Monsters of Rock: Coal demand will remain during energy transition, New Hope says

Pic: David Gray/Bloomberg via Getty Images

- Coal miner New Hope says the commodity will have a place in the energy transition as prices remain near record highs

- CEO Rob Bishop tells shareholders demand for thermal coal from South East Asia will grow in the short term

- Energy stocks fall as oil prices sag while materials companies lift almost 1%

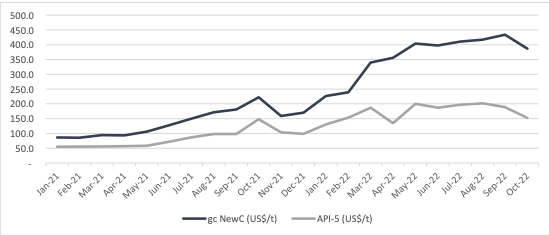

Coal prices remain near record highs, with Newcastle grade thermal coal paying over US$345/t today.

That has belied predictions of the fuel’s demise from the energy transition, with the war in Ukraine and tight supply and demand balances combining to keep prices above historical records for a year now.

Coal prices fell as low as US$48/t during the darkest days of the pandemic.

But any losses from that period have been paid back handsomely, mostly in the form of dividends and share buybacks to investors with coal miners reluctant to invest in new sources of supply in an uncertain market.

New Hope Corp (ASX:NHC) was the latest miner to front shareholders in AGM season today.

Its CEO Robert Bishop said its long term strategy would remain centred on coal through its existing thermal portfolio as well as pursuing ‘new opportunities’ in thermal and met coal production.

Alongside its Bengalla mine in New South Wales, New Hope expects to see first coal from the long contested New Acland Stage 3 mine in Queensland in the middle of 2023.

The short-term outlook remains bullish for coal producers, Bishop told shareholders.

“Looking ahead, we expect that coal prices will remain well above historical averages, as uncertainty remains about security of global energy supply,” he said.

“The supply demand imbalance was clear prior to the Russian invasion of Ukraine which only caused a further supply shock to the global energy market.

“We believe prices will remain elevated due to this imbalance, coupled with the time it will take for the world to transition responsibly to a decarbonised energy market given the investment required to scale up and firm renewable energy generation sufficient to displace fossil fuel generation within the existing generation mix, as well as the significant infrastructure build up required to transform electricity grids and networks to accommodate renewables and increasing electrification.”

What a mouthful that was

Where will demand from coal come from? Bishop says it is estimated to increase in the near term in South East Asia, where NHC is “well positioned” to supply into the market.

“New Hope remains firm that the demand for high quality, low emission thermal coal, produced from our Australian operations is critical to supporting the transition to a decarbonised economy,” he said.

“Government policy and regulation will largely drive the transition to a decarbonised economy. We will work within the policy and regulatory framework to ensure that reliable energy continues to be provided to those in need, including the Australian domestic market.”

The term “low emission” is all relative, we guess.

Regardless of the ethics of it all, NHC’s operations look like they’ll be a cash machine for some time yet, with Bishop predicting a recent pullback in prices from a milder than expected northern winter would stabilise or lift again as colder weather approaches.

NHC pulled in underlying EBITDA of $648.1m in the October quarter (it reports on a one month lag to the rest of the market), up 167% on the $242.5m earned in the same quarter in 2021.

That left NHC with $1.8 billion in cash and equivalents and trade receivables of $139.2m ahead of its FY22 dividend payment on a 215% YoY rise in average prices to US$412.72/t.

Coal stocks fell today as oil prices fell and a Bloomberg report that Chinese coal output could hit a record 4.4Bt in 2022.

Whitehaven Coal (ASX:WHC) was down almost 7% with New Hope sinking 9%.

Whitehaven CEO Paul Flynn, it was revealed, sold 900,000 shares in the company worth almost $7.9 million “for personal reasons” including to satisfy tax obligations after being issued shares under WHC’s equity incentive plan.

He remains one of its largest individual shareholders with 1,070,451 shares, 449,884 vested performance rights and 2,534,161 performance rights subject to meeting vesting conditions.

Energy stocks were down 1.6% at 4pm AEDT, the only ASX sector in the red, with miners up 0.96% including a host of major gold players.

Coal miners share prices today:

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.