Monsters of Rock: Big lithium tie-ups and the road to 1 million ounces

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

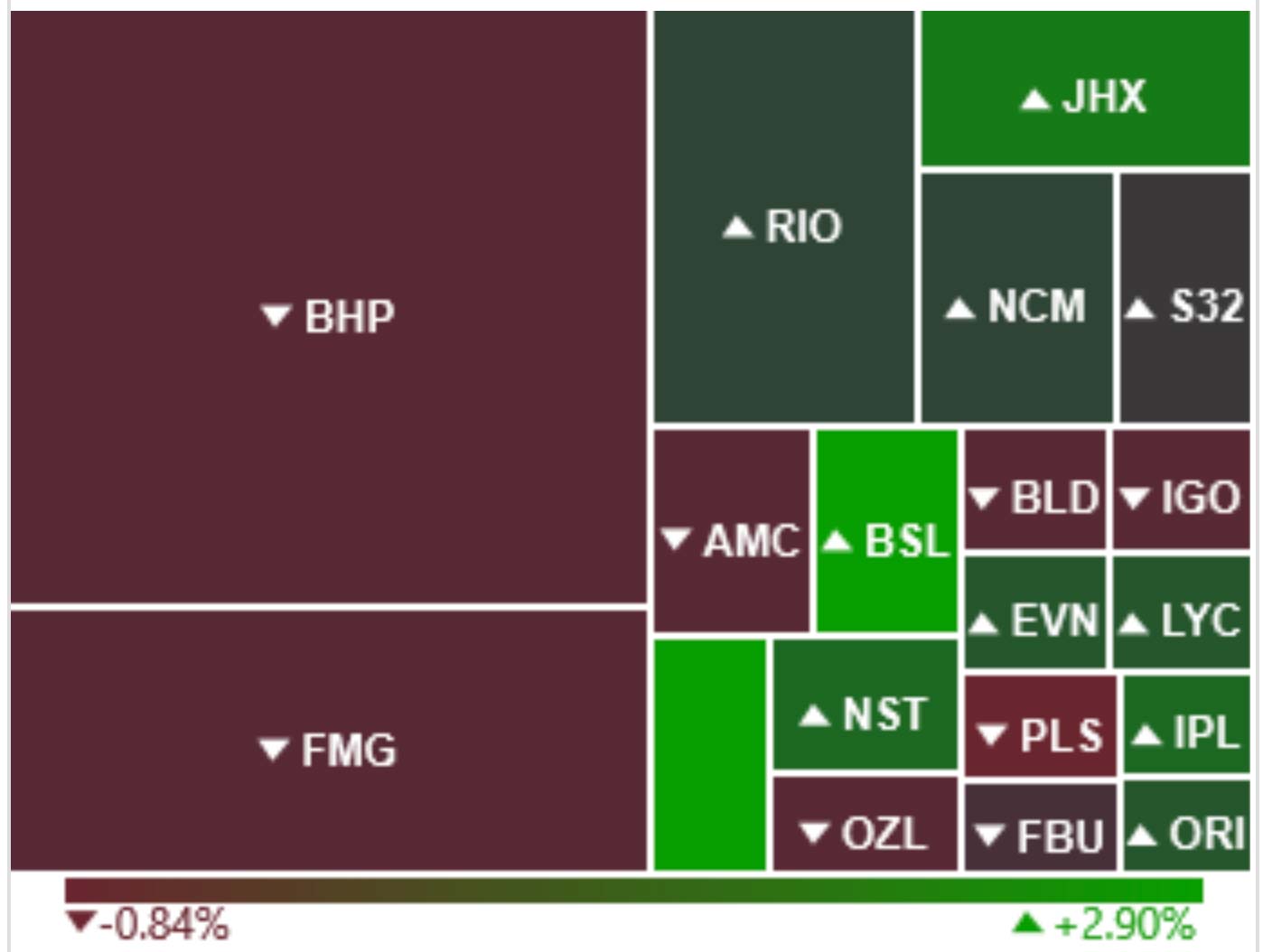

Materials edged higher today, but gains were tempered by losses from the big iron ore miners BHP (ASX:BHP) and Fortescue (ASX:FMG).

Miner and contractor Mineral Resources (ASX:MIN) – which is exposed to both iron ore and lithium — was up 2.4% today for a week-to-date gain of 5.5%.

EVOLUTION MINING (ASX:EVN)

Australia’s #3 gold miner Evolution Mining (ASX:EVN) will raise US$550 million via private placement, “strongly supported by investors with a significant level of oversubscription”, the company says.

Proceeds will be used to repay a loan associated with the $450m acquisition of Red Lake, and for general corporate purposes.

The placement also gives Evolution some breathing room when it comes to debt repayments — debt maturity profile has been extended from an average of 2.7 years to 7.1 years.

“Evolution’s balance sheet is well positioned to fund the recently announced pipeline of growth projects and this placement will more closely align debt maturity with the group’s average mine life,” the miner says.

“Following settlement in early November, Evolution will not have any material funding maturities falling due until FY26.”

Evolution could become the ASX’s third Australian-based million ounce gold miner by 2024 after buying the Kundana gold operations from neighbour Northern Star Resources (ASX:NST) in July.

Evolution had previously chartered a path to 880,000–950,000ozpa by 2024 through organic means by expanding its existing mines in Australia and Canada.

With Kundana added to the mix its ceiling has been raised to 940,000–1,010,000oz by FY2024.

EVN share price chart

GALAXY RESOURCES AND OROCOBRE (ASX:ORE)

+98% of Galaxy shareholders have today voted in favour of its proposed merger with fellow lithium miner Orocobre, whereby Orocobre will acquire all Galaxy shares via scheme of arrangement.

Galaxy will now seek approval for the tie-up from the Supreme Court of WA at a hearing scheduled for Friday, 13 August.

If/ when this occurs, Galaxy shares will be suspended from trading on ASX from close of trading on Monday, 16 August 2021.

The merger would create the world’s fifth largest lithium chemicals company.

It is expected to be included in the ASX 200 index and approaches the market value threshold for inclusion in the ASX 100 index.

GXY, ORE share price charts

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.