Moho’s shares jump as Aussie gold price takes off again

(Getty Images)

Special Report: Investors are rewarding the ‘goldies’ that are making good progress at the same time the Aussie dollar gold price just hit a new all-time record.

Moho Resources’ (ASX:MOH) share price shot up 13.5 per cent on news the gold hopeful had completed maiden aircore drilling to follow up gold and arsenic anomalies on the Crossroads prospect at its Burracoppin gold project.

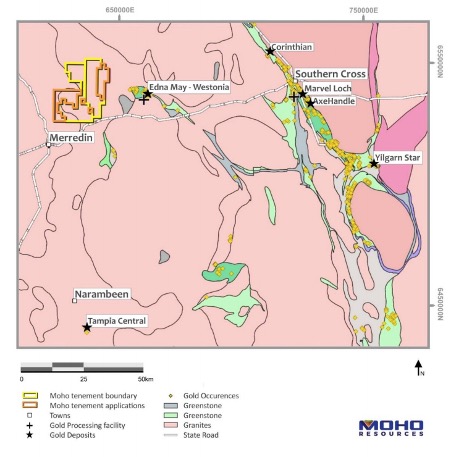

Burracoppin is located within a gold-rich area of the Wheatbelt region of WA.

Ramelius’ hungry 80,000oz per annum Edna May gold mine is only 22km to the east, while its 460,000oz Tampia deposit is located about 140km to the south.

At the same time the Aussie dollar gold price just punched through the $2,700 an ounce mark – a new all-time high.

Moho also has the advantage of being based in WA, which means it hasn’t had to scale back work on its key gold projects at East Sampson Dam near Kalgoorlie or the Burracoppin project because of the COVID-19 crisis.

The forward-thinking company is working hard to minimise any exploration impact on this crucial farming area by using a ‘zero impact’ drill rig, contracted from Bostech Drilling, that minimises disturbance and sample spoil in the paddocks.

Thirty-seven reconnaissance air core holes were drilled across coincident gold and arsenic anomalies in soils and auger drill samples at the Crossroads prospect in March.

Moho expects to announce the results to market in late April 2020.

Last November, Moho identified a second gold soil anomaly about 5km south and along strike from the Crossroads anomaly at the Burracoppin project.

Earlier this month, the company topped up its coffers with a $1.28m tax refund from research and development (R&D) spending across its WA and Queensland projects.

Moho is setting itself up to be a self-funded explorer. The company is currently undertaking investigations into gold mining at its East Sampson Dam gold prospect about 50km north of Kalgoorlie, potentially starting later this year.

Moho recently increased its stake in the high-grade East Sampson Dam prospect to 70 per cent.

“Given record gold prices, Moho is focused on advancing its gold projects towards production so it can become a self-funded explorer, which could happen as early as the end of this year at East Sampson Dam,” commercial director Ralph Winter told Stockhead.

“Also, the company has the added benefit of having two key projects in WA which gives it the ability to continue working and not currently be limited by the effects of COVID-19.”

This story was developed in collaboration with Moho Resources, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.