Monsters of Rock: Coal miners are quietly making a comeback

Pic: John W Banagan / Stone via Getty Images

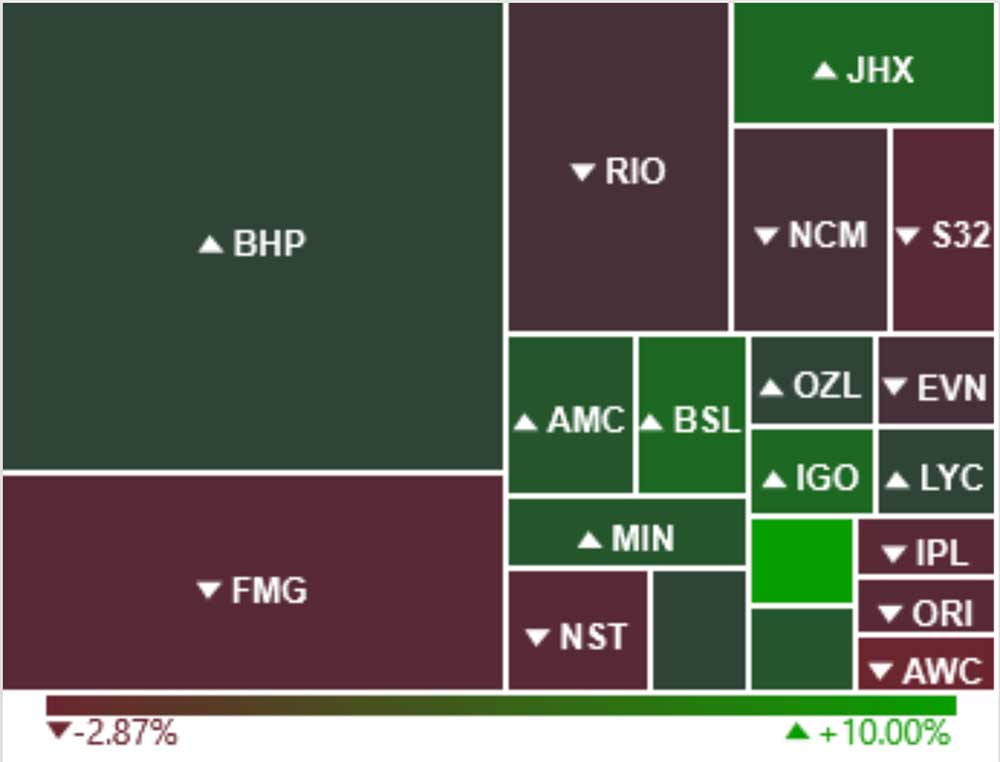

Materials edged higher Tuesday, with lithium-facing miners Pilbara Minerals (ASX:PLS), IGO (ASX:IGO), and Mineral Resources (ASX:MIN) the most prominent large cap winners.

$6.73bn market cap Pilbara – which hit fresh all-time highs today — is now up 510% over the past 12 months.

Lynas Rare Earths (ASX:LYC) — the only scale producer of separated rare earths outside China — also edged higher after The VanEck Vectors Rare Earth/Strategic Metals ETF punched through 7-year highs overnight.

Iron ore and gold producers like FMG (ASX:FMG), Northern Star (ASX:NST), Newcrest (ASX:NCM) and Rio Tinto (ASX:RIO) were amongst the biggest large cap losers as prices continued to decline.

CORONADO GLOBAL RESOURCES (ASX:CRN)

Coronado, which recorded a net loss of $96m for H1, would be breathing a sigh of relief as coal prices begin to climb.

Its US and Aussie operations are set to benefit from current higher metallurgical (steelmaking) coal prices, the company said today.

This should translate into a big boost to bottom line earnings in the second half.

“During the first half, Coronado successfully completed a $550 million refinancing package which eliminated the application of the legacy SFA financial covenants, extended our debt maturity profile, provided diversification of funding sources, and ensured enhanced liquidity for the business,” CEN boss Gerry Spindler says.

“As we look to the second half of 2021, we are buoyed by the prospect of prolonged higher metallurgical coal prices as steel demand continues to rise faster than supply growth driven by ongoing robust industrial output.

“Coronado is well positioned to improve production rates and lower costs in the second half of the year, allowing us to take advantage of the higher prices and to continue our trajectory of increasing liquidity and reducing net debt.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.