Winmar reckons Canada’s the place for cobalt – not just cannabis

Image: Getty

ASX-listed junior Winmar Resources has made a move into the rapidly expanding cobalt sector with an acquisition in Canada.

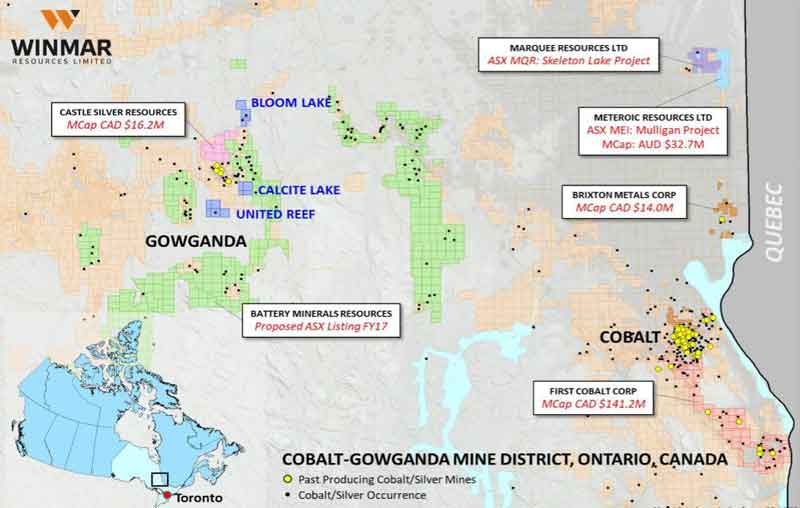

Winmar (ASX:WFE) has struck a deal to acquire rights to 2240 hectares of mining claims in the historic high-grade Cobalt-Gowganda silver-cobalt mining district of eastern Ontario in Canada.

The district is one of the world’s most prospective cobalt districts outside the Democratic Republic of Congo, according to Winmar.

Canada is well-known among ASX investors as the main global driver of another commodity starting with ‘C’ — cannabis. But it’s also the third biggest producer of cobalt, after China and the Congo, according to the US government’s 2017 geological survey. (Australia is fifth).

Winmar’s $120,000 cash and scrip deal in Canada won’t be its last. “Further acquisitions are anticipated”, Winmar says.

The Bloom Lake, Calcite Lake and United Reef claims border a cluster of former producing high-grade silver-cobalt mines at Gowganda, 85km North West of the town of Cobalt.

Production to the end of 1969 was 60.2 million ounces of silver and 1.3 million pounds of cobalt, although the focus of mining was silver and much of the cobalt was left unmined.

Historic grab samples taken from the Bloom Lake prospect yielded up to 0.9 per cent cobalt, up to 603 grams per tonne of silver and up to 14.7 per cent copper.

Results are considered high-grade at more than 2 per cent for cobalt, 50 grams for silver and 1.5 per cent for copper.

The Cobalt-Gowganda district is part of the so-called “Cobalt Camp” — an area that had been largely forgotten for more than half a century and only seen limited exploration since the 1980s. (See map below).

The region originally witnessed a silver mining rush, but in more recent times the electric vehicle revolution has sparked an increase in exploration for cobalt, which is often found with other minerals such as silver, copper and nickel.

Demand for cobalt is expected to grow because of its use in lithium cobalt oxide electrodes — a common lithium ion battery technology used in electric cars.

Bloomberg New Energy Finance estimates electric cars will account for 2 per cent of the market by 2020, rising to 8 per cent by 2025 and 20 per cent by 2030.

The Cobalt-Gowganda silver-cobalt mining district has become the focus of acquisitions and amalgamations by several cobalt-focused companies such as unlisted Battery Mineral Resources and dual-listed First Cobalt (TSXV/ASX:FCC)..

First Cobalt, which recently made its debut on the ASX following an all-scrip merger with Australian junior Cobalt One, is expanding its footprint in the Cobalt Camp.

The company has purchased four contiguous mining claims located in the Central Cobalt region of the Cobalt Camp near the past producing Caswell mine.

“Cobalt Central was historically underexplored yet the Caswell mine to the east of these claims boasts one of the highest historic cobalt-to-silver ratios within the camp, making this region highly attractive for continued exploration,” chief Trent Mell told investors.

A recent prospecting program at Caswell identified high grade mineralization at surface, including 9.44 per cent cobalt, 1.27 per cent copper and 2.92 per cent nickel.

The mine produced almost 5000 pounds of cobalt and over 1500 ounces of silver in 1936, at a ratio of 3.3 pounds of cobalt for each 1 ounce of silver produced.

The claims were acquired for 224,000 First Cobalt shares, valuing the deal at just over $300,000 based on the closing price of the company’s shares on the day prior to the announcement.

The properties are contiguous to First Cobalt’s projects to the west of the Caswell and La Tour mines and the Thompson prospect in Central Cobalt.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.