right now is strong demand from the Eastern investment community and you’ve got central bank continuing to hold it up.

“So we’re seeing that strength on the floor, but we’re also seeing a bit of a run and it’s coming back off somewhat and I think the speculators are realising that they need to be a bit careful.”

Gold producers have responded to the higher prices, with mine production rising to a first quarter record of 893t and recycled supply up 12% YoY to a 3.5 year high.

Cavatoni said 2024 and 2025 would be strong years for gold production growth, threatening the all time high set in 2018.

Nickel Industries lays claim to green credentials

Nickel Industries (ASX:NIC) says an emissions intensity study at its 10% owned Huayue Nickel-Cobalt Project shows it would be the second cleanest nickel producer based on emissions intensity if it were in Australia.

According to NIC, Huayue boasts a per tonne intensity of 6.97t CO2e, behind only IGO’s Nova (6.33t).

The study by Skarn Associates places it well below WA laterite mines Ravensthorpe (11.20t) and Murrin Murrin (14.01t) as well as the sulphide producers of IGO’s Forrestania (8.37t) and BHP’s Nickel West (12.21t).

NIC largely produces lower quality nickel pig iron via the dirtier rotary kiln electric arc furnace route.

But a substantial portion of its production will eventually come from the Excelsior nickel cobalt HPAL, a project which will eventually produce up to 144,000tpa (72,000tpa in its first stage, in which NIC will eventually have a 55% interest) based off the same template at Huayue.

Unlike Huayue, which only produces mixed hydroxide precipitate, NIC says Excelsior will also be able to produce nickel sulphate and nickel cathode.

MD Justin Werner said NIC was looking for a “Tier 1” global EV maker for offtake and a potential asset level stake in ENC, which is due to come online at the end of 2025.

While Australian miners have fallen into despair as oversupply from Indonesia halved nickel prices last year, NIC has successfully leveraged relationships in the South-East Asian country and with Chinese stainless steel producer Tsingshan to emerge as one of the world’s largest producers.

It produced 31,840t in the March quarter at costs of US$9446/t at its RKEF operations and 2120t of MHP at the 10% owned Huayue, but pulled in just US$48.2m in RKEF EBITDA (US$1472/t, down from US$2473/t) as delays to Indonesian operating approvals caused by February’s national election forced it to run off lower grade stockpiles. There were also delays to accessing ore at the Hengjaya mine due to permitting.

NIC ran at record levels in March, producing 9928t, with US$41m of its US$70.3m total EBITDA pulled in the last month of the quarter.

“With operations now back to normal, RKEF costs reducing by 6% in the March quarter and a strengthening nickel price environment which has seen the spot LME nickel price as at 28 April 2024, increase to 15% above the average March LME nickel price (US$19,069 vs US$16,604) and current spot NPI prices above the average March NPI price, we look forward to delivering a strong June quarter,” Werner said.

NIC’s hopes to capture the higher prices stand in stark contrast to the Australian industry, with the heavily lossmaking Ravensthorpe mine mothballed yesterday and BHP still analysing the potential shutdown of its Nickel West division.

Sandfire to deliver on promise?

It was copper day on the ASX, with Sandfire Resources (ASX:SFR), Metals Acquisition (ASX:MAC) and Aeris Resources (ASX:AIS) looking to flaunt their wares after copper prices scaled above US$10,000/t on Monday.

LME prices are now sitting just a few hundred bucks shy of the records seen in 2021 amid a major supply crunch sparked by production disappointments in Latin America.

Sandfire, currently trading around record highs, thinks its net debt levels have peaked, with higher grades at its MATSA mine in Spain expected in the fourth quarter after an issue with its paste fill infrastructure cut access to zinc and lead rich zones at Aguas Tenidas.

SFR produced 25,013t of copper (up 11% QoQ), 18,526t of zinc (down 23%) and 1408t of lead (down 45%) along with 900,000oz of silver (unchanged) in the March quarter.

That was 2% higher on a copper equivalent basis (33,100t), though the issues at MATSA saw unit costs rise 11% to US$2.15/lb.

On a positive note, Sandfire’s Motheo mine in Botswana hit a 4.7Mtpa run rate in the quarter, closing on its 5.2Mtpa target, with the Kalahari mine’s unit costs down 2% to US$1.67.lb.

Net debt is up 16% YoY at US$481m, but with prices rising and production expected to lift, Sandfire MD Brendan Harris flagged falling debt levels heading into the June reporting period. He said Sandfire would be reducing hedges left over from financing of its MATSA acquisition as the company effectively becomes a play on the copper price for Aussie investors.

“I think our shareholders own us for exposure to the underlying commodity. We have some hedges in place tied to our financing facilities, they will roll off over time,” Harris said.

“Our main objective is to generate revenue, generate cash flow, pay down debt. We will manage price volatility through having a strong balance sheet.

“I remember the years when commodities like copper were US$1 a pound and when they went to US$1.50 everyone thought they were amazing prices and the risk is that you hedge at the wrong time.

“We want to be a good mining company. I think others can play in the forwards I think the best thing we can do is give our shareholders exposure to the underlying commodity to the maximum extent that we can and then run the business well.”

MAC, the other $1bn capped copper pure play listed in Australia, similarly had production issues, with a power outage and low grades contributing to an 11% QoQ drop to 8786t at the CSA mine in Cobar in New South Wales.

The company expects to see production and stoping grades lift across 2024 and in the years ahead after increasing CSA’s mine life to 11 years via a reserve and resource update last week.

It expects to see production rise from 38,000-43,000t this year to 43,000-48,000t in 2025 and 48,000-53,000t in 2026.

Aeris meanwhile was hammered, down more than 13%, after producing 9100t copper equivalent (5900t Cu, 12,700oz gold, 37,300oz silver) in the March quarter at all in sustaining costs of A$5.31/lb CuEq.

That included production from the Tritton copper, Mt Colin copper and Cracow gold mines, with the Jaguar polymetallic mine in WA still on ice.

All in costs were $5.74/lb, up from $5.55/lb in December, while all in costs at the Cracow gold mine came in at $2877/oz, down from $3191/oz in the December term. Closing cash fell from $22.7m to $19.4m, with AIS currently in a process to refinance its debt and bonding facilities.

Tietto acquiesces to Chinese gold takeover and IGO rises like a phoenix

IGO (ASX:IGO) has shown the worst may be behind its lithium business, saying the Greenbushes mine will return to full production in the June quarter.

Co-owned and offtaker Tianqi has elected to take 200,000t of spodumene concentrate early in the June quarter, while TLEA paid out a $25m dividend to IGO after dumping distributions amid a falling lithium price for the December quarter.

IGO saw underlying EBITDA fall 110% QoQ to negative $15m despite a 182% lift in underlying free cash flow to $79m.

Spod con production at Greenbushes fell 22% to 280,000t, with costs rising 8% to $386/t and sales revenue for the world’s largest lithium mine dropping 78% QoQ to $285.9m.

EBITDA fell 82% to $211.2m with prices sliding from US$3016/t to US$1034/t FOB Australia. Production at Greenbushes was scaled back after Tianqi decided to pull back its purchases, but it appears the Chinese miner and converter is in a better mood after the 200,000t sale on April 29 was revealed.

IGO’s nickel business delivered 6527t (-8%) at a cash cost of $6.80/lb (up 7%).

TLEA, the 51-49 JV with Tianqi through which IGO holds its stake in Greenbushes, ate a $10.3m loss in the quarter, reversed from a $167.3m profit in the December quarter on lower prices.

But there were positives in the direction of IGO and Tianqi’s Kwinana lithium hydroxide plant, where production lifted 55% to 954t, still well shy of its 24,000tpa nameplate capacity. Despite the ramp up in production IGO’s share still generated a large $63m EBITDA loss, well above sonsensus estimates of -$17m.

RBC’s Kaan Peker said the surprise TLEA dividend was a positive, with IGO’s cash position of $276m at the end of March exceeding the investment bank’s forecast of $225m, and he noted unit costs at Greenbushes were below RBC’s estimate of US$450/t and consensus of $412/t despite spodumene sales of 183,000t coming in well below both bank and consensus forecasts.

Outside final day the reporting season dump, Tietto Minerals (ASX:TIE) finally acquiesced to a long-running takeover bid from Chinese gold miner Zhaojin Capital.

The last wall in the Abujar gold mine owner’s defence was shattered when its first and third largest shareholders sold into the bid, with over 42% of shares now mopped up in the offer.

Zhaojin’s control began to pick up after it lifted its offer from 58c, the same price top shareholder Chifeng Jilong Gold Mining Co. Ltd entered the Ivorian gold miner at in 2022, to 68c, pricing the bid at $768m.

Tietto is paying 67c today, with the offer price representing a five year gain of around 380%. Some shareholders who piled in at the stock’s 83c peak in December 2022 will be sitting on a loss, and the sale price remains below the fair value assessment delivered by independent expert Grant Thornton last year.

But Tietto’s board says the risk of not selling into the offer is now too high for shareholders, with four company directors advising they intend to sell either into the offer or on-market on the ASX to cash in immediately.

The ASX materials sector, which contains the big miners, closed at 0.4% today.

Among the miners up big were Azure Minerals, which announced a $1.7b bid for the lithium explorer from Hancock Prospecting and SQM had received a long awaited Foreign Investment Review Board approval.

There had been market chatter that Chinese investor Tianqi’s stake in SQM could be a sticking point, despite its long history of prior investment in WA’s lithium market.

Today’s Best Miners

Arcadium Lithium (ASX:LTM) (lithium) +8.4%

Azure Minerals (ASX:AZS) (lithium) +8.2%

IGO (ASX:IGO) (lithium, nickel) +7.3%

Nickel Industries (ASX:NIC) (nickel) +4.4%

Today’s Worst Miners

WA1 Resources (ASX:WA1) (niobium, rare earths) -2.8%

Perseus Mining (ASX:PRU) (gold) -2.5%

Monstars share prices today

ASX 300 Metals and Minings Index today

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.