Monsters of Rock: Aluminium flying out the door as China’s power woes drive prices to 13-year highs

Pic: Tyler Stableford / Stone via Getty Images

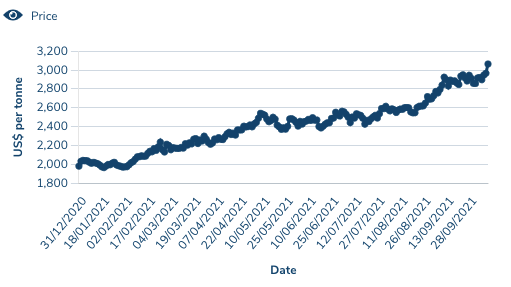

Aluminium prices soared 3.3% overnight to their highest level in 13 years. The downtrodden metal is suddenly back in vogue as smelter shutdowns in power strapped China lift the ceilings on prices for the industrial metal.

A few years ago Rio Tinto (ASX:RIO) said its aluminium businesses in Australia, a series of smelters across the east coast, were on thin ice.

It has also been long eyeing the closure of the Tiwai Point smelter on New Zealand’s South Island.

Today it linked arms with the Queensland Government, whose Premier Annastasia Palasczcuk is on the renewable energy comeback tour of the State this week.

Rio’s Boyne Smelters near Gladstone — where fellow iron ore giant Fortescue (ASX:FMG) wants to set up a green hydrogen manufacturing hub — is the State’s largest energy user, consuming around 13% of its power.

That’s right — 13%.

It signed a statement today pledging to underpin the State’s green energy transition by becoming a green offtaker for its integrated aluminium business, which extends all the way up to the Weipa bauxite mine in the state’s north.

“Transitioning to a low carbon economy presents a real opportunity for industrial regions if stakeholders are willing to both think differently and collaborate,” Rio aluminium chief executive Ivan Vella said today.

“As Queensland’s largest energy user and a major Gladstone employer and manufacturer, Rio Tinto is uniquely positioned to work with the Queensland Government to deliver this vision.

“We have been in the region for more than 50 years and we share the State Government’s goals for decarbonisation, job creation and a vibrant industrial future for the region.

“We are working closely with the Queensland Government on the role we can play by underwriting long-term green offtake for our industrial assets.

“This should help create the industrial demand needed to develop a globally competitive green energy solution and lead to more processing and manufacturing in Central Queensland.”

Not the words of a dying business, whose return from the abyss has analogies to BHP’s (ASX:BHP) last ditch bid to salvage its now front and centre nickel business Nickel West.

Aluminium prices sparked by energy crisis

Aluminium is so energy intensive, Westpac head of financial market strategy Robert Rennie says it is sometimes referred to as ‘solidified electricity’.

This highlights why it has been one of China’s most vulnerable industries in the face of power shortages in the Asian economic superpower.

“So with rising concerns over energy shortages and crises like costs, aluminium prices closed in on fresh 13yr highs at the end of the week,” Rennie said.

“And with forecasters in the UK suggesting that we may see a sudden polar vortex developing in October/ November, the scramble to secure fuel supplies will likely continue.”

This has driven manic buying of reduced aluminium reserves in the wake of China’s National Day holidays, pushing prices beyond US$3000/t.

“Chinese buyers returned with force following a weeklong National Day holiday and with Chinese smelters still struggling to get access to a more reliable power supply, (prices) flirted with the magic US$3,000/t mark,” Rennie said.

“This demand is there for everyone to see as LME reported yet another decent weekly draw as the cadence of inventory leaving LME warehouse picks up to over 50kt per week.”

On the flip side Rio has bartered a collective labour agreement with staff at its Kitimet smelter in Canada, which will return to full production – around a tenth of the North American market – after strikes restricted output since July, Rennie said.

Alumina Limited (ASX:AWC) was up 9c, or 4.19%, to a year-long high of $2.24 on the price moves.

Iron ore prices charged by over US$10/t overnight to US$135/t, but reactions for BHP and Rio were muted, while FMG fell 1.4%.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.