Monsters of Rock: Everyone from carmakers to mining giants are after a slice of Chalice’s 3Mt Julimar pie

Pic: Daniela Simona Temneanu/EyeEm via Getty Images

- Chalice boss Alex Dorsch says the company is drawing interest from across the EV supply chain for a strategic partner process at its Julimar discovery

- Comes after nickel-copper-PGE play boosted resource by 50% to 3Mt NiEq

- Market goes bonkers on Albemarle’s $5.2b Liontown bid

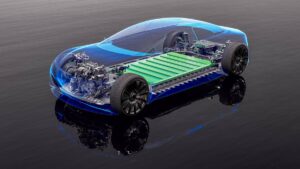

Global OEMs are among those bashing down the door of the Chalice Mining (ASX:CHN) dataroom as it opens a strategic process to find a partner for its massive Gonneville nickel, copper and PGE discovery in WA.

The project just 70km north of the State’s capital Perth has emerged as the second largest undeveloped deposit of nickel sulphides in Australia behind OZ Minerals’ (ASX:OZL) $1.7 billion West Musgrave, with a 50% increase in the resource today to 3Mt nickel equivalent another signal of its world class potential.

While a scoping study is still in the works, the massive agglomeration consisting of 16Moz of contained 3E PGMs (platinum, palladium and gold), 860,000t nickel, 520,000t copper and 83,000t cobalt is one of the largest of its kind globally.

And, found in what was previously believed to be an infertile area on the western margins of the Yilgarn Craton near WA’s west coast, it has opened up an entirely new exploration domain stretching for hundreds of kilometres in WA’s South West.

Located on private farmland purchased by Chalice, the Gonneville deposit itself covers just 2km or 7% of a 26km stretch known as the Julimar Complex, much of which heads north underneath a state forest.

Its rapid expansion and scale drew interest from all along the value chain, Chalice MD Alex Dorsch told Stockhead with Standard Chartered and Macquarie Bank drafted in the formally run a process to bring in a strategic partner for the mine.

“We’ve gone all the way to carmakers, we’ve got a number of carmakers that are already in the dataroom, and we’ve got some downstream and sort of battery producers as well,” he told Monsters.

“So it’s a really quite broad mix across the entire value chain. What we’ve flagged, I guess today is that now we’re going to allow the mining parties in, we previously have not shared anything with any of those parties, the majors or any of the operating partners. So we’re now going to let them in.

“We feel we’ve got enough definition now over the project that they can start to add some value to the equation, and obviously, we’ll now weigh up whether it’s a partner transaction with an operating company, or an OEM or a downstream company, or both.

“In reality, we’ve got obviously lots of room here to attract even multiple partners to the project.”

Going, going, Gonneville?

The decision to put out the resource ahead of a scoping study came with an additional 260 drill holes into the Gonneville resource, now defined over a strike extent of 1.9km to a depth of 800m, where it remains open.

It is likely to contain an open pit with an expected strip ratio of around 1.6, with a deeper underground block cave, a technology used in large low grade underground mines like Newcrest’s Cadia, Rio’s Oyu Tolgoi and BHP’s Leinster where nickel sulphides are being mined by what has been termed a “baby block cave”.

A higher grade sulphide component with a 0.6% NiEq cut off was increased in tonnage by 27% to 120Mt at 1.6g/t 3E, 0.2% Ni, 0.18% Cu, 0.017% Co (0.9% NiEq or 2.7g/t PdEq) for 5.8Moz of 3E, 230,000t Ni, 210,000t Cu and 20,000t Co.

Work is still ongoing to assess the best processing route, though Dorsch says the company will likely be competitive on costs with jurisdictions where deposits like these are typically mined like South Africa and Russia due to WA’s low cost power and the simple open cut style of the initial development.

Dorsch says the rise of electric vehicles and interest from across the supply chain on ramping up the supply of raw materials was driving interest from third parties.

But issues in traditional platinum and palladium jurisdictions like South Africa, which generates around 70% of the world’s platinum and 40% of its palladium, and Russia, the world’s other major palladium supplier, was stoking OEM interest as well.

Platinum and palladium are poised for a rebound in demand as internal combustion engine car production rebounds in the near term from stultifying Covid restrictions and semiconductor shortages. They are used in catalytic converters, which help reduce ICE emissions.

“There are certain OEMs that are starting to get interested in the PGMs, because (of) just how reliant primarily on South Africa they are and I think the market is starting to become acutely aware of just how dire operational circumstances are in South Africa and political circumstances,” Dorsch told Stockhead.

“That’s not being reflected yet in PGM pricing, but it’s certainly in our view coming, just how shaky the South African PGE industry is right now.

“The industry players are focused on the nickel and cobalt and the copper but we’re starting to get more strategic interest on the PGMS as well from the same parties talking there as well.

“It has evolved a little bit, the EV sourcing problems in terms of raw material sourcing is just a bit more public and a bit more mainstream than the problems that they’re having on the PGM side.”

Supply challenge

Gonneville is looming as one of the few major emerging sources of supply for both battery metals and PGMS, which will also play a role in the green hydrogen industry as a key material in electrolyser membranes.

Most OEMs have been able to source their material from major secondary processors like Heraeus and Johnson Matthey, but that could become complicated as social discord impacts South Africa’s dominant PGM industry from where the raw materials are largely sourced.

Security of supply of both battery metals and PGMs have drawn high profile investors to Chalice.

Gina Rinehart’s Hancock Prospecting is sitting with a stake just below the 5% significant shareholder threshold which would trigger the public disclosure of its stake.

Andrew Forrest and Wyloo Metals is also believed to have been snooping around, though Dorsch says he’s had no contact at this point with anyone in the Twiggyverse.

That supply challenge, and the urgency to construct technology critical to Net Zero targets and the energy transition is also a tool in the belt for Chalice as it looks to get Gonneville permitted.

While Gonneville itself is located on farmland, the proximity of the project to Perth and previous opposition to its, since approved, plans to drill in the Julimar forest highlighted the complexities it could face which more remote mining operations won’t.

“We’ve already acquired a lot of farmland, which creates a big buffer already around for the local residents. And … we’re engaging … wider in the community there, we’ve gone out with a formal survey, a chance for community members to provide formal responses to a survey,” Dorsch said.

“Those responses are sort of just coming in now. So we’re doing the right engagement. We understand that there are certain certain members of the public that will be more open minded, and some will be less open minded to a major mine development.

“We’re working through that as sensitively as we can. Just because we appreciate that it’s not a mining area so we have to tread lightly.”

Chalice Mining (ASX:CHN) share price today:

And on the markets?

Oh you haven’t heard? Like Napoli running off with the Serie A, lithium is back baby.

After a dry few months the champagne flowed across the sector as everyone got excited a deep pocketed major may buy the bag they’ve been holding through the (not so great) lithium price fall of Q1 2023.

The reason? Liontown Resources (ASX:LTR) and its decision to knock back a non binding indicative proposal of a $2.50 a share buyout, valued at $5.2 billion, from US lithium giant Albemarle.

Its stock is up 67.5% to $2.55, beyond the offer price and well above its previous ATH of $2.20, signalling investors think another bid from Albemarle or another resource hungry major could be in order.

Both Chalice and Liontown count Perth businessman Tim Goyder as a major shareholder. Some day for last year’s Diggers and Dealers GJ Stokes Award winner.

Materials stocks rose 2.19% with lithium companies jostling for position at the head of the winner’s list.

But energy was an even bigger winner as crude oil surged. Chinese demand is rising and someone may well buy out Silicon Valley Bank, easing fears around financial institutions and the collapse of the global order.

Coal and oil and gas plays like Whitehaven (ASX:WHC) and Woodside (ASX:WDS) sidled up awkwardly to battery metals miners at the top of the leaderboard.

(Lithium) Monstars share prices today:

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.