‘Misleading and inconsistent’: Miners are underreporting real production costs, Gold Fields says

Pic: Tyler Stableford / Stone via Getty Images

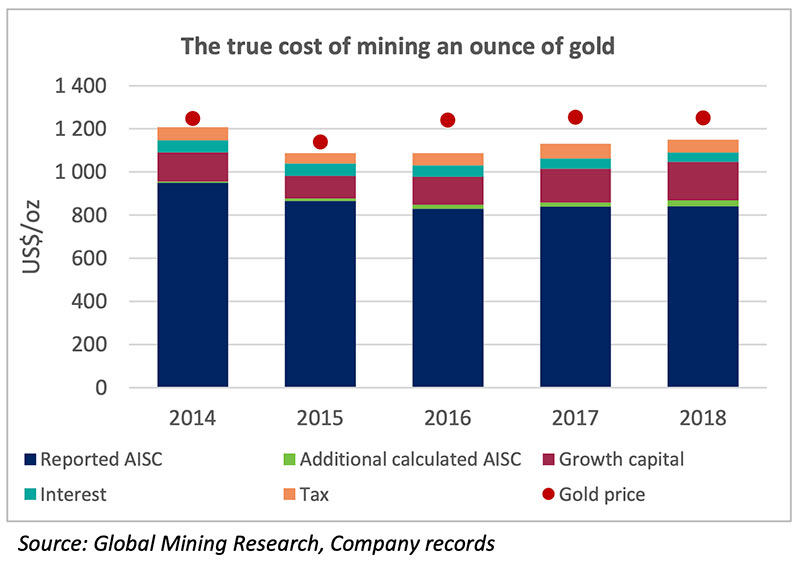

Gold production costs could be higher than officially reported due to “potentially misleading and inconsistent reporting” by miners, says Gold Fields boss Nick Holland.

JSE-listed Gold Fields is a +$70 billion global gold miner with mines and development projects in WA, Peru, Chile, Ghana and South Africa.

On the face of it, cost performance of the gold industry has been good. But this is only because miners haven’t been spending enough on exploration to sustain production at current levels, Holland told delegates at the Paydirt 2019 Africa Downunder conference in Perth.

“We face a situation where gold miners have not been spending enough capital to sustain production, let alone grow production,” Holland said.

Over the past five to six years, all in sustaining costs (AISC) have been widely adopted by gold mining companies as part of their overall reporting disclosure.

It was considered a good measure to appraise the profitability of a project because it includes everything, from mining, refining and transport, through to administration and exploration.

But last year, some AISC reports by the industry excluded capital and exploration costs that should have been included, Holland says.

“The amount of capital and exploration excluded in the reported AISC has been increasing over the past five years at a level equivalent to around US$30/oz ($44/oz),” he says.

This is because — despite the obvious slowdown in global production — expenditure incorrectly classified by the industry as ‘growth’ or ‘non-sustaining’, has increased significantly, Holland says.

This means companies don’t need to include this as part of their AISC.

“In 2018, almost half of all of the gold capital and exploration spend was classified as non-sustaining and therefore not disclosed in reported costs,” Holland says.

“Any growth capital people speak about is in fact largely sustaining capital.

“The cost to sustain production is increasing. The industry is mining more tonnes at lower grade to maintain ounces. Therefore, replacement is becoming more expensive as miners are having to go deeper to extract lower grade gold ore from more complex geological structures. More complex geology simply means higher processing costs, lower recoveries and harder rock.

“As such, AISC will become less representative of what it really costs to produce an ounce of gold, yet the reality is actual costs are higher than the industry is reporting.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.