Monsters of Rock: Evolution closes Kundana deal and OZ green lights Prominent Hill expansion

Pic: Askolds Bererovski/EyeEm via Getty Images

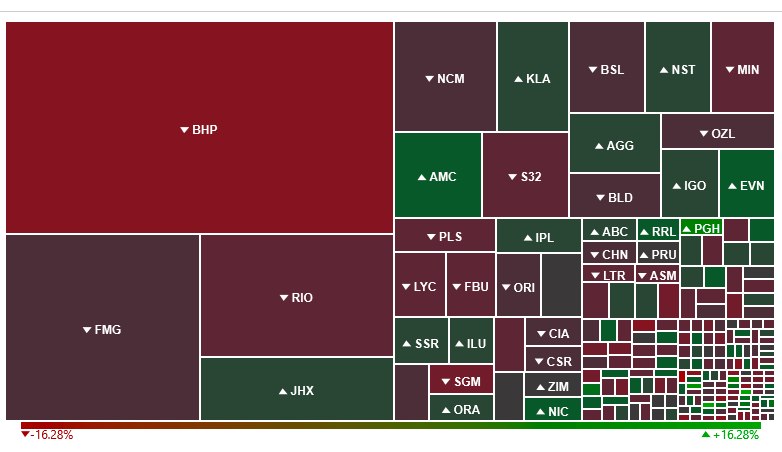

BHP (ASX:BHP) was the main driver in a major red day for the big ASX-listed miners.

Its 7% drop was not unexpected by analysts though, who predicted a fall around that level after the company finally moved to dissolve its dual listing in Australia and London.

The London-based BHP will be bought out by the ASX-listed entity in a move that unwinds the dual-listed structure that has existed since the Billiton merger in 2001.

It came alongside decisions to merge its $20 billion petroleum business with Woodside (ASX:WPL) and invest US$5.7 billion building the new Jansen potash mine in Canada.

Materials fell close to 3% on what was a broadly positive day for the other sectors across the ASX.

EVOLUTION MINING (ASX:EVN)

Gold stocks have largely held firm to start the week and Evolution gained ~1.3% after sewing up the $400 million purchase of the Kundana gold mines from Northern Star Resources (ASX:NST).

The deposits in and around Kalgoorlie are closer to Evolution’s Mungari operations than they were to Northern Star’s Kanowna Belle mill where ore from the assets used to go.

Evolution’s Jake Klein said Mungari was now one of four cornerstone assets in the portfolio of Australia’s third biggest gold miner, along with Cowal, Ernest Henry and Red Lake.

“The consolidation of these assets elevates Mungari into the fourth cornerstone asset in Evolution’s portfolio through increased production, mine life, and Mineral Resources,” he said.

“This Transaction continues Evolution’s track record of identifying and securing opportunities that are both accretive and improve the quality of the portfolio.

“We now look forward to integrating the operation and delivering on the clear and significant synergies.”

Evolution Mining share price today:

OZ MINERALS (ASX:OZL)

OZ Minerals has given the green light to an expansion of the Prominent Hill copper-gold mine which will extend its life by six years to 2036.

It will install a $600 million shaft at the underground mine which the company says will result in savings of 20 per cent over the life of mine estimate and increase average annual production by 23%.

The shaft will be fully installed by 2024.

The South Australia and South America focused miner today reported a 237% increase in NPAT in 2021 to $269 million and EBITDA of $561 million, up 123% on 2020.

The company will pay a fully franked 8c special dividend on top of an 8c per share interim dividend on the back of its strong performance, which came off the back of record copper prices during the June Quarter.

OZ Minerals share price today:

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.