Monsters of Rock: BHP pumped $34.1bn into the Australian economy in FY21, out of the goodness of its heart

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Good blokes that lot over at BHP (ASX:BHP), who say they have kindly pumped $34.1 billion into the Australian economy this year.

Of course $12.4 billion of that came in the form of taxes and royalties they have to pay as a function of their licence to operate their mines and business activities in Australia — $3 billion of that directly to the WA Government where BHP houses its massive Pilbara iron ore empire.

Another $4.5 billion went into the hands of 45,000 employees and contractors, with $6 billion heading to dividend payments and interest payments to lenders and $11.1 billion paid to local suppliers.

BHP reported payments of US$7.5 billion to Australian governments in the form of taxes and royalties in FY2020, with higher commodity prices and expansions fuelling large increases in contributions to authorities in 2021.

The release comes ahead of tomorrow’s State Budget in WA, which will be beefed up by the past year’s windfall from the iron ore miners, not to mention high prices for other commodities including gold, nickel and copper.

“The past 18 months have thrown unprecedented challenges at all Australians, and we know many in the community are doing it tough,” BHP’s Minerals Australia president Edgar Basto said.

“It is through the commitment of our people, and the support of governments, communities, suppliers and traditional owners, that we have been able to keep operating safely through the pandemic.

“We are grateful for their support and the contribution that our continued operation has been able to make to the broader Australian economy during this time.”

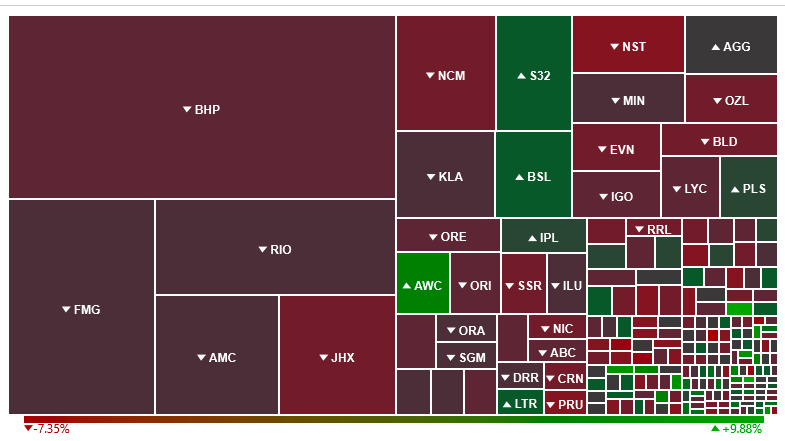

Gold suffered sharp falls overnight, sliding below US$1800/oz in its biggest drop in a month, which brought pain for miners in the precious metals space.

Northern Star (ASX:NST) suffered a 5.28% drop as of 4pm AEST, with St Barbara (ASX:SBM) off more than 6%.

Evolution (ASX:EVN), Perseus (ASX:PRU), Newcrest (ASX:NCM) and Regis Resources (ASX:RRL) were among the other big names to suffer.

Bright spots came from Alumina (ASX:AWC), which is still moving up on higher aluminium prices, lithium developer Liontown Resources (ASX:LTR) and South32 (ASX:S32).

Mineral Resources (ASX:MIN) fell amid broader negative sentiment for resources despite announcing the discovery of Perth basin gas at its Lockyer Deep 1 Well. Its 20% joint venture partner Norwest Energy (ASX:NWE) was one of the top small cap movers with a 125% gain.

AERIS RESOURCES (ASX:AIS)

Aeris bucked the trend for the precious metals producers, defying the poor form of its peers with more stellar copper grades from its Constellation discovery near the Tritton gold mine in New South Wales.

One might say its boss Andre Labuschagne, the father of Australian test star Marnus, posted a decent score today despite a lack of assistance from the rest of the batting line-up.

The top results from a 58 hole reverse circulation program at Constellation included 18.4m at 9.40% Cu, 0.87g/t Au, 4.4g/t Ag from 53m, 5.5m at 6.85% Cu, 1.02g/t Au, 2.9g/t Ag from 81.5m and 17.9m at 2.97% Cu, 0.77g/t Au, 4.1g/t Ag from 94m.

There were strong results from diamond drilling as well, with a previously reported 60m long sulphide interval returning a strike of 48.7m at 2.56% Cu, 1.21g/t Au, 6.2g/t Ag from 140.3m downhole.

A maiden mineral resource at Constellation, which is expected to be considerably higher in grade than the 1.2% copper grade at the main Tritton deposit, is due in the third quarter of 2022, with feasibility studies also in the works.

“The latest drill results continue to show that Constellation is a high grade copper deposit with some exceptionally high grade intersections reporting from the shallow supergene zone,” Labuschagne said.

“In the 10 months since the discovery hole at Constellation we have completed over

150 RC and diamond drill holes. The results from this drilling are compelling, with the mineralised extents and copper grade both significantly greater than initial

expectations, and supporting our view that Constellation is a significant deposit.

“The resource in-fill drilling campaign is now underway and as a sign of our confidence in the Constellation deposit we are fast tracking the development

pathway by commencing various options studies in parallel.”

Aeris Resources share price today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.