Modern Victorian goldrush continues with North Stawell debut

Getty Images

Special Report: Another chapter in the renaissance of the Victorian goldfields begins today with the listing of North Stawell Minerals on the ASX.

North Stawell shares are scheduled to start trading under the ticker code of NSM at 11.30am AEST after the company wrapped up its $20 million initial public offering earlier this month.

It will be the first Victorian gold float to list on the ASX since Navarre Minerals in 2010. However, there was a Victorian gold float that listed on the TSX Venture Exchange in April that offers a more recent proxy of sorts.

Fosterville South Exploration, which owns the Lauriston gold project to the south of Kirkland Lake Gold’s Fosterville mine, one of the biggest and highest grade gold operations in the country, saw its share price increase 500% within three months of debuting on the TSX-V.

The strong investor interest in Victorian gold from North America was also evident in the North Stawell IPO, with six institutions from that part of the world backing the new company, along with a number of Australian funds and high net worth investors.

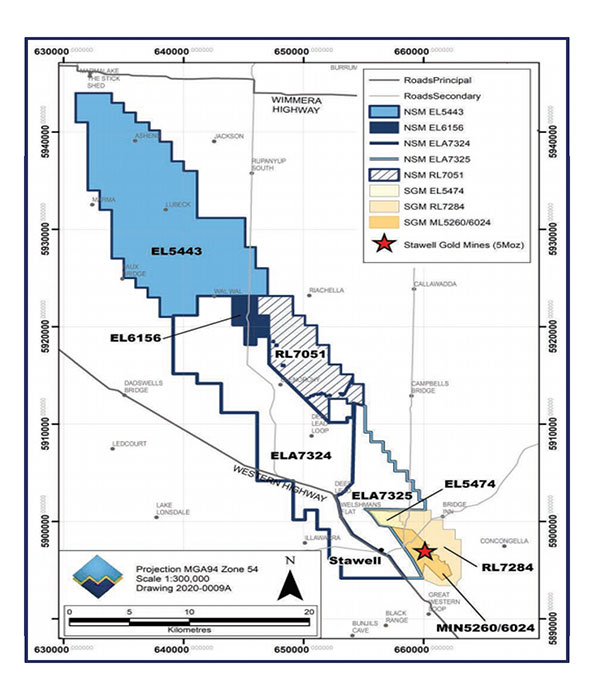

More than 80% of the funds raised through the IPO have been earmarked for exploration on the company’s 550km2 package of tenements along the Stawell Mineralised Corridor, immediately adjacent to the +5Moz Stawell Gold Mine.

Along with Bendigo and Ballarat, the town of Stawell is acknowledged to be a corner point of Victoria’s “Golden Triangle”, an area that is responsible for more than 66 million ounces of combined historical gold production.

With the IPO funds now received, North Stawell chief executive officer Steven Tambanis said the company would accelerate exploration activities, including making a start on drilling in the December quarter.

“We have a wealth of targets on our tenements, many already demonstrated to be gold mineralised,” he said. “More significantly, we have assembled an excellent exploration team to lead the chase for Victoria’s next gold orebody”.

“We look forward with great anticipation to commencing what we believe to be one of the largest drilling campaigns contemplated by a junior explorer in recent times.”

North Stawell has budgeted for 75,000 metres of drilling over the next two years, testing 51km of northerly strike extension along the Stawell Mineralised Corridor.

The company has already defined forty-three individual targets, including 17 basalt domes similar to – and in some cases several times larger than – the Magdala dome that hosts Stawell.

The initial focus for North Stawell will be one of those basalt domes at the Wildwood prospect, which already contains an JORC Inferred Mineral Resource Estimate of 55,000 ounces of gold.

A 5,000-6,000m RC and diamond drilling program will begin at Wildwood in the December quarter, with drilling contractors submitting bids.

Major shareholders staying put

North Stawell effectively offered a third of the company to the public through the IPO process, with two-thirds remaining with the owners of the Stawell Gold Mine.

Victor Smorgon Group held a 54% interest prior to the IPO, but will be diluted down to 36% upon the issue of shares to new investors.

Arete Capital Partners, the private equity vehicle associated with former WMC boss Hugh Morgan and which operates SGM, holds 5% of NSM, but that will reduce to 3.3% post-listing.

All shareholders invested in the company prior to the IPO have agreed to a 24-month escrow period.

The company will have a market capitalisation of $60 million when it begins trading.

This story was developed in collaboration with North Stawell Minerals, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.