Monsters of Rock: China’s ‘bold’ stimulus turns taps on for miners

Pic: Getty Images

- Chinese stimulus sends miners running in a broad rally

- Uranium miners lead as big dog banks pledge to support nuclear energy expansion

- Materials sector closes 2.42% higher, energy up 1.53%

For months, Xi Jinping has kept miners stuck in bear mode with constant commentary from behind the red stained iron curtain that the ‘bazooka-style’ stimulus they’re hoping for is not on the cards (yeah, bazooka’s actually the word the market uses).

But, finally, something of substance has emerged from the other side of the Great Wall.

Following the US Fed rate cut last week, Beijing’s People’s Bank has come through with policy rate and reserve requirement ratio cuts, as well as mortgage rate cuts and new finance facilities for banks, fund managers and insurance companies.

The downpayment ratio on first and second homes has been trimmed from 25% to 15%, with mortgage lending rates down 50bps in moves to support the property market – currently the weakest seen in China since 2006.

Overall the reduction in the reserve requirement ratio by 50bps to 6.6% will unlock around a trillion Yuan in liquidity for banks (US$140bn), with 800bn RMB worth of swap and relending facilities announced.

Oxford Economics lead economist Brett Wang flagged reviews to the think tank’s China forecasts on the policy shift, saying the move was “bold by historical standards and came earlier than we had expected”.

“The continuous weakness in domestic economy and the outsized rate cut from the Federal Reserve were the likely catalysts behind the PBoC’s latest move,” he said in a note today.

“In addition to the easing measures announced today, Governor Pan (Gongsheng) sent a dovish signal and expressed policy willingness to provide additional support in the future if needed.

“Specifically, he mentioned the possibility of further reducing the RRR and extending the scale of structural monetary policy.”

RBC analysts led by Kaan Peker said the new measures to support the housing market are incremental but positive for commodity demand.

Capital Economics head of China economics Julian Evans-Pritchard was more cautious, saying the move signals a greater sense of urgency for the Communist Party to support the economy.

But he is not rushing to upgrade growth forecasts.

“… the announced cuts to existing mortgage rates are smaller than what had previously been reported by Bloomberg,” Evans-Pritchard wrote.

“And although the PBOC says the cuts will lower interest payments for homeowners by RMB150bn, the net transfer to households will be offset by the planned reduction in deposit rates. As such, it is unlikely to provide much support to consumption.

“The big picture is that, with households deleveraging and many private firms cautious about borrowing, monetary policy has lost much of its effectiveness in China. As such, today’s moves are unlikely, on their own, to drive a turnaround in credit growth and economic activity.

“Achieving that would require more substantial fiscal support than the modest pick-up in government spending that’s currently in the pipeline. That’s not out of the question.”

How did the miners react?

The iron ore price, under pressure for months, moved violently up.

A 5.41% gain at 4pm AEST had prices, stumbling below US$90/t yesterday, up to US$94.30/t in Singapore.

The January contract in Dalian ran higher after midday, up more than 3.3%, peaking at US$99.41/t.

Coking coal for the same month’s delivery was up 2.37% on the Dalian Commodity Exchange.

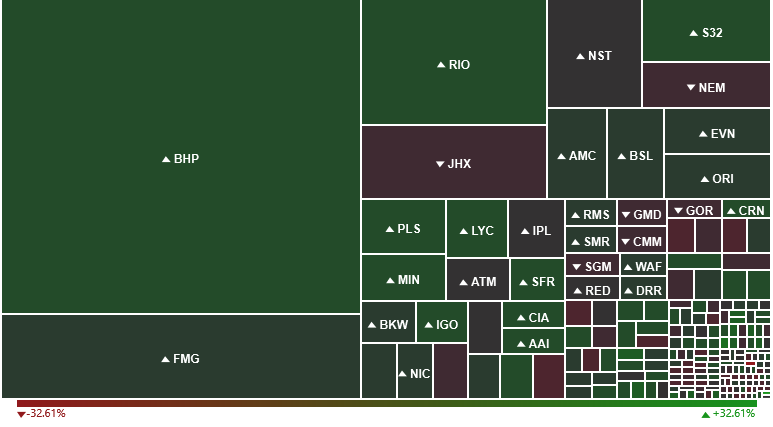

That saw Aussie miners climb, with the materials sector up 2.42% despite a hawkish RBA keeping rates steady, the ASX 200 benchmark down 0.13%.

Energy stocks, hurt in recent weeks by fading Chinese demand for oil, were 1.53% higher.

Uranium stocks also powered those gains, with producers Paladin Energy (ASX:PDN) and Boss Energy (ASX:BOE) both +10% or more as news Microsoft will sponsor the relaunch of a shuttered nuclear facility in the US sparked a bullish turn.

Fourteen Wall Street banks, including Goldman Sachs, Morgan Stanley, BoA, Citi and more, also announced a largely sentimental pledge to support a tripling of nuclear capacity by 2050 at an event during New York’s Climate Week.

Moves up across iron ore producers were strong, with BHP (ASX:BHP) and Rio Tinto (ASX:RIO) 3.72% and 3.8% up respectively.

Mini-miner Fenix Resources (ASX:FEX) lifted 8.16%.

And lithium players rose to attention too.

Liontown Resources (ASX:LTR) and Mineral Resources (ASX:MIN) were between 6-7% higher, with IGO (ASX:IGO), Pilbara Minerals (ASX:PLS) and Arcadium Lithium (ASX:LTM) also seeing big gains.

Copper stocks charged in the broad based rally, sold off Aeris Resources (ASX:AIS) up 15% with market bellwether Sandfire Resources (ASX:SFR) 6.2% higher.

Making gains

Lotus Resources (ASX:LOT) (uranium) +18.8%

Deep Yellow (ASX:DYL) (uranium) +10.6%

Paladin Energy (ASX:PDN) (uranium) +10.1%

Boss Energy (ASX:BOE) (uranium) +10%

Eating losses

Ora Banda (ASX:OBM) (gold) -2.9%

Bellevue Gold (ASX:BGL) (gold) -2.4%

Emerald Resources (ASX:EMR) (gold) -2.3%

Genesis Minerals (ASX:GMD) (gold) -1.9%

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.