Monsters of Rock: Boss drops on failed uranium bid

Pic: Getty Images

- Boss drops on failed Jabiluka uranium deal

- Stanmore sees demand return for PCI coal

- Liontown, Ramelius and Resolute report

A surprise attempt to take the Jabiluka uranium deposit from the effective control of Rio Tinto (ASX:RIO) has fallen apart after the NT Government’s decision not to renew the lease held by its majority-owned subsidiary Energy Resources of Australia (ASX:ERA).

Boss Energy (ASX:BOE) was revealed over the weekend to have been in discussions about a $550 million deal that would have traded shares in the Honeymoon uranium mine owner with minority investors, many of whom had been pushing the for project’s eventual development.

ERA and Rio, which holds around 86% of the company, are effectively operating a money sink, trying to procure funds to deliver on a constantly expanding $2.3bn bill to rehab the closed Ranger uranium mine.

The Jabiluka lease has long been considered a viable underground development, aside from the reality that its traditional owners the Mirarr have refused to consent to its operation. ERA had offered the group veto right, though that’s all academic since the NT Government, on Canberra’s advice, has refused a 10 year renewal.

Boss shares fell 4.1% after it confirmed the speculation, saying its offer has been ‘highly conditional’.

“The non-binding offer, which was put to Jabiluka’s leaseholder ERA, contained several key conditions precedent,” the company said.

“These included that any transaction involving Boss would have the full support and approval of the Mirarr traditional owners, the Northern Land Council, relevant regulatory bodies and the Federal Government.

“The offer was also subject to satisfactory due diligence being completed by Boss (including being satisfied with the Jabiluka mining lease).

“Boss made the offer in the belief that there may be a limited opportunity to acquire the asset in a structure that could benefit all stakeholders. Given the Federal Government’s decision late last week to end the mineral lease on Jabiluka, Boss has withdrawn the offer and discussions have concluded.”

Boss recently restarted Honeymoon in SA on the back of a revival in uranium prices over the past couple years, while it also took a 30% non-operating stake in the Alta Mesa mine in America last year.

ERA shares lifted almost 9.5% after the news emerged, saying the deal structure would have delivered a 10% free-carried interest post-capital payback to a “Northern Territory focussed indigenous foundation to support indigenous communities”.

ERA says it is “assessing the options available” following the NT’s decision not to renew lease.

Russian sanctions favour Aussie coal again

Stanmore Coal (ASX:SMR) CEO and executive director Marcelo Matos says restrictions on Russian coal exports are again favouring Australian producers.

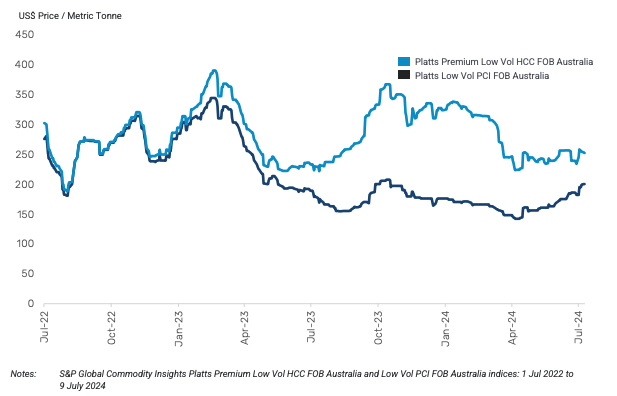

The lower grade PCI met coal product of which it is a major producer in Queensland has been one of the weaker coal sectors in the past year or so due to a flood of Russian origin material at cut prices, which has sunk its value relative to a tight and robust premium hard coking coal market.

But that situation may be unwinding.

“Prime hard coking coal prices were generally stable through the quarter despite a generally challenging steel market. PCI pricing gained strength relative to prime hard coking coal prices along with a general return to Australian origin PCI material in response to imposition of further Russian sanctions,” Matos said.

“Stanmore’s sales volumes continued to perform well in the quarter, and the company maintains a strong forward sales program and is well placed through the upcoming quarters.”

SMR, which agreed to acquire all of the Eagle Downs project in the quarter in an agreement with Chinese steelmaker Baowu and ASX miner South32 (ASX:S32), finished the June quarter with US$192 million in net cash and US$404m of cash in the bank.

That came after a US$170m tax payment in June and the US$136m sale of the southern portion of its Wards Well tenement.

SMR produced 4.9Mt of ROM coal in the June term, up from 4.6Mt in March, with 3.5Mt produced coal sold (6.9Mt year to date).

Total coal sales for the first half of the year are up from 6Mt in 2023 to 7Mt this year.

That was anchored by the expanding South Walker Creek mine and Poitrel, the two deposits acquired in a game changing deal from BHP (ASX:BHP) last year.

Liontown inching towards production at Kathleen Valley

Meanwhile, lithium hopeful Liontown Resources (ASX:LTR) announced its Kathleen Valley project in WA is sitting at a completion rate of over 95%, with first concentrate on the horizon at the Goldfields lithium mine.

Once of three major new spodumene mines expected to open this year alongside Wesfarmers and SQM’s Mt Holland and Ganfeng’s Goulamina in Mali, LTR MD Tony Ottaviano said the site was ‘on the cusp’ of completing the development required for first production.

Almost 1600m of development metres were plowed through in the quarter, with around 58,000t of crushed ore at the KV process plant, excluding 25,000t of sheeting material.

First development ore in the underground is expected in August, with fire production from stoping (the main part of the resource) is due by the end of the year.

Also reporting was gold miner Ramelius Resources (ASX:RMS), which set solid FY25 guidance of 270,000-300,000oz at all in sustaining costs of $1500-1700/oz, led by 230,000-250,000oz at $1300-15000/oz at Mt Magnet.

It plans to spend up to $50m on exploration, but has effectively confirmed it plans to put the Edna May gold mine near Westonia on ice from the end of the year after deciding the $300 million cost of a new cutback was not justified.

40,000-50,000oz, predominately from lower grade stockpiles are expected to be mines at a cost of $2500-2700/oz, including a non-cash inventory charge of around $500/oz.

And African gold miner Resolute Mining (ASX:RSG) produced 90,787oz at all in sustaining costs of US$1402/oz, on track for CY24 guidance and delivering first half EBITDA of $116m, or $73.1m in cash flow before interest and debt repayments, working capital, and a deferred payment on its formerly owned Ravenswood mine.

RSG expects to produce 345,000-365,000oz at US$1300-1400/oz in 2024.

The materials sector was up 0.33%, with energy almost 0.6% higher today.

Making gains

Energy Resources of Australia (ASX:ERA) (uranium) +9.4%

NexGen Energy (ASX:NXG) (lithium) +5.1%

Bannerman Energy (ASX:BMN) (uranium) +3.7%

Stanmore Coal (ASX:SMR) (coal) +2.2%

Eating losses

Boss Energy (ASX:BOE) (uranium) -4.4%

Bellevue Gold (ASX:BGL) (gold) -2.4%

Paladin Energy (ASX:PDN) (uranium) -2.2%

Whitehaven Coal (ASX:WHC) (coal) -2.2%

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.