Monsters of Rock: BHP sees red hope in copper and Chinese stimulus

Pic: Getty Images

- BHP production strong, weak iron ore price hurts the margins

- The miner is upbeat about copper prices and its foray into Argentina

- And that’s because China is expected to boost its economic stimulus package and start increasing imports

BHP started the quarter with a bang, rising 20% on the back of its deal with Lundin to buy out Argentine copper assets for $3.2bn, to trade at $45.96 by the end of the month.

The share price has since dipped after a drop in iron ore prices due to the sting of low-grade Fe sales, and is down 1.58% today, yet BHP remains on track to produce 282-294mt across FY25, with an expectation to boost that up to 330Mt with a new mine development.

The Big Aussie boosted iron ore production from its mines in WA in the three months to September 30, but prices fell 12 per cent on the previous quarter and were down 18 per cent on the same time last year.

The global major is pinning hopes on copper to bounce back, with the red metal forecast to keep on its upward trajectory.

BHP’s bullish copper predictions

While realised iron ore output is down, BHP should be set to benefit from maintained growth in copper demand for a variety of reasons:

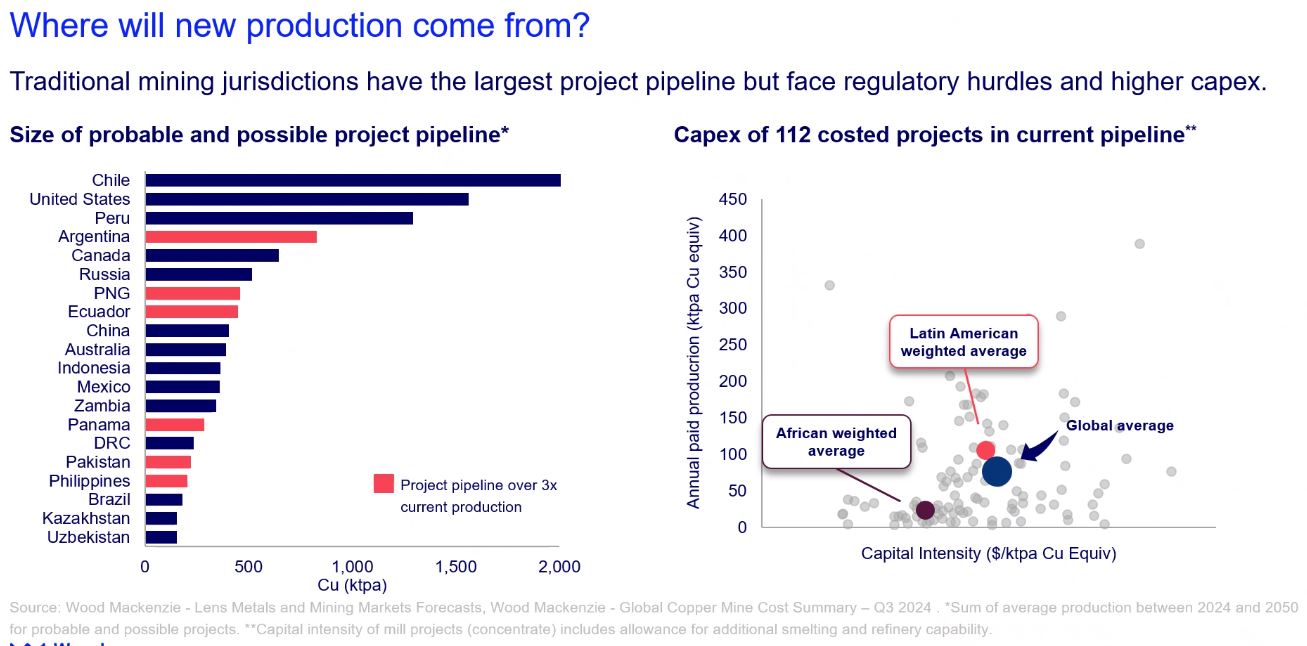

- Its $3.2bn foray into Argentine copper assets

- Two or three more projected US interest rate cuts before the end of the year (which copper tends to benefit from)

- Stronger growth from China with an expected additional 1-2 trillion yuan to its stimulus package and a stabilising property sector

- Increased demand through continued electrification growth

BHP CEO Mike Henry echoed the sentiments.

“China has announced a series of monetary easing policies in an effort to support economic growth, and has indicated more significant fiscal stimulus is on the horizon,” Henry said in a note today.

“[The] upcoming stimulus is likely to focus on relieving local debt, stabilising the property market and bolstering business confidence.”

BHP’s copper prospects are good, though. In regards to the Argentina deal, the country is on a heater with M&A deals and attracting exploration to the country not just in copper, but lithium and gold, too.

The country is set to go from basically zero copper production to rival that of its neighbour Peru, the world’s second-largest copper producer after its other neighbour Chile with BHP at the fore of accelerating production out of the South American nation.

READ MORE: A growing force in copper supply, Argentina is unlocking its mining potential

BHP remains confident its big bet on copper in Argentina will pay off and is standing by forecasts that demand will grow by 70 per cent by 2050 as part of the electrification of the global economy.

The miner’s red metal production was up 4 per cent on the same time last year to 476,300 tonnes but pricing fell 7 per cent from the June quarter.

Making gains

Ora Banda (ASX:OBM) (gold) 13.43%

South32 (ASX:S32) (base metals) +2.72%

Incitec Pivot (ASX:IPL) (mining services) +4.04%

Westgold Resources (ASX:WGX) (gold) +10.37%

Eating losses

Stanmore Coal (ASX:SMR) (coal) -3.57%

Coronado Global Resources (ASX:CRN) (coal) -2.14%

Fortescue (ASX:FMG) (iron ore) -2.74%

Mineral Resources (ASX:MIN) (mining services) -3.79%

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.