Monsters of Rock: Even as it heads for 1Mtpa, 18 new Pilgangooras are still needed to meet demand from EVs by 2040

Pic: Pogonici/iStock via Getty Images

Pilbara Minerals (ASX:PLS) boss Dale Henderson is the latest major market figure to suggest a pullback in Chinese lithium pricing is a temporary phenomenon, pointing to a bullish long term outlook for the commodity.

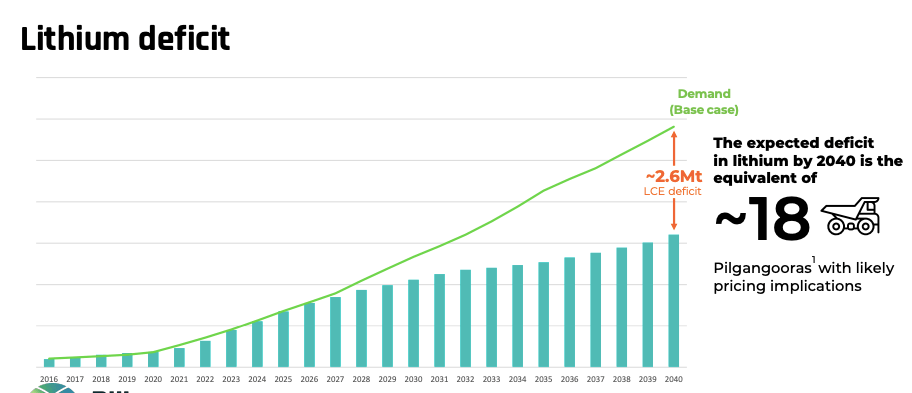

He said new modelling shows a market of deficit equivalent to 18 of its world-leading Pilgangoora mines will emerge by 2040, according to Benchmark Mineral Intelligence, a stark warning that investment in raw materials to build the electric vehicles of the future is running well short of requirements.

That should mean a robust market for years to come for lithium miners, who are fast evolving their businesses to move downstream and capture more of the value chain.

Henderson’s comments to analysts came after the $13.5 billion WA miner, once a penny dreadful operating out of a tin shed in North Fremantle, announced its maiden dividend, a payout of 11c a share or $329.8m after positing its a more than 900% rise in NPAT to $1.24 billion.

The profit print was extraordinarily more than double the combined profits of Australia’s three ASX 100 listed gold miners Newcrest (ASX:NCM), Northern Star (ASX:NST) and Evolution (ASX:EVN).

“I would point out that January Spring Festival is always a soft month and even in the short history of the lithium industry, if you look back at 2018, 2019, 2020, ’21, this is the time you see a pullback and domestic pricing is a function of the slowdown in the China market,” Henderson told analysts and media.

“So we are seeing a bit of that. But what I’d put to everyone is just remind everyone of the structural shift, which is underway. What we see is, which everyone sees through the headlines, more EVs, more investment.

“Pilbara enjoys the enviable position of being one of the few major lithium operators who’s producing who’s got a readily expandable platform to deliver more tonnes to the market and with no shortage of inquiry of groups wanting to to partner with Pilbara, so the long game remains positive.”

The long game is where those Benchmark Mineral Intelligence forecasts come in, tastefully illustrated by this PLS graph. That 18x number has been used by Henderson before, but we are now talking about a much bigger Pilgangoora mine as well.

“I’d point out that in 2030 this graph, the last version of this graph, there was no gap, demand equalled supply, but there’s a gap now,” Henderson said.

“And then at 2040 that gap has now widened. At 2040, there (is) a 2.6 million tonne LCE deficit, that’s the equivalent of 18 Pilgangoora operations.

“So don’t forget Pilgangoora, one of the largest hard rock operations globally, and that 18 times is sized at 1Mtpa, I’d remind everyone of that.

“I’d also remind everyone of how long it takes to bring these assets to life. For Pilbara it was four years from first drill hole to operation and that is breakneck speed.”

Pilbara Minerals (ASX:PLS) share price today:

Bulls on parade

Also bullish on the long term outlook for lithium were Allkem and MinRes.

They posted some handy battery metals profits today as well, with MinRes’ lithium contribution to EBITDA rising from $61 million in H1 FY22 to $756m of its $939m total. MinRes is, we remind you, also a big iron ore and mining services player.

It is expanding further in that space, announcing a deal yesterday to restructure its Wodgina and Kemerton JVs with US giant Albemarle and invest almost $1 billion in a half share in 100,000t of lithium chemical production from Chinese plants owned or under construction by its bigger brother.

That has raised questions about whether Australia is doing enough to attract participants in what it is forecast could be a $30 billion industry converting Australia’s dominance in lithium raw materials supply into a major stake in the lithium chemical sector.

Refining capacity has been built by Albemarle at its Kemerton plant and IGO and Tianqi in their Kwinana JV, with another to be opened in 2025 by Wesfarmers and SQM as part of the Covalent Lithium JV.

But with labour shortages, cost blowouts and long commissioning times, Australia’s early efforts to compete with the Chinese market have proved challenging.

MinRes boss Chris Ellison says it is investing in Chinese conversion capacity despite the potential sovereign risks because of the fast and attractive payback terms on offer, but is still keen to develop a plant locally.

While there is no replacement for Australia’s mineral wealth when it comes to raw material supply — without our 50% share of global output the EV sector would be boned — Ellison says government support is needed to build refining capacity which could theoretically be located anywhere across the globe.

“We do need government help otherwise we’re simply not going to get our joint venture partners in Australia, but it is incredibly positive to Australia, if we can get those plants down here,” he told anaysts.

“We’re keen to do it ourselves but we can’t get it done on our own and the opportunities that are being offered by Europe and the US is very significant.”

Mineral Resources (ASX:MIN) share price today:

A fight for market share

Allkem’s marketing chief Christian Barbier is unfazed by reports of lower chemical prices out of China, saying the recent pullback in hydroxide and carbonate spot prices was “healthy”.

A fight for market shares has seen EV makers begin to drop prices to convince consumers outside the luxury market to come on board, for instance.

He says the company has seen no issues placing its spodumene for customers, many of whom undertook maintenance over the Lunar New Year holiday.

“At the same time, a fight for market share in the EV market has happened, a price war between OEMs and that has impacted probably in an unintended manner,” he said.

“It has impacted consumer behavior in China, because a number of people are waiting to see if prices will further decrease. There’s been as I mentioned the adjustments on the spot price for lithium chemicals in China.

“And again that needed to happen and I think it was a healthy thing.

“And the third dynamic that I think I’d like to underline is the fight for market share that is now happening at the batterymaker level in China, where the market leader is aggressively trying to take market share away from its motor competitors and using its weight to push prices down.

“So every player is pushing its own agenda, it’s creating a bit of a complex situation. And the overall sentiment has been a bit down but fundamentals however are extremely positive.

“Market growth is very strong, stocks are at a very modest level and profitability along the supply chain. as you may have seen that lately in announcements, is very strong too. So that’s why we’re not concerned about the the overall fundamentals and the future direction of prices.”

Allkem (ASX:AKE) share price today:

Miners down today, but enjoy some mid-tier dividend action ahead of your weekend

All this positive market chatter had lithium players, by and large, on a high, with Allkem the top performer, up 3.66%.

Weaker sentiment hammered the traditional gold and iron ore players, with iron ore futures sliding 1.65% to US$127.70/t and Rio Tinto (ASX:RIO) down more than 3%, leading the materials sector to a 1.22% loss.

One iron ore stock which impressed was Grange Resources (ASX:GRR), the standout mid-cap reporter today.

The Tasmanian high grade iron ore exporter saw revenue fall 24% to $594.5m last year and profit was off 47% to $171.7m, but it was still able to leverage the margins for its premium priced product for a 2c per share fully franked dividend.

Less exciting were gold miners Resolute (ASX:RSG) and Westgold (ASX:WGX) and nickel producer Mincor (ASX:MCR), all of whom reported post-tax losses.

Mid-cap reporters share prices today:

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.