Monsters of Rock: Analysts split on Liontown loan, copper miners ride price surge higher

- Gold Road to miss in March quarter as rain hits Gruyere mine hard

- Analysts give their take on Liontown debt package

- Copper miners surge as prices hit 11 month high

Gold Road Resources (ASX:GOR) has joined Capricorn Metals (ASX:CMM), issuing a warning on production as WA’s big wet strikes its mid-tier gold miners.

Both have maintained guidance, though Capricorn said on Monday its March would slide to 26,000oz after 150mm struck its Karlawinda gold mine in recent days.

Combined with 133mm in January it’s lost eight full mining days.

Gold Road and Gold Fields have suffered 140mm of rain so far this month at their Gruyere joint venture, resulting in periods of mining suspensions and road closures.

Low grade stockpiles have delivered much of the mine’s output so far this month, with GOR expecting Gruyere to produce 68-73,000oz in the March quarter. It has left annual guidance of 300,000-335,000oz (100% basis) at all in sustaining costs of $1900-2050/oz unchanged.

Miners commonly project strong second halves, with Gold Road reporting on a calendar year basis, meaning it will have plenty of time to make up the shortfall. But after downgrading guidance last year, the Laverton gold miner will be closely watched.

RBC’s Alex Barkley, who has an underperform rating and $1.30 price target on GOR, thinks while stockpiles will make up the difference early doors, the mine’s temporary closure will delay access to higher grade gold expected in the second half.

He said March guidance was 6% below RBC and 7% below consensus estimates.

“Achieving total material mining rates (ore & waste) were an issue in CY23, and a considerable increase is required in CY24 plans. GOR has maintained its CY24 guidance,” he wrote in a note.

“Positively, some issues around mine contractor staffing appear to be resolved and GOR find total tonnage movements were strong before the rainfall event.”

Goldman Sachs is more bullish, keeping a $1.95 price target and buy rating on the gold miner. They say GOR is pricing in a massive discount to peers with no major growth spend on the horizon and long term gold priced in at US$1575/oz, compared to US$1930/oz across its Aussie gold coverage.

“Bench turnover of the stage three and four pits to improve access to ore remains the priority focus at Gruyere, where mining and production is guided to continue to ramp up through the first half of the calendar year with stronger production performance expected for the second half of the year,” Hugo Nicolaci and other Goldman analysts said.

“We reiterate that a slower recovery of mining operations (either from rain or now resolved workforce issues) likely has lower gold production risk than perceived, where on an exaggerated scenario, processing only stockpiles and pausing mining for the duration of the year would lower our CY24 production from 325koz to ~210koz but preserve >60% of CY24 FCF.”

Goldman thinks Gruyere will produce 325,000oz, but said they continue to see its 300-330,000oz calendar year guidance as ‘conservative’.

Gold Road Resources (ASX:GOR) and Capricorn Metals (ASX:CMM) share prices today

Speaking of analysts, whadda they reckon of Liontown?

Jarden’s Jon Bishop, Ben Lyons and Adam Bennett — in a note coyly titled “Men at work: till the money runs out” — say Liontown’s updated $550 million debt package for the Kathleen Valley lithium mine may not be enough to see it through to its bullet repayment on October 31 next year.

A new financial model is also expected to be delivered in July this year as part of the deal, leaving numbers from a 2021 DFS up in the air.

But they think it will fund the company long enough for it to refinance with a longer term package.

“Even after accepting 31-Dec-23 cash of $515m is sufficient to achieve first SC production from mid-2024, unless the operation commissions ahead of any of the peers to date AND lithium prices are well above US$2,000/dmt SC6, our modelling does not generate sufficient FCF to meet the bullet repayment due 31-Oct-25,” the Jarden analysts wrote.

“We recognise that should either of these scenarios play out, LTR would be in a better position to refinance the facilities with (at least) longer term debt but the ability to refinance remains a key medium-term risk. Assuming the operation continues with development of KV underground to deliver 3mtpa from CY25, we currently model that the $550m facility requires an additional 2.5yrs (assuming steady state achieved by JHFY26) to retire the facility on our price deck.”

Jarden have a 91c price target and now underweight rating on LTR thanks to the sudden boost yesterday’s debt announcement gave to the developer. It’s down 5.73% today to $1.32.

Goldman are more bullish, saying an additional $50-100m of external capital would only be needed if spodumene prices were to fall to US$600/t. They’re currently ~US$975/t.

“We forecast Kathleen Valley turning FCF (free cash flow) positive from mid-CY25 on our spodumene price forecast, which we expect to support any refinancing of the debt if not already agreed prior, where LTR is continuing to explore options for a longer-term funding solution in parallel,” they said.

“LTR does not currently anticipate needing to drawdown on the facility until early in 3Q CY24, and note that Kathleen Valley remains on schedule and budget to commence first production in the middle of CY24 (GSe Sep-24).”

Hugo Nicolaci, Paul Young and Elise Bailey say an expansion from 3Mtpa to 4Mtpa, deferred after a $760m debt package fell over earlier this year, would cost around $100m from FY28, making it a ‘compelling brownfield expansion’ on Goldman’s benchmarks.

“Our 12m PT is unchanged at A$1.45/sh on our LT spodumene price of US$1,150/t, where LTR is trading at a modest premium to our revised NAV at ~1.05x (having traded down to ~0.7x), and an implied LT spodumene price of ~US$1,175/t (peer average ~1.25x & ~US$1,350/t),” they said.

“We remain Neutral rated, where we note that historically mining stocks tend to underperform through the execution and ramp up phase of a project.”

The same analysts were less positive about Core Lithium (ASX:CXO), saying its decision to halt mining at the Grants pit, suspend the BP33 underground development and give notice to Primero Group to end its operation and maintenance deal on the Finniss mine’s DMS process plant, made it less likely the company would restart operations at the NT mine.

Core announced the departure of boss Gareth Manderson on Tuesday after reporting a $167.6m after tax loss and ~$120m impairment on the carrying value of the Finniss mine.

Goldman has a 13c price target and sell rating on $400m miner, which has fallen 88% from the all time high it touched in November 2022.

Three cheers for copper

Chinese copper producers agreed to cut output on Wednesday after treatment charges fell to more than decade long lows, leading to a 3.1% climb in prices to US$8927/t — an 11 month high.

City Index analyst David Scutt warned traders against buying the breakout just yet.

“While I freely admit the breakout looks tempting to buy, I’m inclined to wait for a potential retracement before slinging into a long, especially as we’ve seen similar moves in gold and silver beforehand,” he said.

“Dips below $4 would provide a decent entry point, allowing for a stop to be placed below the former downtrend for protection. Given the ease the price took out the highs from July 2023, an initial upside target would be around $4.20.

“For those brave enough to short the break, you could flip the trade idea around and look to sell here with a stop above Wednesday’s high looking for a retest of the former downtrend.”

Investors in Aussie equities on the other hand …

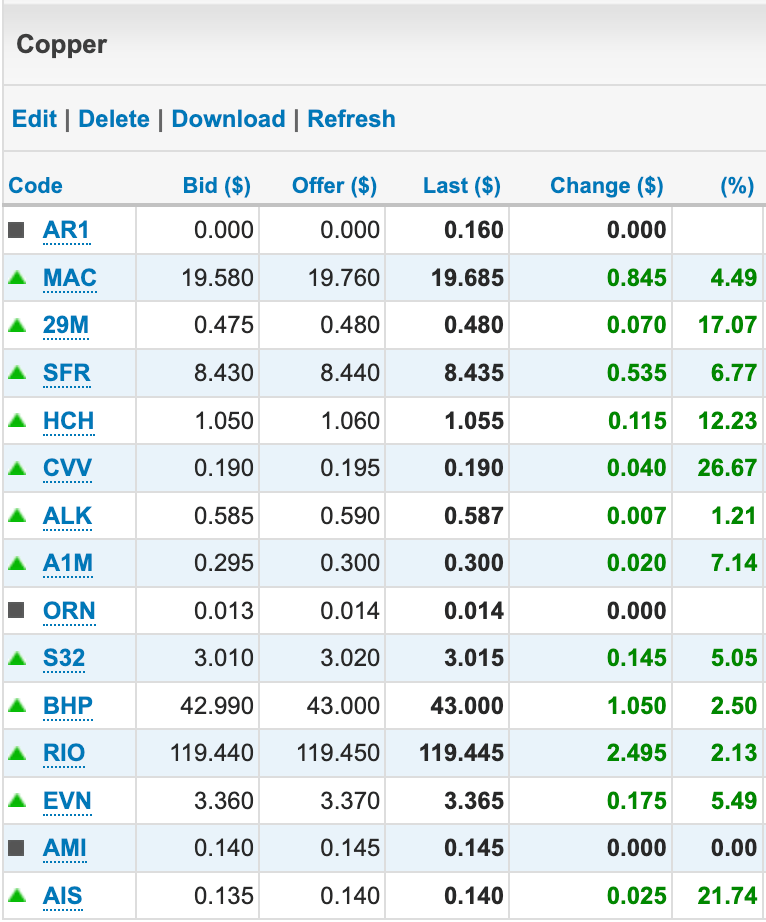

Massive moves up for some previously unloved names like Aeris (ASX:AIS) (+21.74%), 29Metals (ASX:29M) (+17.07%), Hot Chili (ASX:HCH) (+12.23%) and heavily hyped mid-tiers like Sandfire (ASX:SFR) (+6.77%) and Metals Acquisition Corp (ASX:MAC) (+4.49%).

Big gains in there for BHP and Rio also pushed the materials sector to a 1.82% gain. But it was Arafura Rare Earths (ASX:ARU) that dominated the market in spite of weak rare earths prices, leaving a trading halt to an 84% gain a day after it was announced as the recipient of $840m in loan funding from the Australian Government for its Nolans project in the NT.

Monstars share prices today

At Stockhead, we tell it like it is. While Arafura Rare Earths was a Stockhead advertiser at the time of writing, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.