Monsters of Rock: Back by popular demand, one of the world’s largest uranium mines

Pic: Getty

Canadian uranium giant Cameco has announced the biggest shift in uranium supply in several years, revealing plans to stage the recovery of its giant McArthur River mine and Key Lake mill in Canada.

The mine, which previously produced around 12% of the world’s supply of yellowcake, has been on ice since 2018.

Reporting its 2021 results yesterday, Cameco says the Saskatchewan mine will be progressively brought back online in light of improvements in both the spot and term contract markets for uranium.

From 25% of its licenced capacity in 2021, when it delivered a net loss of US$103 million, Cameco aims to inch up to 60% by 2024.

Despite the promise of all this production coming back online junior uranium miners have been in a buoyant mood today.

That’s probably because Cameco is embracing a level of unbridled optimism it hasn’t in years about the state of the nuclear fuel supply chain.

Over a billion pounds of uncommitted demand is lying in wait over the next decade or so, with Cameco’s top brass saying we are entering the “security of supply” stage of the contracting cycle, a time when utilities are itching to get their hands on uranium supplies.

“We are in the early innings of a market recovery, the uncommitted requirements, 1.4 billion pounds of uranium to be bought over the next 12, 13 years according to UxC,” Cameco CFO Grant Isaac said.

“Of course, when you’re looking for the uranium component of it, you’ve got less time to buy, that’s a lot of demand that’s got to come to the market.”

Cameco CEO Tim Gitzel said after removing 190Mlbs of product from the spot market since 2016, it was time to switch McArthur River back on as uranium and nuclear energy promises to play a role in the transition away from fossil fuels.

“I am pleased to tell you that with the improvements we have seen in the uranium market and the success we have had in putting 70 million pounds of new long-term contracts in place since the beginning of 2021, it is time,” he said.

“It’s time to claim our incumbency advantage and proceed with the next phase of our supply discipline decisions in alignment with our contract portfolio and the market opportunities.

“And it’s time to reward those who understand and have supported our strategy, which has laid the foundation to capture the value of the clean energy transition.”

Spot prices have risen from around US$18/lb at the time McArthur River was placed on care and maintenance to over US$40/lb today, having briefly touched US$51/lb late last year in a rally driven by spot purchases by the Sprott Physical Uranium Trust.

No end to supply discipline

Cameco, which produced 18Mlb from McArthur River in its last full year of operations in 2017, will ramp up to 5Mlb on a 100% basis in 2022 and 15Mlb by 2024.

But Gitzel says it is not the end of “supply discipline”, a positive signal for new uranium miners hoping to join Cameco and the other major player Kazakhstan’s Kazatomprom in the market in the coming years.

While McArthur River will ramp up, Cameco’s Cigar Lake mine will reduce its production profile from 18Mlb to 13.5Mlb, while production at is Inkai JV in Kazakhstan with Kazatomprom will remain 20% below capacity until the end of 2023 unless Kazatomprom extends its supply restrictions.

Despite a $103 million loss, Cameco’s financial position has also improved, with the miner offering shareholders a 50% increase in dividends to C12c a share.

Isaac told analysts on an earnings call supply discipline would continue “indefinitely”.

But Gitzel also said the supply and demand fundamentals for uranium were improving due to growing support from the US Government and investment in new nuclear reactors in China.

“(China) have 50 reactors today, they are going to 70 reactors. So, you can even imagine that 20 new reactors in 5 years, 70 by 2025, and we have seen from some of their organisations well over 100 by 2030,” he said.

“And so then you start asking where is the supply coming from at a time when supply is going down.

“Remember, we started 2021 with Cominak (in Niger) going down and Ranger (in Australia) going down. And so yes, the supply-demand fundamentals are really setting up nice for the industry.

“And then of course during the year, you had Sprott and other juniors come in and buy a significant quantity of uranium and put it away. And so yes, I think the market is setting up very nicely and it’s in this context that we expect to add to our portfolio going forward.”

Cameco bounce powers local uranium juniors

Boss Energy (ASX:BOE), which announced a deal to give Canadian copper and nickel major First Quantum the rights to explore for base and precious metals at its Honeymoon uranium project, was up 6.2%.

$2 billion capped Paladin (ASX:PDN), which is waiting on the right market conditions to restart its Langer-Heinrich mine in Namibia, was 6.7% higher.

$117.2m cappped Elevate Uranium (ASX:EL8) was the biggest gainer on our uranium watchlist. The owner of the Koppies and Marenica projects near Langer-Heinrich in Namibia and a host of early stage resources and exploration projects in Australia, Elevate was up 6c or more than 13% to 51c today.

Most uranium stocks significantly outperformed the broader energy sector in the ASX 200, which was down 0.44%.

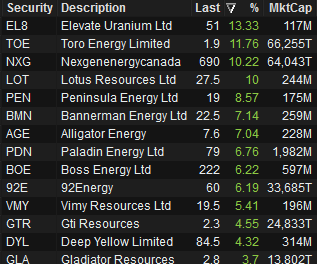

Uranium share prices today:

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.